EUR/USD: the euro is strengthening

16 December 2019, 10:58

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 1.1143 |

| Take Profit | 1.1200, 1.1229 |

| Stop Loss | 1.1115, 1.1100 |

| Key Levels | 1.1062, 1.1080, 1.1096, 1.1115, 1.1143, 1.1174, 1.1200, 1.1229 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1110, 1.1095 |

| Take Profit | 1.1062, 1.1050 |

| Stop Loss | 1.1143, 1.1160 |

| Key Levels | 1.1062, 1.1080, 1.1096, 1.1115, 1.1143, 1.1174, 1.1200, 1.1229 |

Current trend

EUR shows a slight increase against USD during today’s Asian session, adding about 0.13% compared with the closing session last Friday. On December 13, the instrument showed a sharp increase updating local highs of August 13, after which it quickly lost almost all of its advantage, responding to reports of the signing of the first phase of a trade agreement between the United States and China. A little later, on Twitter Donald Trump confirmed that the parties had reached an agreement and the increase in import duties planned for December 15 would be canceled. Today, investors expect publication of statistics on business activity in Europe and the United States for December. It is expected that Markit Composite PMI of euro zone in December will grow from 50.6 to 50.9 points, which will provide moderate support to the euro.

Support and resistance

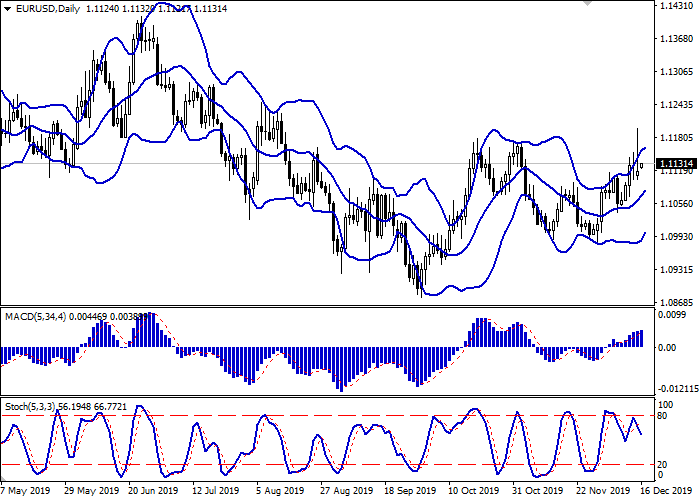

Bollinger Bands in D1 chart show stable growth. The price range is narrowing, limiting the development of “bullish” trend in the short term. MACD indicator is growing preserving a moderate buy signal (located above the signal line). Stochastic showed a rebound from the level of 80 at the end of last trading week and still maintains a confident downtrend.

To open new positions, it is necessary to wait for the signals from technical indicators to be clarified.

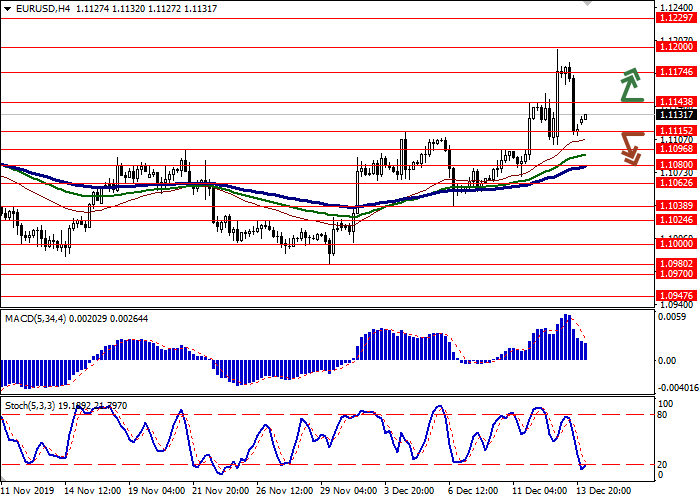

Resistance levels: 1.1143, 1.1174, 1.1200, 1.1229.

Support levels: 1.1115, 1.1096, 1.1080, 1.1062.

Trading tips

To open long positions, one can rely on the breakout of 1.1143. Take profit – 1.1200 or 1.1229. Stop loss – 1.1115 or 1.1100.

The return of “bearish” trend with the breakdown of 1.1115 or 1.1100 may become a signal for new sales with the target at 1.1062 or 1.1050. Stop loss – 1.1143 or 1.1160.

Implementation time: 2-3 days.

EUR shows a slight increase against USD during today’s Asian session, adding about 0.13% compared with the closing session last Friday. On December 13, the instrument showed a sharp increase updating local highs of August 13, after which it quickly lost almost all of its advantage, responding to reports of the signing of the first phase of a trade agreement between the United States and China. A little later, on Twitter Donald Trump confirmed that the parties had reached an agreement and the increase in import duties planned for December 15 would be canceled. Today, investors expect publication of statistics on business activity in Europe and the United States for December. It is expected that Markit Composite PMI of euro zone in December will grow from 50.6 to 50.9 points, which will provide moderate support to the euro.

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range is narrowing, limiting the development of “bullish” trend in the short term. MACD indicator is growing preserving a moderate buy signal (located above the signal line). Stochastic showed a rebound from the level of 80 at the end of last trading week and still maintains a confident downtrend.

To open new positions, it is necessary to wait for the signals from technical indicators to be clarified.

Resistance levels: 1.1143, 1.1174, 1.1200, 1.1229.

Support levels: 1.1115, 1.1096, 1.1080, 1.1062.

Trading tips

To open long positions, one can rely on the breakout of 1.1143. Take profit – 1.1200 or 1.1229. Stop loss – 1.1115 or 1.1100.

The return of “bearish” trend with the breakdown of 1.1115 or 1.1100 may become a signal for new sales with the target at 1.1062 or 1.1050. Stop loss – 1.1143 or 1.1160.

Implementation time: 2-3 days.

No comments:

Write comments