EUR/USD: general analysis

06 December 2019, 11:16

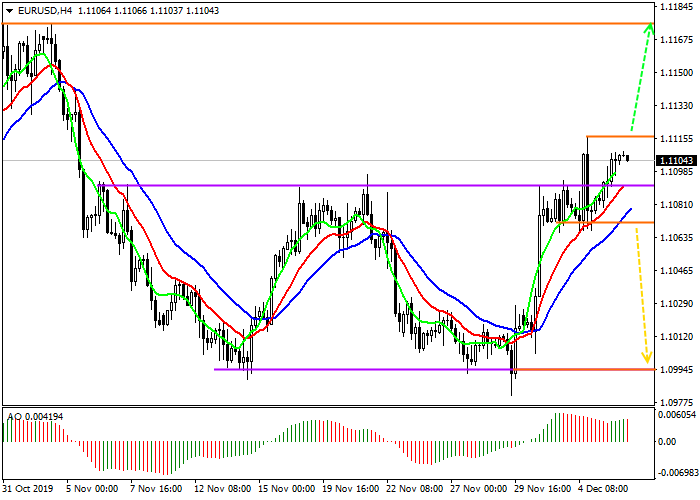

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.1110 |

| Take Profit | 1.1170 |

| Stop Loss | 1.1080 |

| Key Levels | 1.0990, 1.1070, 1.1110, 1.1170 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1070 |

| Take Profit | 1.0990 |

| Stop Loss | 1.1100 |

| Key Levels | 1.0990, 1.1070, 1.1110, 1.1170 |

Current trend

During her speech earlier this week, ECB chairman Christine Lagarde said the EU economic growth remains very poor due to global factors that impede investor confidence. The forecast for the future was restrained, which cast doubt on possible future economic growth. After such statements on Thursday at a meeting of EU finance ministers, the former President of European Commission Jean Claude Juncker hastened to reassure investors and said that he believed in the reliability of the euro, and the regulator, in turn, would take all measures to maintain price stability in the future. The single European currency strengthened against the US dollar by more than 1%.

Meanwhile, the USD Index continues to renew anti-records, reaching a minimum at 97.54 points on Thursday.

The weakening US dollar and the generally positive fundamental background after the meeting in the EU inspire confidence that the currency pair will continue to grow.

Support and resistance

It seems that the upward trend in the pair intends to break the resistance level of the sideways channel and consolidate above 1.1100. The Alligator indicator keeps a stable buy signal, and the AO oscillator is still in convergence, which increases the likelihood of growth.

Resistance levels: 1.1110, 1.1170.

Support levels: 1.1070, 1.0990.

Trading tips

If the asset continues to grow and the price consolidates above 1.1110, buy positions with the target at 1.1170 will be relevant. Stop loss is advisable to set below the local minimum, around 1.1080.

In the case of a reversal and decrease, as well as fixing the price below the local minimum around 1.1070, it is better to open sell positions with a possible target of 1.0990. In this case, stop loss should be set behind the previous maximum, around 1.1100.

Implementation period: 7 days or more.

During her speech earlier this week, ECB chairman Christine Lagarde said the EU economic growth remains very poor due to global factors that impede investor confidence. The forecast for the future was restrained, which cast doubt on possible future economic growth. After such statements on Thursday at a meeting of EU finance ministers, the former President of European Commission Jean Claude Juncker hastened to reassure investors and said that he believed in the reliability of the euro, and the regulator, in turn, would take all measures to maintain price stability in the future. The single European currency strengthened against the US dollar by more than 1%.

Meanwhile, the USD Index continues to renew anti-records, reaching a minimum at 97.54 points on Thursday.

The weakening US dollar and the generally positive fundamental background after the meeting in the EU inspire confidence that the currency pair will continue to grow.

Support and resistance

It seems that the upward trend in the pair intends to break the resistance level of the sideways channel and consolidate above 1.1100. The Alligator indicator keeps a stable buy signal, and the AO oscillator is still in convergence, which increases the likelihood of growth.

Resistance levels: 1.1110, 1.1170.

Support levels: 1.1070, 1.0990.

Trading tips

If the asset continues to grow and the price consolidates above 1.1110, buy positions with the target at 1.1170 will be relevant. Stop loss is advisable to set below the local minimum, around 1.1080.

In the case of a reversal and decrease, as well as fixing the price below the local minimum around 1.1070, it is better to open sell positions with a possible target of 1.0990. In this case, stop loss should be set behind the previous maximum, around 1.1100.

Implementation period: 7 days or more.

No comments:

Write comments