USD/CHF: USD remains under pressure

06 December 2019, 11:15

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9895 |

| Take Profit | 0.9950, 0.9964 |

| Stop Loss | 0.9850 |

| Key Levels | 0.9800, 0.9838, 0.9848, 0.9867,0.9889, 0.9909, 0.9926, 0.9950 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9860 |

| Take Profit | 0.9800 |

| Stop Loss | 0.9889, 0.9895 |

| Key Levels | 0.9800, 0.9838, 0.9848, 0.9867,0.9889, 0.9909, 0.9926, 0.9950 |

Current trend

USD is stable against CHF during today’s Asian session trading near local lows updated on Wednesday (0.9854). The pressure on USD is exerted by the growth of uncertainty around the US-Chinese trade negotiations after the publication of conflicting data.

Today, investors expect the publication of the November report on the US labor market, which could trigger the appearance of correctional dynamics in favor of USD. The previously published ADP employment report turned out to be worse than its forecasts, so it is possible that the official report will be weaker than expected. One way or another, at the moment investors expect Nonfarm Payrolls to grow by 186K in November after rising by 128K in October. Average Hourly Earnings in November may grow by 0.3% MoM, accelerating from the previous values of 0.2% MoM. The Unemployment Rate is expected to remain at the previous level of 3.6%.

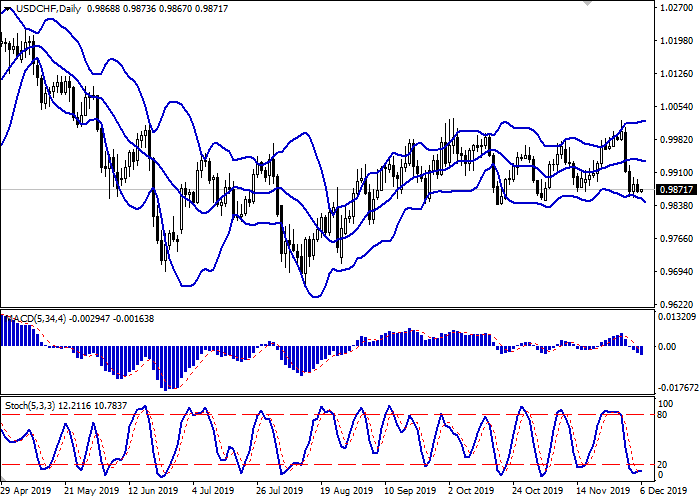

Support and resistance

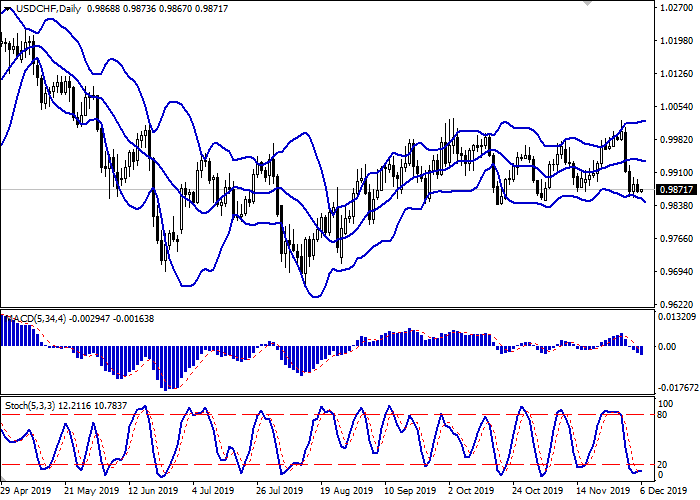

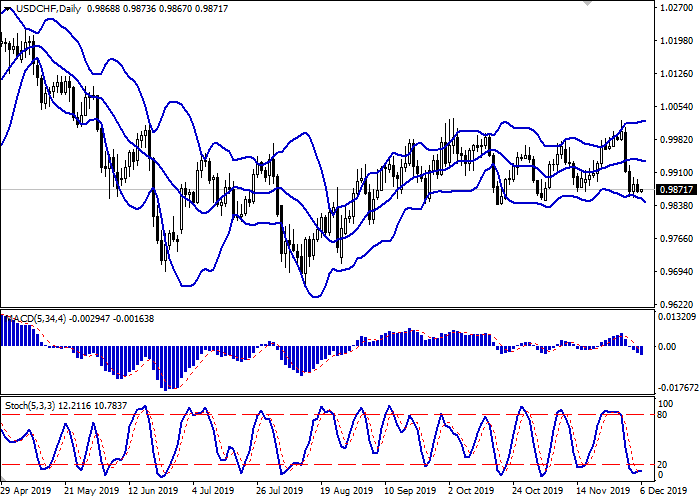

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is actively expanding, making way for new local lows for the "bears". MACD is going down preserving a stable sell signal (located below the signal line). Stochastic, having approached its lows, reversed into a horizontal plane, indicating risks of strongly oversold USD in the ultra-short term.

Existing short positions should be kept in the short term until the situation clears up.

Resistance levels: 0.9889, 0.9909, 0.9926, 0.9950.

Support levels: 0.9867, 0.9848, 0.9838, 0.9800.

Trading tips

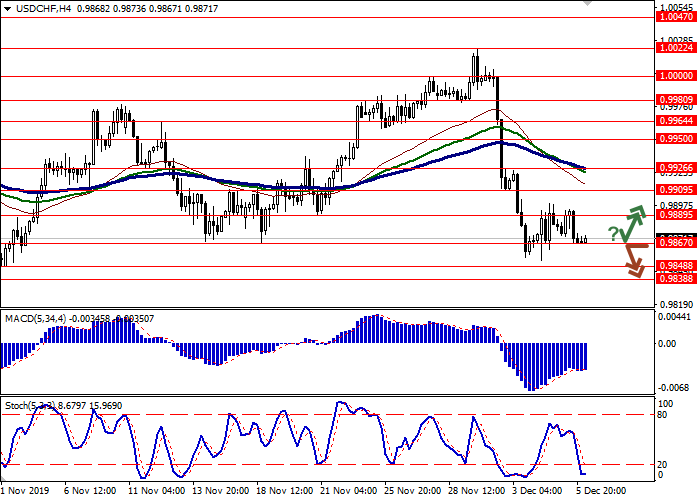

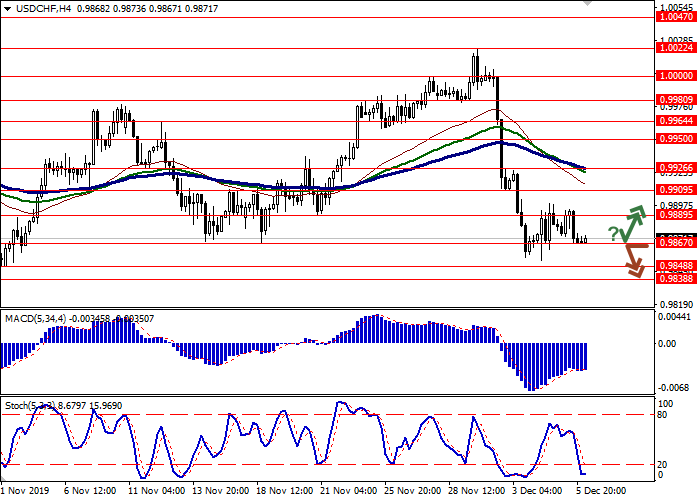

To open long positions, one can rely on the rebound from the support level of 0.9867, with the subsequent breakout of 0.9889. Take profit – 0.9950 or 0.9964. Stop loss – 0.9850.

The breakdown of 0.9867 may serve as a signal to new sales with the target at 0.9800. Stop loss – 0.9889 or 0.9895.

Implementation time: 2-3 days.

USD is stable against CHF during today’s Asian session trading near local lows updated on Wednesday (0.9854). The pressure on USD is exerted by the growth of uncertainty around the US-Chinese trade negotiations after the publication of conflicting data.

Today, investors expect the publication of the November report on the US labor market, which could trigger the appearance of correctional dynamics in favor of USD. The previously published ADP employment report turned out to be worse than its forecasts, so it is possible that the official report will be weaker than expected. One way or another, at the moment investors expect Nonfarm Payrolls to grow by 186K in November after rising by 128K in October. Average Hourly Earnings in November may grow by 0.3% MoM, accelerating from the previous values of 0.2% MoM. The Unemployment Rate is expected to remain at the previous level of 3.6%.

Support and resistance

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is actively expanding, making way for new local lows for the "bears". MACD is going down preserving a stable sell signal (located below the signal line). Stochastic, having approached its lows, reversed into a horizontal plane, indicating risks of strongly oversold USD in the ultra-short term.

Existing short positions should be kept in the short term until the situation clears up.

Resistance levels: 0.9889, 0.9909, 0.9926, 0.9950.

Support levels: 0.9867, 0.9848, 0.9838, 0.9800.

Trading tips

To open long positions, one can rely on the rebound from the support level of 0.9867, with the subsequent breakout of 0.9889. Take profit – 0.9950 or 0.9964. Stop loss – 0.9850.

The breakdown of 0.9867 may serve as a signal to new sales with the target at 0.9800. Stop loss – 0.9889 or 0.9895.

Implementation time: 2-3 days.

No comments:

Write comments