USD/CAD: general analysis

10 December 2019, 09:52

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.3220 |

| Take Profit | 1.3150 |

| Stop Loss | 1.3270 |

| Key Levels | 1.3150, 1.3220, 1.3265, 1.3305 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3265 |

| Take Profit | 1.3305 |

| Stop Loss | 1.3225 |

| Key Levels | 1.3150, 1.3220, 1.3265, 1.3305 |

Current trend

Despite stability in monetary policy, Canada’s statistic is negative. Thus, the unemployment rate rose immediately by 0.4% to 5.9% against 5.5% in the previous period. The indicator of building permits fell by –1.5% against the forecast of +2.9%.

The OPEC monthly report, which will be published tomorrow, is expected to announce a decision made earlier to reduce production to 500,000 barrels per day, which will positively affect the income of exporting countries, one of which is Canada.

Taking into account the poor economic statistics of Canada and the pessimistic expectations of investors regarding the meeting of the US Federal Reserve, a possible downward trend in the instrument is possible in the first half of this week.

Support and resistance

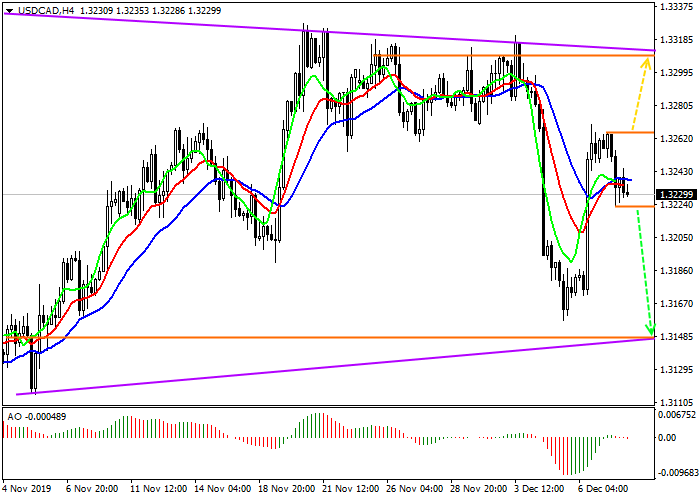

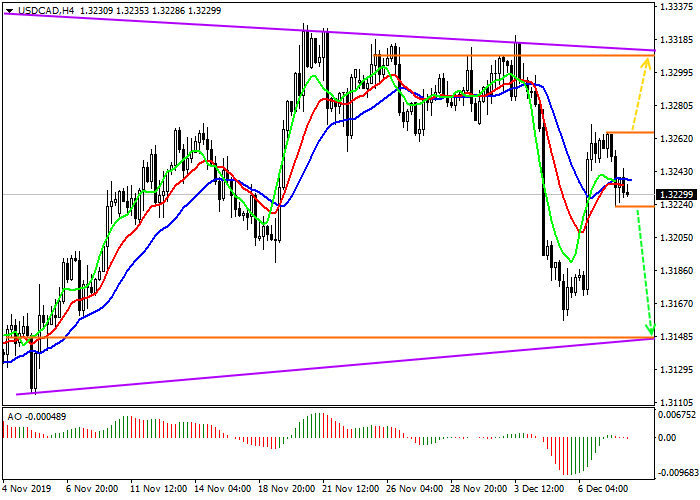

Price continues to move within the global pattern "triangle". After corrective growth on the news of last week, the asset is returning to its previous dynamics. The Alligator indicator has canceled the buy signal and is preparing to give a sell signal. Given that the global pattern is “bearish”, transactions for sale inside it are quite safe.

Resistance levels: 1.3265, 1.3305.

Support levels: 1.3220, 1.3150.

Trading tips

If the asset continues to decline and the price is kept below the local minimum at 1.3220, it is important to open sell positions with a possible target of 1.3150. Stop loss is beyond the local maximum of 1.3270.

In case of asset growth and price fixing above a local maximum around 1.3265, buy positions with the target at 1.3305 will be relevant. Stop loss is advisable to set below the local maximum around 1.3225.

Implementation period: 7 days or more.

Despite stability in monetary policy, Canada’s statistic is negative. Thus, the unemployment rate rose immediately by 0.4% to 5.9% against 5.5% in the previous period. The indicator of building permits fell by –1.5% against the forecast of +2.9%.

The OPEC monthly report, which will be published tomorrow, is expected to announce a decision made earlier to reduce production to 500,000 barrels per day, which will positively affect the income of exporting countries, one of which is Canada.

Taking into account the poor economic statistics of Canada and the pessimistic expectations of investors regarding the meeting of the US Federal Reserve, a possible downward trend in the instrument is possible in the first half of this week.

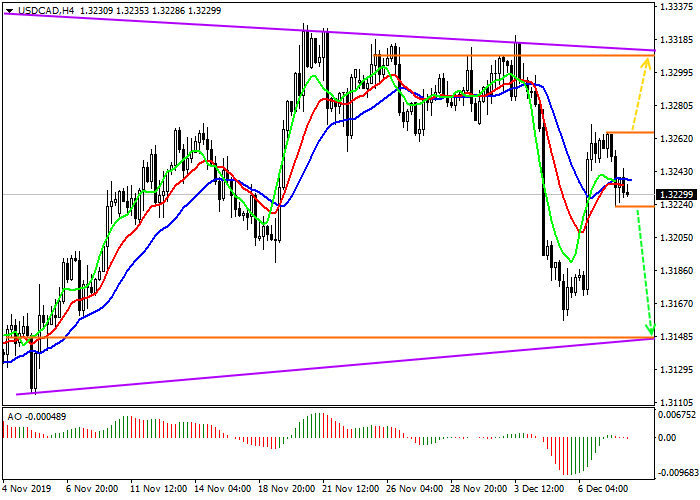

Support and resistance

Price continues to move within the global pattern "triangle". After corrective growth on the news of last week, the asset is returning to its previous dynamics. The Alligator indicator has canceled the buy signal and is preparing to give a sell signal. Given that the global pattern is “bearish”, transactions for sale inside it are quite safe.

Resistance levels: 1.3265, 1.3305.

Support levels: 1.3220, 1.3150.

Trading tips

If the asset continues to decline and the price is kept below the local minimum at 1.3220, it is important to open sell positions with a possible target of 1.3150. Stop loss is beyond the local maximum of 1.3270.

In case of asset growth and price fixing above a local maximum around 1.3265, buy positions with the target at 1.3305 will be relevant. Stop loss is advisable to set below the local maximum around 1.3225.

Implementation period: 7 days or more.

No comments:

Write comments