USD/CHF: general review

16 December 2019, 11:05

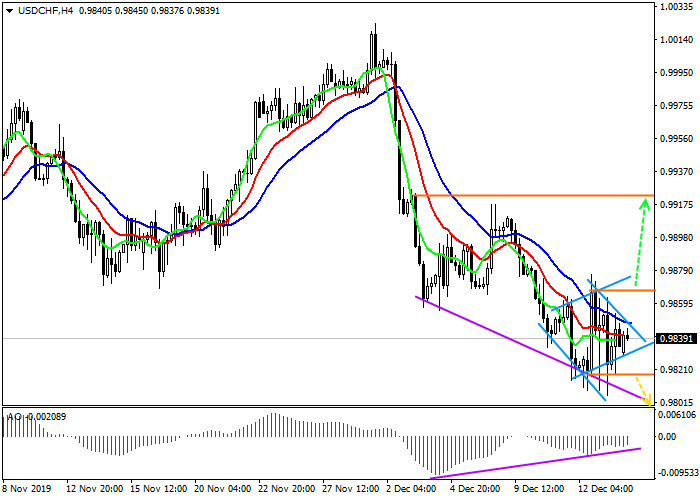

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 0.9870 |

| Take Profit | 0.9930 |

| Stop Loss | 0.9830 |

| Key Levels | 0.9710, 0.9815, 0.9870, 0.9930 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9815 |

| Take Profit | 0.9710 |

| Stop Loss | 0.9870 |

| Key Levels | 0.9710, 0.9815, 0.9870, 0.9930 |

Current trend

The US and China concluded the first stage of a trade deal. The American side postponed the entry into force of additional duties on Chinese goods in the amount of 15% in exchange for a fixed amount of purchases by China of agricultural products from the US. In response, the PRC Committee on Customs Duties and Tariffs issued a statement informing that the country's authorities had decided to temporarily postpone additional US import duties on December 15.

The USD/CHF pair was negatively affected by a decrease in PPI to –0.4% against expectations of –0.1%. However, the news that the SNB left the interest rate unchanged at –0.75% and does not intend to change its monetary policy in the foreseeable future compensated for the negative, and the rate continued to move sideways.

Due to the lack of Swiss data this week, the pair will move under the influence of news from the US and adhere to the dynamics of the USD Index.

Support and resistance

The situation affecting USD led to an increase in the pair’s volatility but there was no directional movement. Instead, a rare “diamond” reversal pattern has formed on the chart, in which case the price may grow. This is indirectly confirmed by the readings of the AO oscillator, on which divergence begins to form.

Resistance levels: 0.9870, 0.9930.

Support levels: 0.9815, 0.9710.

Trading tips

After a reversal and growth, or consolidation above the level of 0.9870, buy positions with the target at 0.9930 will be relevant. Stop loss is below the local minimum, around 0.9830.

After decline and consolidation below the local minimum at 0.9815, it is better to open sell positions with a target at 0.9710. Stop loss is beyond the local maximum, around 0.9870.

Implementation period: 5 days or more.

The US and China concluded the first stage of a trade deal. The American side postponed the entry into force of additional duties on Chinese goods in the amount of 15% in exchange for a fixed amount of purchases by China of agricultural products from the US. In response, the PRC Committee on Customs Duties and Tariffs issued a statement informing that the country's authorities had decided to temporarily postpone additional US import duties on December 15.

The USD/CHF pair was negatively affected by a decrease in PPI to –0.4% against expectations of –0.1%. However, the news that the SNB left the interest rate unchanged at –0.75% and does not intend to change its monetary policy in the foreseeable future compensated for the negative, and the rate continued to move sideways.

Due to the lack of Swiss data this week, the pair will move under the influence of news from the US and adhere to the dynamics of the USD Index.

Support and resistance

The situation affecting USD led to an increase in the pair’s volatility but there was no directional movement. Instead, a rare “diamond” reversal pattern has formed on the chart, in which case the price may grow. This is indirectly confirmed by the readings of the AO oscillator, on which divergence begins to form.

Resistance levels: 0.9870, 0.9930.

Support levels: 0.9815, 0.9710.

Trading tips

After a reversal and growth, or consolidation above the level of 0.9870, buy positions with the target at 0.9930 will be relevant. Stop loss is below the local minimum, around 0.9830.

After decline and consolidation below the local minimum at 0.9815, it is better to open sell positions with a target at 0.9710. Stop loss is beyond the local maximum, around 0.9870.

Implementation period: 5 days or more.

No comments:

Write comments