AUD/USD: general review

13 December 2019, 09:35

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 0.6940 |

| Take Profit | 0.7030 |

| Stop Loss | 0.6880 |

| Key Levels | 0.6780, 0.6880, 0.6940, 0.7030 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6880 |

| Take Profit | 0.6780 |

| Stop Loss | 0.6940 |

| Key Levels | 0.6780, 0.6880, 0.6940, 0.7030 |

Current trend

In the middle of the week, the Australian government published a mid-year economic and budget forecast. The main risks, as expected, were the fall in housing prices (despite an increase in the third quarter by 2.4%) and a decrease in the prospects for economic growth to 3% from the estimated 3.5%. Among the positive aspects, there is the potential to reduce core inflation to 2% instead of 2.2%, as well as a possible budget surplus due to high prices for iron ore, which is one of the main export products.

The outcome of the FOMC meeting yesterday also supported the instrument. The regulator said that he did not intend to change monetary policy in the near future and the whole of the next year, which, in turn, caused the depreciation of the American currency.

Against the background of the generally positive report of the Australian government and the continued decline in the USD Index, an increase in the growth rate in the AUD/USD pair seems quite likely.

Support and resistance

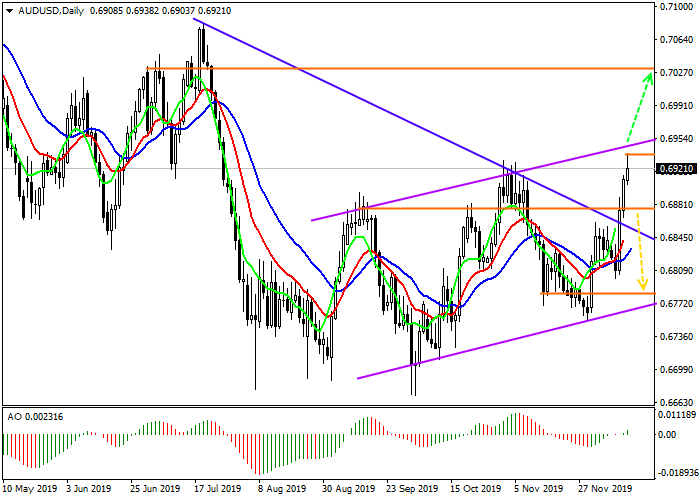

The asset continues to move within the sideways upwards channel. However, such rapid growth may become a harbinger of a new amplification cycle within the possible head and shoulders pattern, and in this case, the upward movement potential will be at least 3%.

Resistance levels: 0.6940, 0.7030.

Support levels: 0.6880, 0.6780.

Trading tips

After growth and if the daily candle closes above 0.6940, both previously opened and new buy positions with the target at 0.7030 will be relevant. Stop loss is below the local minimum, around 0.6880.

After decrease and consolidation below the local minimum at 0.6880, it is better to open sell positions with the target at 0.6780 and stop loss 0.6940.

Implementation period: 7 days or more.

In the middle of the week, the Australian government published a mid-year economic and budget forecast. The main risks, as expected, were the fall in housing prices (despite an increase in the third quarter by 2.4%) and a decrease in the prospects for economic growth to 3% from the estimated 3.5%. Among the positive aspects, there is the potential to reduce core inflation to 2% instead of 2.2%, as well as a possible budget surplus due to high prices for iron ore, which is one of the main export products.

The outcome of the FOMC meeting yesterday also supported the instrument. The regulator said that he did not intend to change monetary policy in the near future and the whole of the next year, which, in turn, caused the depreciation of the American currency.

Against the background of the generally positive report of the Australian government and the continued decline in the USD Index, an increase in the growth rate in the AUD/USD pair seems quite likely.

Support and resistance

The asset continues to move within the sideways upwards channel. However, such rapid growth may become a harbinger of a new amplification cycle within the possible head and shoulders pattern, and in this case, the upward movement potential will be at least 3%.

Resistance levels: 0.6940, 0.7030.

Support levels: 0.6880, 0.6780.

Trading tips

After growth and if the daily candle closes above 0.6940, both previously opened and new buy positions with the target at 0.7030 will be relevant. Stop loss is below the local minimum, around 0.6880.

After decrease and consolidation below the local minimum at 0.6880, it is better to open sell positions with the target at 0.6780 and stop loss 0.6940.

Implementation period: 7 days or more.

No comments:

Write comments