USD/JPY: USD is strengthening

13 December 2019, 09:02

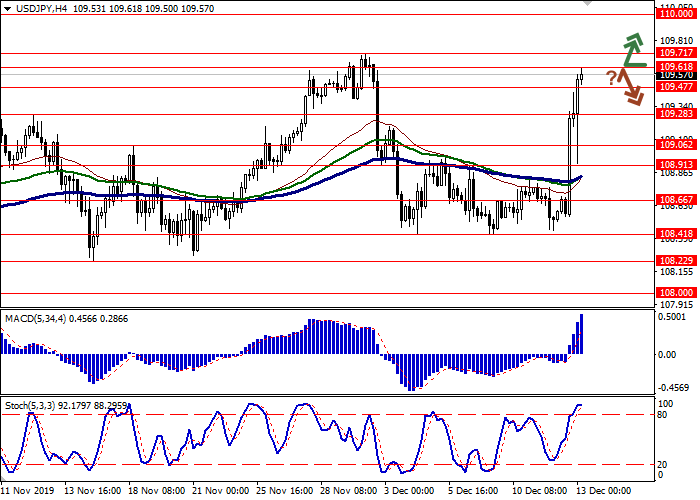

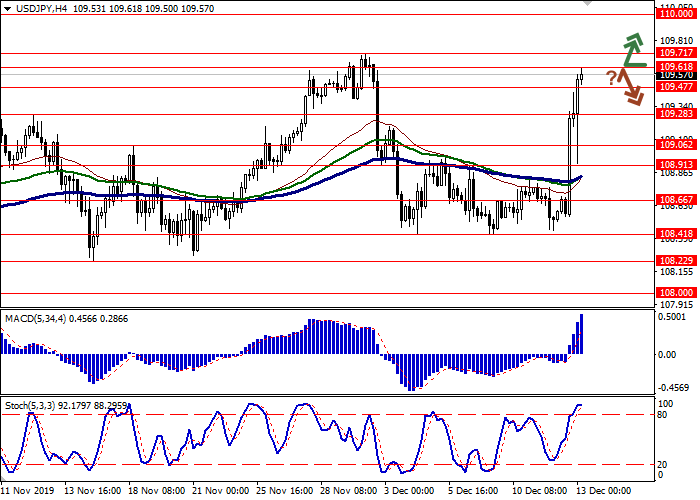

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 109.65, 109.75 |

| Take Profit | 110.00 |

| Stop Loss | 109.40 |

| Key Levels | 108.91, 109.06, 109.28, 109.47, 109.61, 109.71, 110.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 109.45 |

| Take Profit | 109.06, 108.91 |

| Stop Loss | 109.71 |

| Key Levels | 108.91, 109.06, 109.28, 109.47, 109.61, 109.71, 110.00 |

Current trend

USD is growing during today’s Asian session, continuing the development of the “bullish” impulse formed yesterday. USD is adding about 0.28%, receiving support from the growing optimism regarding the prospects for a trade agreement between the US and China. Also, investors are reacting to the publication of the preliminary results of the British Parliamentary elections, where Boris Johnson’s party wins, which will allow to ratify the agreement with the EU in the near future.

JPY is under pressure from uncertain Japanese macroeconomic statistics. Industrial Production in Japan in October fell by 7.7% YoY after falling by 7.4% YoY in September. In monthly terms, production decreased by 4.5% MoM after a decrease of 4.2% a month earlier. Tankan Large Manufacturers Index in Q4 2019 fell from 5 to 0 points, with the forecast of 2 points.

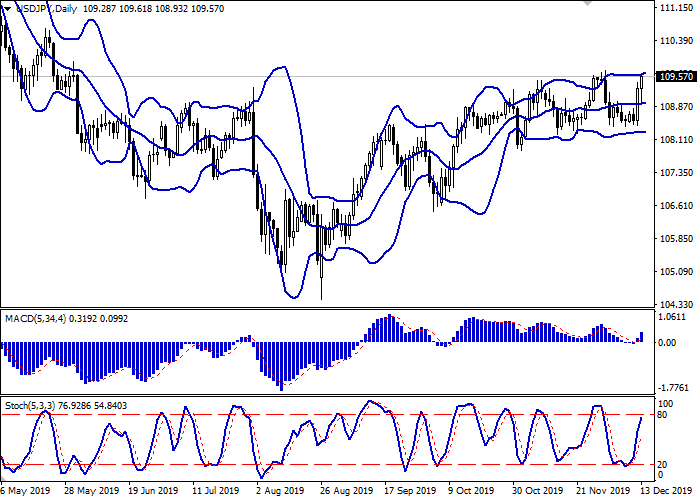

Support and resistance

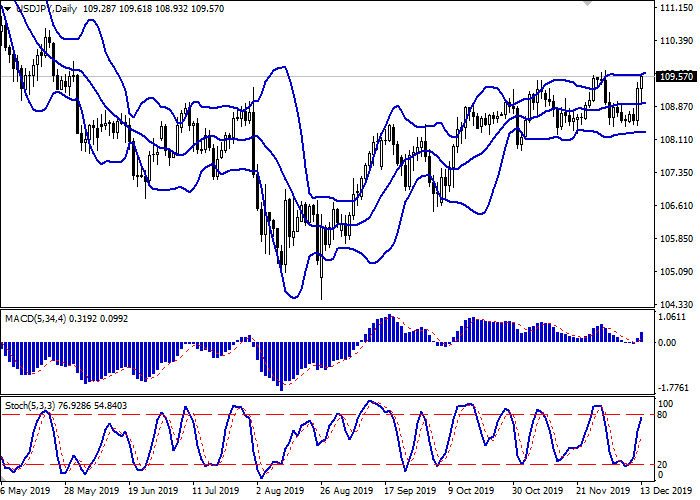

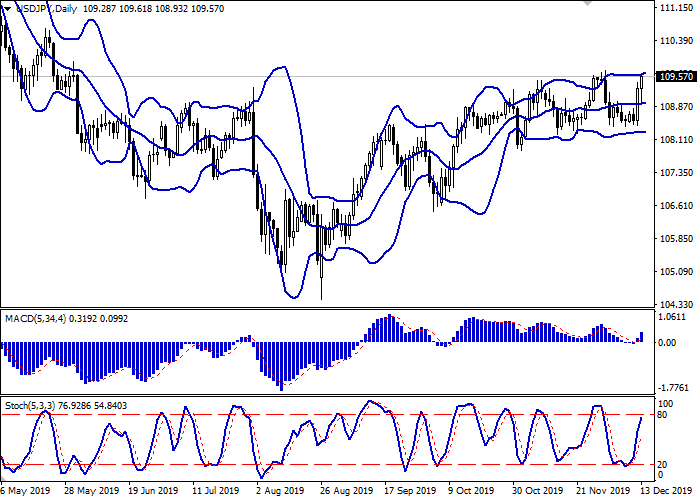

Bollinger Bands in D1 chart show insignificant growth. The price range is expanding from above, struggling to keep up with a surge of “bullish” sentiment. MACD indicator is growing preserving a stable buy signal (located above the signal line). Stochastic keeps a confident upward direction but is rapidly approaching its highs, which indicates the risks of overbought instrument in the ultra-short term.

Technical indicators do not contradict the further growth of the instrument in the short and/or ultra-short term.

Resistance levels: 109.61, 109.71, 110.00.

Support levels: 109.47, 109.28, 109.06, 108.91.

Trading tips

To open long positions, one can rely on the breakout of 109.61 or 109.71. Take profit – 110.00. Stop loss – 109.47 or 109.40. Implementation time: 1-2 days.

The rebound from 109.61 as from resistance, with the subsequent breakdown of 109.47, can become a signal to new sales with target at 109.06 or 108.91. Stop loss – 109.71. Implementation time: 2-3 days.

USD is growing during today’s Asian session, continuing the development of the “bullish” impulse formed yesterday. USD is adding about 0.28%, receiving support from the growing optimism regarding the prospects for a trade agreement between the US and China. Also, investors are reacting to the publication of the preliminary results of the British Parliamentary elections, where Boris Johnson’s party wins, which will allow to ratify the agreement with the EU in the near future.

JPY is under pressure from uncertain Japanese macroeconomic statistics. Industrial Production in Japan in October fell by 7.7% YoY after falling by 7.4% YoY in September. In monthly terms, production decreased by 4.5% MoM after a decrease of 4.2% a month earlier. Tankan Large Manufacturers Index in Q4 2019 fell from 5 to 0 points, with the forecast of 2 points.

Support and resistance

Bollinger Bands in D1 chart show insignificant growth. The price range is expanding from above, struggling to keep up with a surge of “bullish” sentiment. MACD indicator is growing preserving a stable buy signal (located above the signal line). Stochastic keeps a confident upward direction but is rapidly approaching its highs, which indicates the risks of overbought instrument in the ultra-short term.

Technical indicators do not contradict the further growth of the instrument in the short and/or ultra-short term.

Resistance levels: 109.61, 109.71, 110.00.

Support levels: 109.47, 109.28, 109.06, 108.91.

Trading tips

To open long positions, one can rely on the breakout of 109.61 or 109.71. Take profit – 110.00. Stop loss – 109.47 or 109.40. Implementation time: 1-2 days.

The rebound from 109.61 as from resistance, with the subsequent breakdown of 109.47, can become a signal to new sales with target at 109.06 or 108.91. Stop loss – 109.71. Implementation time: 2-3 days.

No comments:

Write comments