GBP/USD: general review

16 December 2019, 11:08

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.3310 |

| Take Profit | 1.2980 |

| Stop Loss | 1.3500 |

| Key Levels | 1.2980, 1.3310, 1.3510, 1.3650 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3430 |

| Take Profit | 1.3650 |

| Stop Loss | 1.3300 |

| Key Levels | 1.2980, 1.3310, 1.3510, 1.3650 |

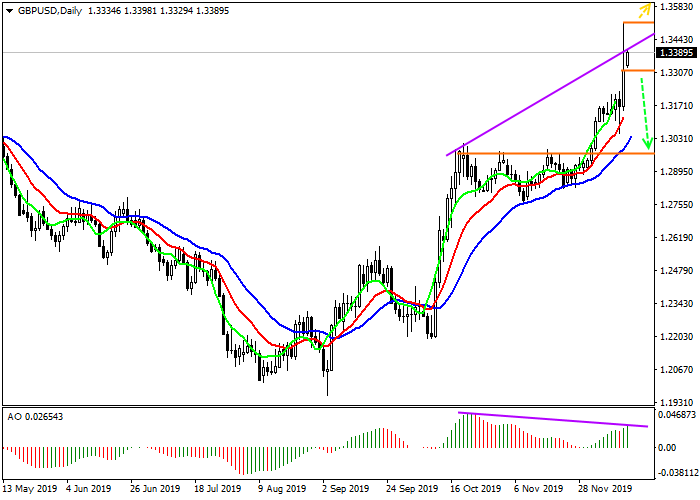

Current trend

Despite the fact that the victory of Prime Minister Boris Johnson was expected, unpredictable for many was the majority received by his team in Parliament, which will now allow the politician to fulfill his promise to complete Brexit by January 31, 2020. Investors greeted the victory with the subsequent purchases of GBP. Boris Johnson assured his supporters that the Brexit plan would be fulfilled within the declared time period. Judging by the growth of the pair by more than 4%, the market perceives this as a signal to strengthen the instrument.

The maximum growth of the pair was promoted by quotations of USD, which is falling at the moment. The USD Index fell to 96.800 points. Subsequent correction and growth to 97.100 points provoked a correction in the pair, which won back a third of its movement.

Support and resistance

After news of Johnson’s party victory, the price instantly jumped to 1.3500. After reaching this level, a downward correction began, which is currently in effect. There is no certainty in the pair, and there will not be any until the volatility decreases. The Alligator indicator continues to hold an uptrend signal. Divergence begins to form on the AO oscillator, but it is too early to talk about sales deals.

Resistance levels: 1.3510, 1.3650.

Support levels: 1.3310, 1.2980.

Trading tips

If the asset declines and the price consolidates below the local low at 1.3310, short positions can be opened with target at 1.2980. Stop loss should be placed above the local high at 1.3500.

If the asset continues growing and the price consolidates above the local high at 1.3510, buy positions will be relevant with target at 1.3650. It is advisable to place the stop loss below the local low at 1.3300.

Implementation time: 5 days.

Despite the fact that the victory of Prime Minister Boris Johnson was expected, unpredictable for many was the majority received by his team in Parliament, which will now allow the politician to fulfill his promise to complete Brexit by January 31, 2020. Investors greeted the victory with the subsequent purchases of GBP. Boris Johnson assured his supporters that the Brexit plan would be fulfilled within the declared time period. Judging by the growth of the pair by more than 4%, the market perceives this as a signal to strengthen the instrument.

The maximum growth of the pair was promoted by quotations of USD, which is falling at the moment. The USD Index fell to 96.800 points. Subsequent correction and growth to 97.100 points provoked a correction in the pair, which won back a third of its movement.

Support and resistance

After news of Johnson’s party victory, the price instantly jumped to 1.3500. After reaching this level, a downward correction began, which is currently in effect. There is no certainty in the pair, and there will not be any until the volatility decreases. The Alligator indicator continues to hold an uptrend signal. Divergence begins to form on the AO oscillator, but it is too early to talk about sales deals.

Resistance levels: 1.3510, 1.3650.

Support levels: 1.3310, 1.2980.

Trading tips

If the asset declines and the price consolidates below the local low at 1.3310, short positions can be opened with target at 1.2980. Stop loss should be placed above the local high at 1.3500.

If the asset continues growing and the price consolidates above the local high at 1.3510, buy positions will be relevant with target at 1.3650. It is advisable to place the stop loss below the local low at 1.3300.

Implementation time: 5 days.

No comments:

Write comments