USD/JPY: USD is strengthening

10 December 2019, 09:55

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 108.70 |

| Take Profit | 109.06, 109.28 |

| Stop Loss | 108.41, 108.35 |

| Key Levels | 108.00, 108.22, 108.41, 108.66, 108.91, 109.06, 109.28 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 108.35 |

| Take Profit | 108.00 |

| Stop Loss | 108.66 |

| Key Levels | 108.00, 108.22, 108.41, 108.66, 108.91, 109.06, 109.28 |

Current trend

USD increases slightly against JPY during today’s Asian session, adding about 0.03%. Investors are in no hurry to open new trading positions before the Fed and the ECB hold meetings during the week, and JPY, in turn, is stable against the backdrop of market uncertainty. Investors are concerned about the possible introduction of new import duties on Chinese goods on December 15, since Donald Trump’s administration did not report anything new on this subject, and the parties have no time to sign a trade agreement until that moment.

Strong macroeconomic statistics on GDP published on Monday provide additional support for JPY. In Q3 2019, the Japanese economy grew by 0.4% QoQ after growing by 0.1% QoQ in the previous period. Analysts had expected growth rate at 0.2% QoQ.

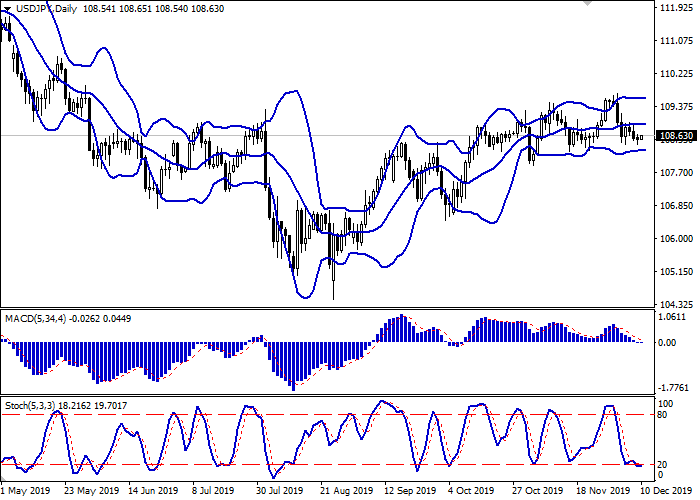

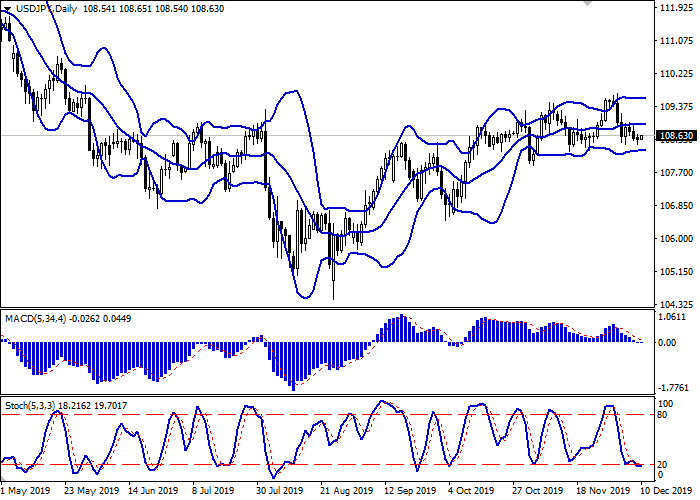

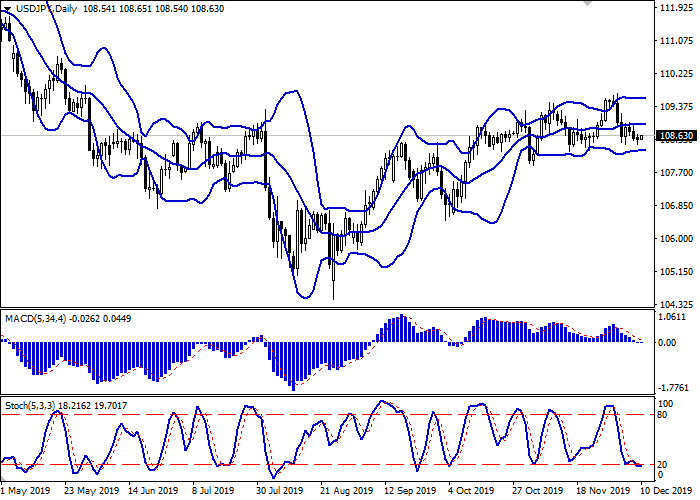

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly narrowing from above, reflecting the ambiguous dynamics of trading in the short term. MACD is declining keeping a weak sell signal (located below the signal line). The indicator is about to test the zero line for a breakdown from above. Stochastic, approaching the level of “20”, reversed into a horizontal plane, indicating the risks of corrective growth in the ultra-short term.

One should wait for the clarification of the situation at the market and clarification of trading signals to open new positions.

Resistance levels: 108.66, 108.91, 109.06, 109.28.

Support levels: 108.41, 108.22, 108.00.

Trading tips

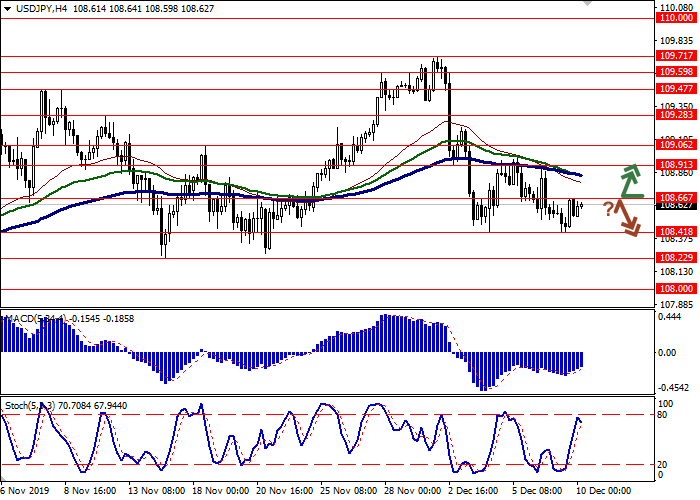

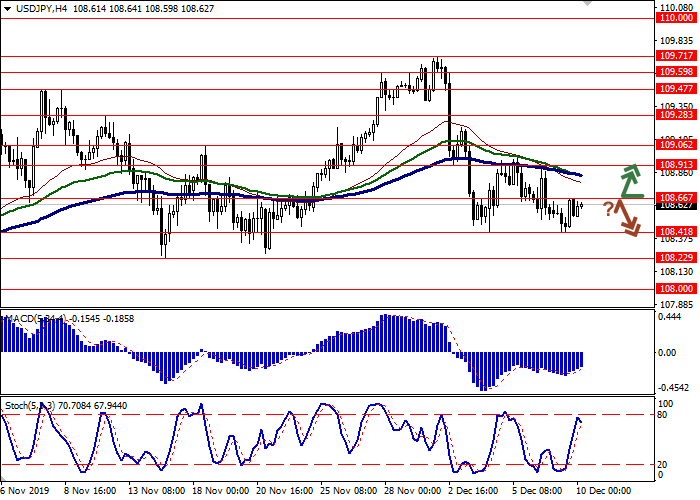

To open long positions, one can rely on the breakout of 108.66. Take profit – 109.06 or 109.28. Stop loss – 108.41 or 108.35.

A rebound from 108.66 as from resistance, followed by a breakdown of 108.41 may become a signal for new sales with the target at 108.00. Stop loss – 108.66.

Implementation time: 2-3 days.

USD increases slightly against JPY during today’s Asian session, adding about 0.03%. Investors are in no hurry to open new trading positions before the Fed and the ECB hold meetings during the week, and JPY, in turn, is stable against the backdrop of market uncertainty. Investors are concerned about the possible introduction of new import duties on Chinese goods on December 15, since Donald Trump’s administration did not report anything new on this subject, and the parties have no time to sign a trade agreement until that moment.

Strong macroeconomic statistics on GDP published on Monday provide additional support for JPY. In Q3 2019, the Japanese economy grew by 0.4% QoQ after growing by 0.1% QoQ in the previous period. Analysts had expected growth rate at 0.2% QoQ.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly narrowing from above, reflecting the ambiguous dynamics of trading in the short term. MACD is declining keeping a weak sell signal (located below the signal line). The indicator is about to test the zero line for a breakdown from above. Stochastic, approaching the level of “20”, reversed into a horizontal plane, indicating the risks of corrective growth in the ultra-short term.

One should wait for the clarification of the situation at the market and clarification of trading signals to open new positions.

Resistance levels: 108.66, 108.91, 109.06, 109.28.

Support levels: 108.41, 108.22, 108.00.

Trading tips

To open long positions, one can rely on the breakout of 108.66. Take profit – 109.06 or 109.28. Stop loss – 108.41 or 108.35.

A rebound from 108.66 as from resistance, followed by a breakdown of 108.41 may become a signal for new sales with the target at 108.00. Stop loss – 108.66.

Implementation time: 2-3 days.

No comments:

Write comments