USD/JPY: general review

16 December 2019, 14:48

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 109.75 |

| Take Profit | 110.15 |

| Stop Loss | 109.50 |

| Key Levels | 107.95, 108.25, 108.46, 108.77, 109.07, 109.30, 109.68, 109.85, 110.12, 110.32 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 109.25 |

| Take Profit | 108.70, 108.45 |

| Stop Loss | 109.60 |

| Key Levels | 107.95, 108.25, 108.46, 108.77, 109.07, 109.30, 109.68, 109.85, 110.12, 110.32 |

Current trend

During the week, USD strengthened against JPY amid growing investor interest in risk. On Friday, the pair weakened after the publication of the US retail sales statistics. The fall in November confirms the Fed's forecasts of low inflation.

On Sunday, a primary agreement between the United States and China was announced. The USA cancels additional duties. September tariffs will be reduced from 15% to 7.5%. China will increase purchases of agricultural products by USD 50 billion. Beijing also promised to redefine its attitude to intellectual property, technology transfer, and make the financial sector more transparent.

However, market uncertainty persists. 240 billion Chinese import duties continue to be applied and used by the USA as an instrument of pressure in further negotiations. Human rights issues in Hong Kong and the oppression of Uyghurs are still a problem. Growth in agricultural production, as well as increasing the value of exports by raising prices, will hit American farmers.

This week, market participants expect specific data on the implementation of the first phase and the announcement of requirements for the second phase. Today at 16:45 (GMT+2) in the United States will release data Manufacturing and Services PMIs.

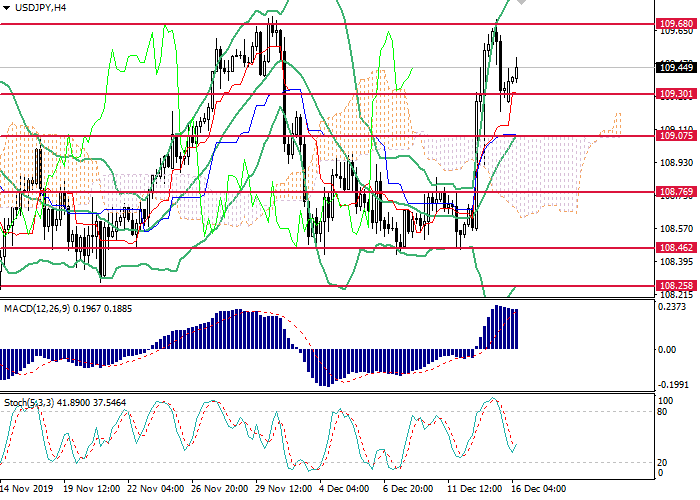

Support and resistance

The H4 chart shows the uptrend correction. Bollinger Bands are directed upwards, and the price range has expanded significantly, indicating continued growth. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic does not give a signal to open positions.

Support levels: 109.30, 109.07, 108.77, 108.46, 108.25, 107.95.

Resistance levels: 109.68, 109.85, 110.12, 110.32.

Trading tips

Long positions may be opened above 109.70 with the target at 110.15 and stop-loss at 109.50. Implementation time: 1-2 days.

Short positions may be opened below 109.30 with targets at 108.70, 108.45 and stop-loss at 109.60. Implementation period: 2-3 days.

During the week, USD strengthened against JPY amid growing investor interest in risk. On Friday, the pair weakened after the publication of the US retail sales statistics. The fall in November confirms the Fed's forecasts of low inflation.

On Sunday, a primary agreement between the United States and China was announced. The USA cancels additional duties. September tariffs will be reduced from 15% to 7.5%. China will increase purchases of agricultural products by USD 50 billion. Beijing also promised to redefine its attitude to intellectual property, technology transfer, and make the financial sector more transparent.

However, market uncertainty persists. 240 billion Chinese import duties continue to be applied and used by the USA as an instrument of pressure in further negotiations. Human rights issues in Hong Kong and the oppression of Uyghurs are still a problem. Growth in agricultural production, as well as increasing the value of exports by raising prices, will hit American farmers.

This week, market participants expect specific data on the implementation of the first phase and the announcement of requirements for the second phase. Today at 16:45 (GMT+2) in the United States will release data Manufacturing and Services PMIs.

Support and resistance

The H4 chart shows the uptrend correction. Bollinger Bands are directed upwards, and the price range has expanded significantly, indicating continued growth. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic does not give a signal to open positions.

Support levels: 109.30, 109.07, 108.77, 108.46, 108.25, 107.95.

Resistance levels: 109.68, 109.85, 110.12, 110.32.

Trading tips

Long positions may be opened above 109.70 with the target at 110.15 and stop-loss at 109.50. Implementation time: 1-2 days.

Short positions may be opened below 109.30 with targets at 108.70, 108.45 and stop-loss at 109.60. Implementation period: 2-3 days.

No comments:

Write comments