NZD/USD: New Zealand dollar is growing

10 December 2019, 09:57

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6580 |

| Take Profit | 0.6640 |

| Stop Loss | 0.6539 |

| Key Levels | 0.6464, 0.6500, 0.6521, 0.6539, 0.6575, 0.6614, 0.6640 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6530, 0.6515 |

| Take Profit | 0.6464, 0.6436 |

| Stop Loss | 0.6575 |

| Key Levels | 0.6464, 0.6500, 0.6521, 0.6539, 0.6575, 0.6614, 0.6640 |

Current trend

NZD is showing moderate growth against USD during today’s Asian session, recovering from a decline earlier this week. At the moment, the growth of the instrument is about 0.14%, and NZD itself is again approaching local highs of this August at around 0.6575. Moderate support for the instrument is provided by statistics on Consumer Inflation from China. CPI rose by 4.5% YoY in November after rising by 3.8% YoY in October. Experts expected the index to accelerate to 4.2% YoY. Additional support for the New Zealand dollar is provided by optimistic news regarding the conclusion of a trade agreement between the United States, Mexico and Canada (USMCA).

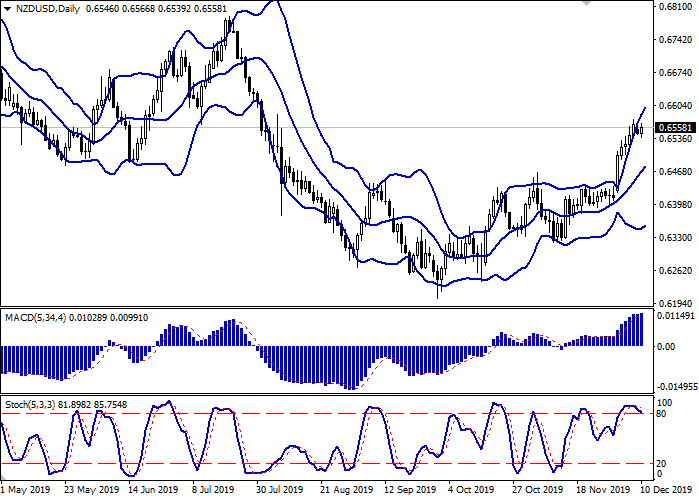

Support and resistance

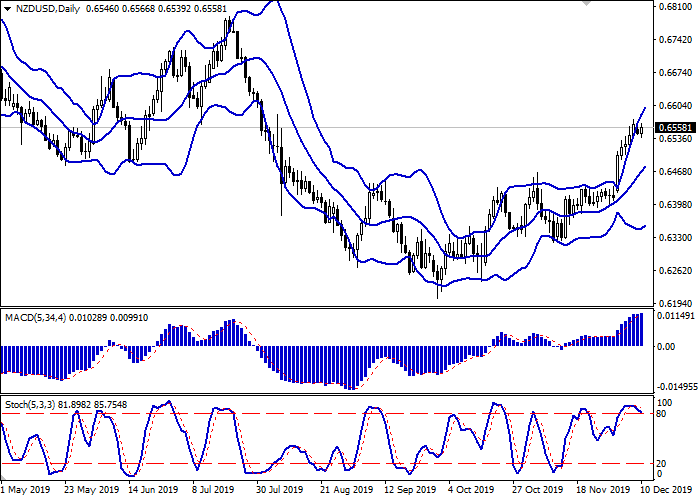

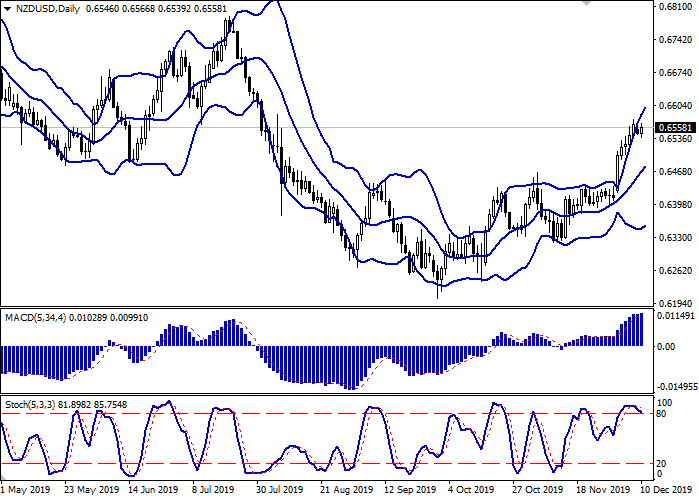

Bollinger Bands in D1 chart show stable growth. The price range is expanding actively, freeing a path to new local highs for the “bulls”. MACD indicator is growing preserving a moderate buy signal (located above the signal line). Stochastic, approaching its highs is reversing into a downward plane, which signals in favor of the development of a correctional decline in the ultra-short term.

It is worth looking into the possibility of the correction trend development in the short and/or ultra-short term.

Resistance levels: 0.6575, 0.6614, 0.6640.

Support levels: 0.6539, 0.6521, 0.6500, 0.6464.

Trading tips

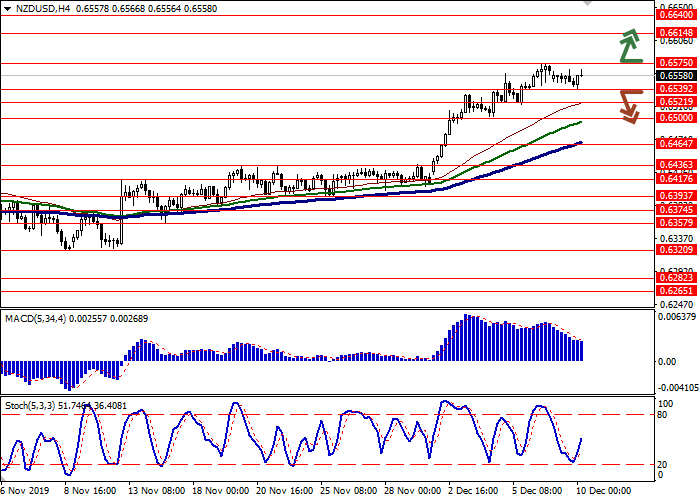

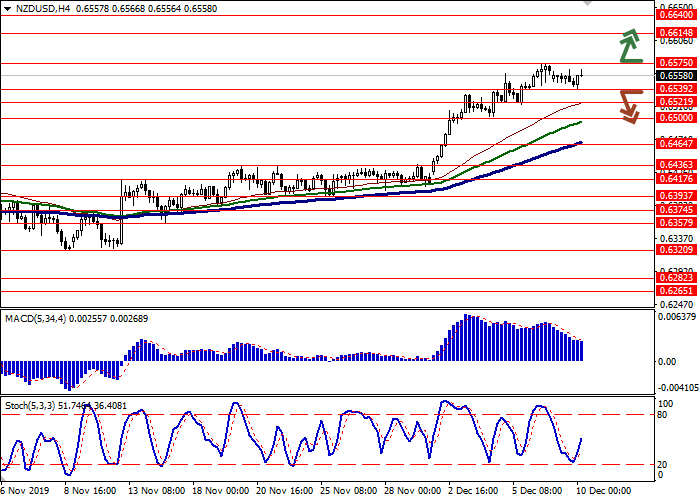

To open long positions, one can rely on the breakout of 0.6575. Take profit – 0.6640. Stop loss – 0.6539. Implementation time: 1-2 days.

A breakdown of 0.6539 or 0.6521 may be a signal for new sales with target at 0.6464 or 0.6436. Stop loss – 0.6575. Implementation time: 2-3 days.

NZD is showing moderate growth against USD during today’s Asian session, recovering from a decline earlier this week. At the moment, the growth of the instrument is about 0.14%, and NZD itself is again approaching local highs of this August at around 0.6575. Moderate support for the instrument is provided by statistics on Consumer Inflation from China. CPI rose by 4.5% YoY in November after rising by 3.8% YoY in October. Experts expected the index to accelerate to 4.2% YoY. Additional support for the New Zealand dollar is provided by optimistic news regarding the conclusion of a trade agreement between the United States, Mexico and Canada (USMCA).

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range is expanding actively, freeing a path to new local highs for the “bulls”. MACD indicator is growing preserving a moderate buy signal (located above the signal line). Stochastic, approaching its highs is reversing into a downward plane, which signals in favor of the development of a correctional decline in the ultra-short term.

It is worth looking into the possibility of the correction trend development in the short and/or ultra-short term.

Resistance levels: 0.6575, 0.6614, 0.6640.

Support levels: 0.6539, 0.6521, 0.6500, 0.6464.

Trading tips

To open long positions, one can rely on the breakout of 0.6575. Take profit – 0.6640. Stop loss – 0.6539. Implementation time: 1-2 days.

A breakdown of 0.6539 or 0.6521 may be a signal for new sales with target at 0.6464 or 0.6436. Stop loss – 0.6575. Implementation time: 2-3 days.

No comments:

Write comments