NZD/USD: New Zealand dollar strengthens

05 December 2019, 10:12

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6565 |

| Take Profit | 0.6614, 0.6630 |

| Stop Loss | 0.6530 |

| Key Levels | 0.6436, 0.6464, 0.6500, 0.6521, 0.6561, 0.6580, 0.6614 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6515, 0.6495 |

| Take Profit | 0.6436, 0.6417 |

| Stop Loss | 0.6540, 0.6561 |

| Key Levels | 0.6436, 0.6464, 0.6500, 0.6521, 0.6561, 0.6580, 0.6614 |

Current trend

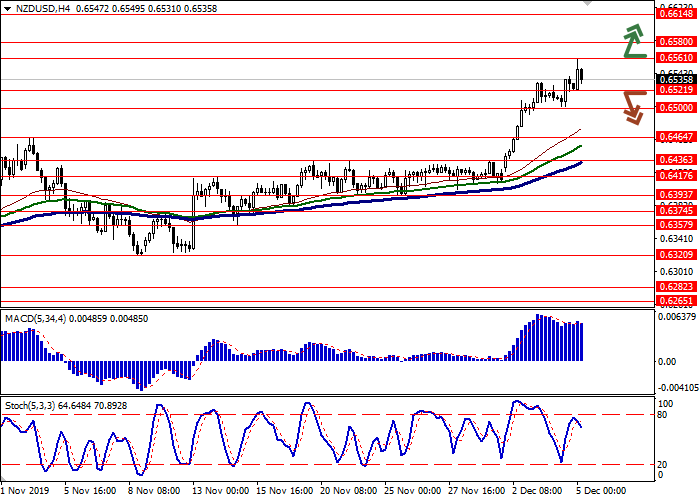

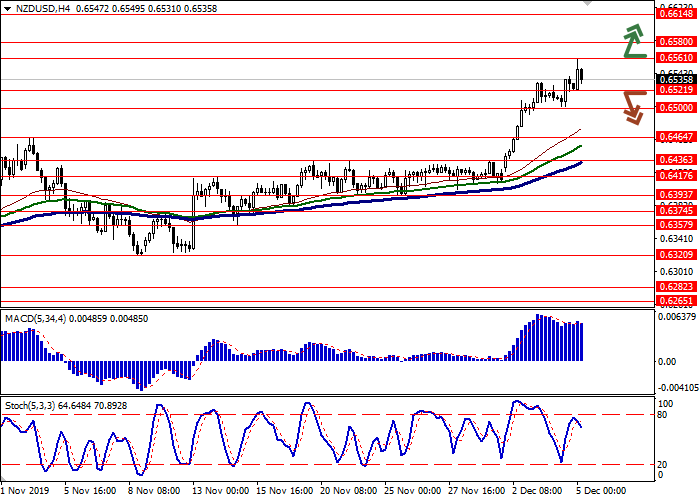

Today, during the Asian session, the NZD/USD pair is trading in an upward trend, adding about 0.05%. The price reached the level of 0.6534, having renewed the local maximums of the beginning of this August around 0.6561.

The growth of the instrument is facilitated by positive news regarding the US-China trade negotiations. The Bloomberg agency, citing unnamed sources, reported that the parties are close to agreeing on the volumes of tariffs that are proposed to be canceled within the first phase of the trade transaction. The deal itself, according to the agency, may be concluded before December 15.

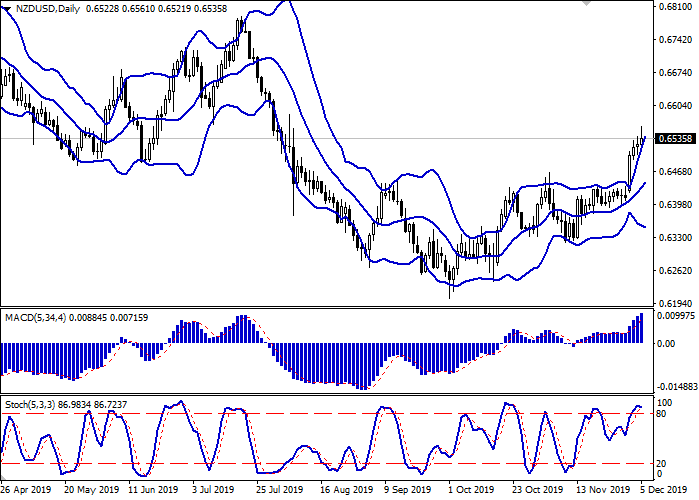

Support and resistance

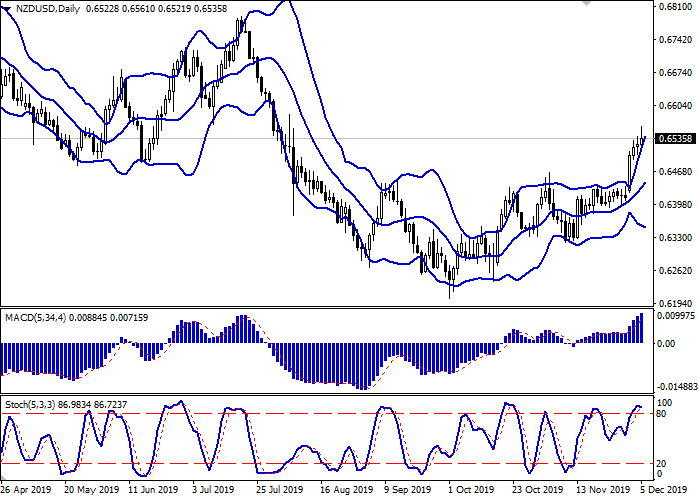

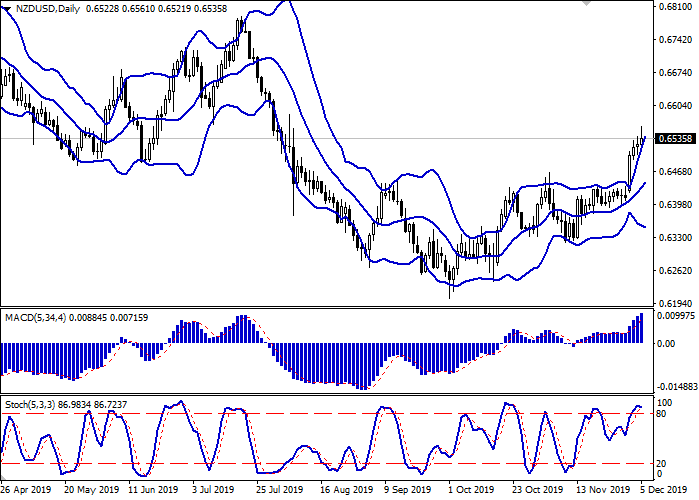

On the daily chart, Bollinger bands are growing moderately. The price range is expanding but not as fast as the “bullish” dynamics develop. The MACD indicator is growing, maintaining a strong buy signal (the histogram is above the signal line). Stochastic, approaching its highs, reverses in a horizontal plane, indicating that NZD may become overbought in the ultra-short term.

A correctional decline in the short and/or ultra-short term is possible at the end of the current trading week.

Resistance levels: 0.6561, 0.6580, 0.6614.

Support levels: 0.6521, 0.6500, 0.6464, 0.6436.

Trading tips

Long positions may be opened after the breakout of the level of 0.6561 with the targets at 0.6614–0.6630. Stop loss – 0.6530.

Short positions may be opened after the breakdown of the levels of 0.6521–0.6500 with the targets at 0.6436–0.6417. Stop loss – 0.6540–0.6561.

Implementation period: 2–3 days.

Today, during the Asian session, the NZD/USD pair is trading in an upward trend, adding about 0.05%. The price reached the level of 0.6534, having renewed the local maximums of the beginning of this August around 0.6561.

The growth of the instrument is facilitated by positive news regarding the US-China trade negotiations. The Bloomberg agency, citing unnamed sources, reported that the parties are close to agreeing on the volumes of tariffs that are proposed to be canceled within the first phase of the trade transaction. The deal itself, according to the agency, may be concluded before December 15.

Support and resistance

On the daily chart, Bollinger bands are growing moderately. The price range is expanding but not as fast as the “bullish” dynamics develop. The MACD indicator is growing, maintaining a strong buy signal (the histogram is above the signal line). Stochastic, approaching its highs, reverses in a horizontal plane, indicating that NZD may become overbought in the ultra-short term.

A correctional decline in the short and/or ultra-short term is possible at the end of the current trading week.

Resistance levels: 0.6561, 0.6580, 0.6614.

Support levels: 0.6521, 0.6500, 0.6464, 0.6436.

Trading tips

Long positions may be opened after the breakout of the level of 0.6561 with the targets at 0.6614–0.6630. Stop loss – 0.6530.

Short positions may be opened after the breakdown of the levels of 0.6521–0.6500 with the targets at 0.6436–0.6417. Stop loss – 0.6540–0.6561.

Implementation period: 2–3 days.

No comments:

Write comments