USD/CAD: general analysis

13 December 2019, 08:59

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.3145 |

| Take Profit | 1.3070 |

| Stop Loss | 1.3190 |

| Key Levels | 1.3070, 1.3145, 1.3185, 1.3265 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3185 |

| Take Profit | 1.3260 |

| Stop Loss | 1.3140 |

| Key Levels | 1.3070, 1.3145, 1.3185, 1.3265 |

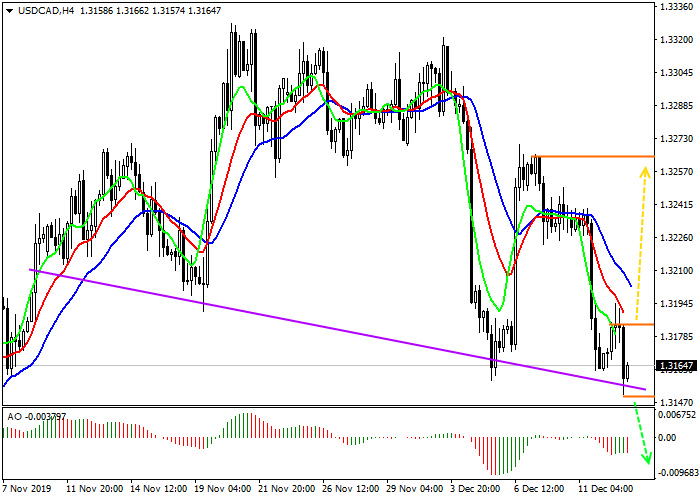

Current trend

The main reason for the fall in the USD/CAD pair was the Fed meeting results and the subsequent decrease in the USD Index to the minimum June values at 79.050. Also, the course was negatively affected by poor Initial Jobless Claims data, which number increased to 252K with a forecast of 213K.

Yesterday’s Canadian new housing price index increased to 0.2%, which is slightly higher than the forecast of 0.1%. The lack of market reaction to this news is expected since investors focused on the speech of the Bank of Canada’s head Stephen Poloz. He mentioned the main points that negatively affect economic stability. The main problem is the slowdown in population growth, which affects the economic growth rate. Interest rates are still low, which increases the debt burden on households, whose debt is 177% of income. Canada's total public debt is growing and reaches 90% of GDP.

Such results were expected and did not find a long-term negative reaction in the market, which indicates a high potential for further reduction of the instrument due to a weakening of USD.

Support and resistance

From the local perspective, the formation of the “head and shoulders” pattern is possible, which enhances the potential for further decline. The Alligator indicator reversed and gave a stable sell signal.

Support levels: 1.3145, 1.3070.

Resistance levels: 1.3185, 1.3265.

Trading tips

After decline and consolidation below the local minimum at 1.3145, it is better to open sell positions with the target at 1.3070. Stop loss is beyond the local maximum of 1.3190.

After growth and consolidation above a local maximum around 1.3185, buy positions with the target at 1.3260 will be relevant. Stop loss is below a local minimum, around 1.3140.

Implementation period: 7 days or more.

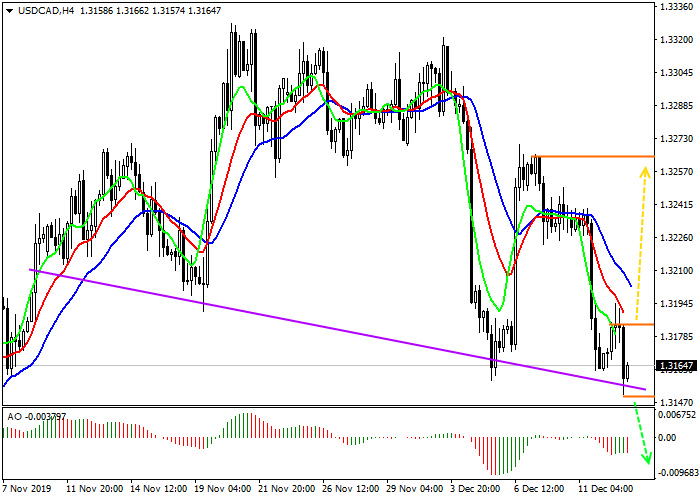

The main reason for the fall in the USD/CAD pair was the Fed meeting results and the subsequent decrease in the USD Index to the minimum June values at 79.050. Also, the course was negatively affected by poor Initial Jobless Claims data, which number increased to 252K with a forecast of 213K.

Yesterday’s Canadian new housing price index increased to 0.2%, which is slightly higher than the forecast of 0.1%. The lack of market reaction to this news is expected since investors focused on the speech of the Bank of Canada’s head Stephen Poloz. He mentioned the main points that negatively affect economic stability. The main problem is the slowdown in population growth, which affects the economic growth rate. Interest rates are still low, which increases the debt burden on households, whose debt is 177% of income. Canada's total public debt is growing and reaches 90% of GDP.

Such results were expected and did not find a long-term negative reaction in the market, which indicates a high potential for further reduction of the instrument due to a weakening of USD.

Support and resistance

From the local perspective, the formation of the “head and shoulders” pattern is possible, which enhances the potential for further decline. The Alligator indicator reversed and gave a stable sell signal.

Support levels: 1.3145, 1.3070.

Resistance levels: 1.3185, 1.3265.

Trading tips

After decline and consolidation below the local minimum at 1.3145, it is better to open sell positions with the target at 1.3070. Stop loss is beyond the local maximum of 1.3190.

After growth and consolidation above a local maximum around 1.3185, buy positions with the target at 1.3260 will be relevant. Stop loss is below a local minimum, around 1.3140.

Implementation period: 7 days or more.

No comments:

Write comments