USD/CHF: dollar is in correction

13 December 2019, 09:33

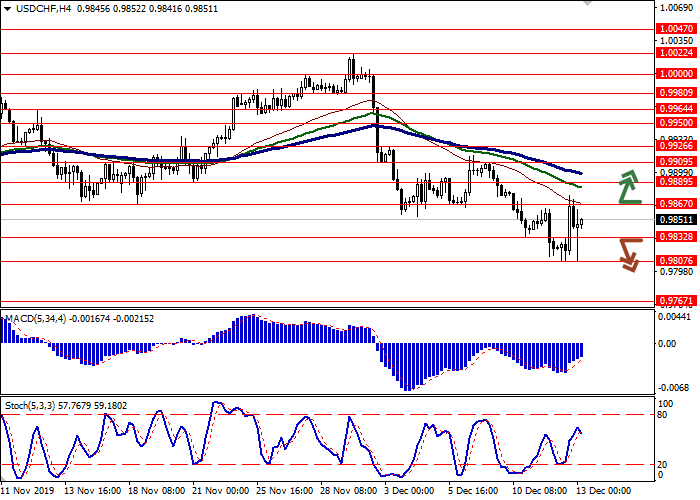

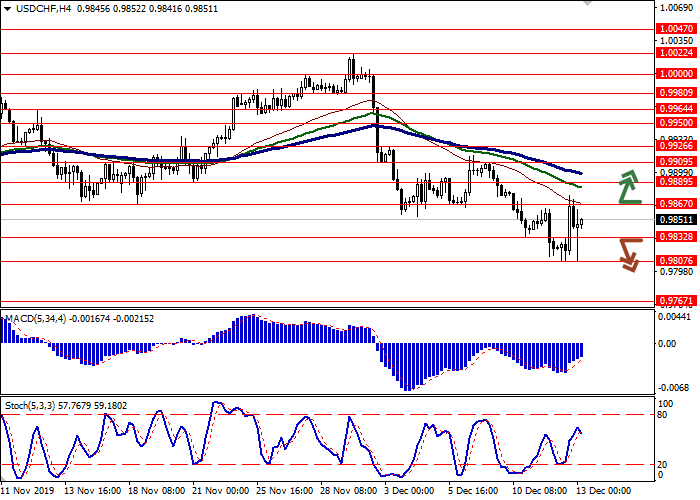

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9870 |

| Take Profit | 0.9926 |

| Stop Loss | 0.9832 |

| Key Levels | 0.9767, 0.9807, 0.9832, 0.9867, 0.9889, 0.9909, 0.9926 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9830 |

| Take Profit | 0.9767 |

| Stop Loss | 0.9867 |

| Key Levels | 0.9767, 0.9807, 0.9832, 0.9867, 0.9889, 0.9909, 0.9926 |

Current trend

Today, during the Asian session, the USD/CHF pair is slightly strengthening, continuing to develop the “bullish” correctional impulse formed the day before. In the first hours of trading, the instrument sharply decreased as a result of growth in correctional sentiment and the general upturn in markets but now it has added about 0.06%.

Yesterday, investors were focused on the meetings of the ECB and SNB. As expected, both regulators left the interest rates unchanged. American statistics released on Thursday turned out to be mostly negative. Thus, Initial Jobless Claims for the week of December 6 rose sharply from 203 to 252K with a forecast of growth of 213K. The producer price index excluding food and energy for November fell by 0.2% MoM after rising 0.3% MoM last month. In annual terms, the industrial inflation index slowed down from +1.6% YoY to +1.3% YoY, which turned out to be worse than the neutral forecast.

Support and resistance

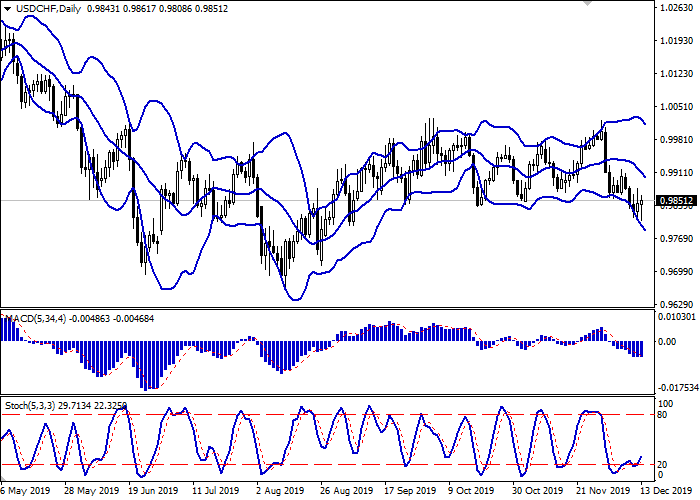

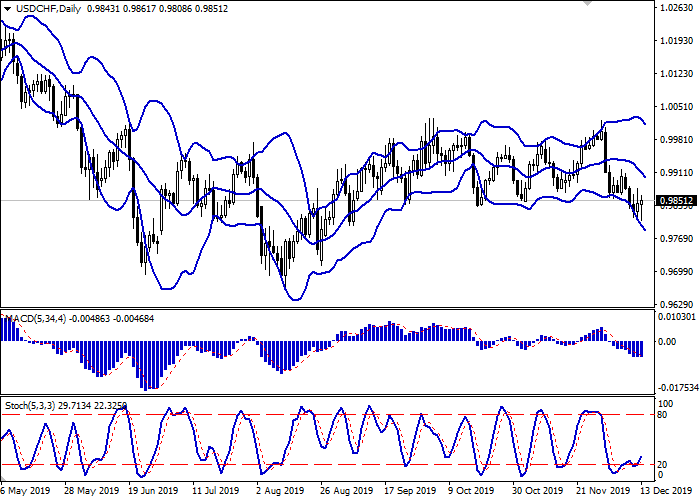

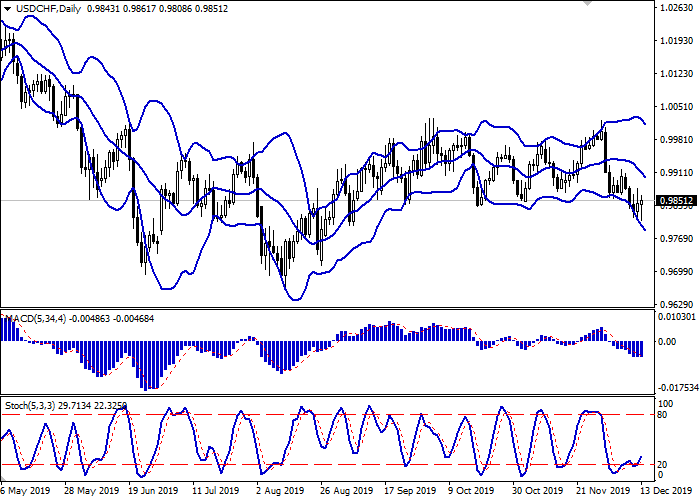

On the daily chart, Bollinger bands are steadily declining. The price range is expanding, letting the "bears" renew local lows. The MACD indicator is reversing upwards, preparing to form a new buy signal (the histogram should be located above the signal line). Stochastic’s dynamics are similar, it retreats from its lows, indicating that the dollar is oversold in the ultra-short term.

Resistance levels: 0.9867, 0.9889, 0.9909, 0.9926.

Support levels: 0.9832, 0.9807, 0.9767.

Trading tips

Long positions may be opened after the breakout of the level of 0.9867 with the target at 0.9926. Stop loss – 0.9832.

Short positions may be opened after the breakdown of the level of 0.9832 with the target at 0.9767. Stop loss – 0.9867.

Implementation period: 2–3 days.

Today, during the Asian session, the USD/CHF pair is slightly strengthening, continuing to develop the “bullish” correctional impulse formed the day before. In the first hours of trading, the instrument sharply decreased as a result of growth in correctional sentiment and the general upturn in markets but now it has added about 0.06%.

Yesterday, investors were focused on the meetings of the ECB and SNB. As expected, both regulators left the interest rates unchanged. American statistics released on Thursday turned out to be mostly negative. Thus, Initial Jobless Claims for the week of December 6 rose sharply from 203 to 252K with a forecast of growth of 213K. The producer price index excluding food and energy for November fell by 0.2% MoM after rising 0.3% MoM last month. In annual terms, the industrial inflation index slowed down from +1.6% YoY to +1.3% YoY, which turned out to be worse than the neutral forecast.

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is expanding, letting the "bears" renew local lows. The MACD indicator is reversing upwards, preparing to form a new buy signal (the histogram should be located above the signal line). Stochastic’s dynamics are similar, it retreats from its lows, indicating that the dollar is oversold in the ultra-short term.

Resistance levels: 0.9867, 0.9889, 0.9909, 0.9926.

Support levels: 0.9832, 0.9807, 0.9767.

Trading tips

Long positions may be opened after the breakout of the level of 0.9867 with the target at 0.9926. Stop loss – 0.9832.

Short positions may be opened after the breakdown of the level of 0.9832 with the target at 0.9767. Stop loss – 0.9867.

Implementation period: 2–3 days.

No comments:

Write comments