USD/JPY: the epidemiological situation in Japan is rapidly deteriorating

28 July 2022, 11:47

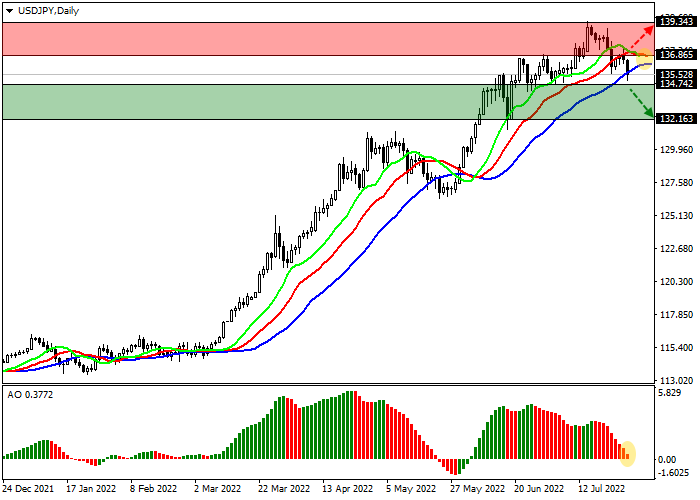

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 134.74 |

| Take Profit | 132.16 |

| Stop Loss | 135.50 |

| Key Levels | 132.16, 134.74, 136.86, 139.34 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 136.86 |

| Take Profit | 139.34 |

| Stop Loss | 136.00 |

| Key Levels | 132.16, 134.74, 136.86, 139.34 |

Current trend

The yen continues to strengthen against the US dollar due to the outcome of the US Federal Reserve's monetary policy meeting held yesterday, as well as ongoing interventions from the Bank of Japan. At the moment, the trading instrument is around 135.49.

According to the World Health Organization, Japan has come out on top in the world in terms of the daily increase in the incidence of coronavirus. More than 200.0K cases of infection were registered yesterday, which has already become the reason for limiting the work of several large industries. The country is fighting the seventh wave of the pandemic. The country's southernmost prefecture, Okinawa, has been hardest hit by the new outbreak, according to authorities, but Tokyo, Osaka, and Hokkaido prefectures in the far north are also on the rise. However, the government does not intend to introduce strict quarantine restrictions soon, citing low mortality and urging the population to get vaccinated. Macroeconomic indicators also show negative dynamics, with the leading indicators index down 1.7% after rising 2.1% in June, and foreign investment in Japanese stocks fell to 298.1B yen this week from 475.0B yen earlier.

As for the US dollar, yesterday, the US Federal Reserve, as part of a meeting on monetary policy, raised the interest rate by 75 basis points. Several experts believe this will not be enough to reduce the rapid pace of inflation, as consumer prices in the country exceeded 9.0%, and the labor market began to decline. Probably, the American financial authorities fear a recession in the economy more than high inflation. However, a recession is already noted, and today's report on the dynamics of gross domestic product for the second quarter will most likely confirm this. Consequently, the regulator did not solve any of the current economic problems, only exacerbating the situation, which created additional pressure on the US dollar, the exchange rate of which the agency is actively trying to strengthen.

Support and resistance

The trading instrument is within the global uptrend, declining to the support line. Technical indicators keep a buy signal, which is actively weakening: indicator Alligator's EMA oscillation range narrows and the AO oscillator histogram forms new downward bars, approaching the transition level.

Support levels: 134.74, 132.16.

Resistance levels: 136.86, 139.34.

Trading tips

Short positions may be opened after the continuation of the corrective decline in the asset or consolidation below 134.74 with the target at 132.16. Stop loss – 135.50. Implementation period: 7 days or more.

Long positions may be opened after the continued global growth of the asset or consolidation above the resistance level of 136.86 with the target at 139.34. Stop loss – 136.00.

No comments:

Write comments