NZD/USD: New Zealand dollar grows

12 December 2019, 09:30

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6605 |

| Take Profit | 0.6680 |

| Stop Loss | 0.6560, 0.6550 |

| Key Levels | 0.6500, 0.6521, 0.6539, 0.6575, 0.6602, 0.6640, 0.6680, 0.6700 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6570 |

| Take Profit | 0.6500, 0.6480 |

| Stop Loss | 0.6620 |

| Key Levels | 0.6500, 0.6521, 0.6539, 0.6575, 0.6602, 0.6640, 0.6680, 0.6700 |

Current trend

Today, during the Asian session, the NZD/USD pair is relatively stable and is consolidating near local maximums (0.6602), renewed the day before. Yesterday, the instrument was strongly supported by the publication of strong data on Retail Sales in New Zealand, as well as the expected results of the Fed meeting on the interest rate. Electronic Cards Retail Sales for November grew by 2.6% MoM and 5.1% YoY, which was significantly better than market forecasts (0.5% MoM and 1.5% YoY). Today, published macroeconomic statistics from New Zealand is not so positive. Thus, the Food Price Index for November fell by 0.7% MoM after a decline of 0.3% MoM last month. Analysts had expected a decrease of 0.1% MoM. The growth in the number of Visitors Arrivals for October slowed down from 1.4% YoY to 0.1% YoY with a forecast of 0.4% YoY.

Support and resistance

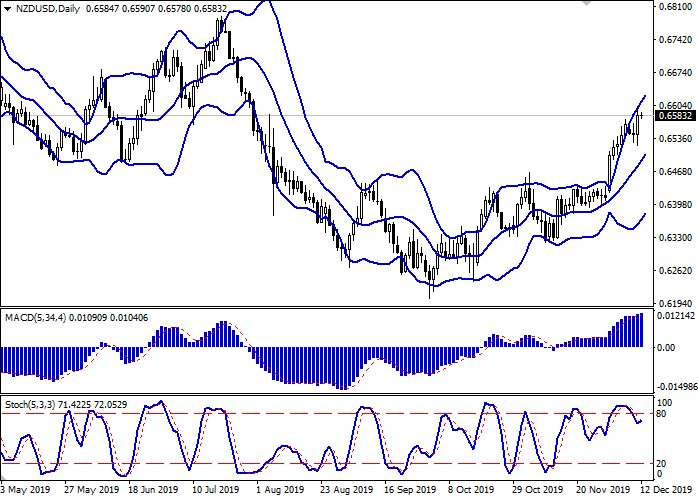

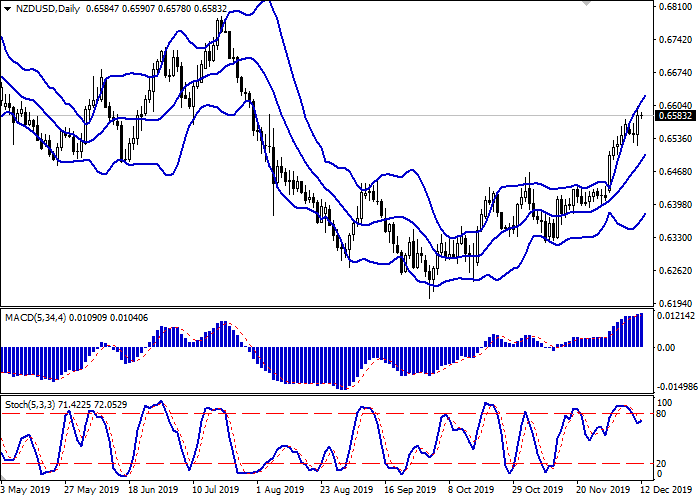

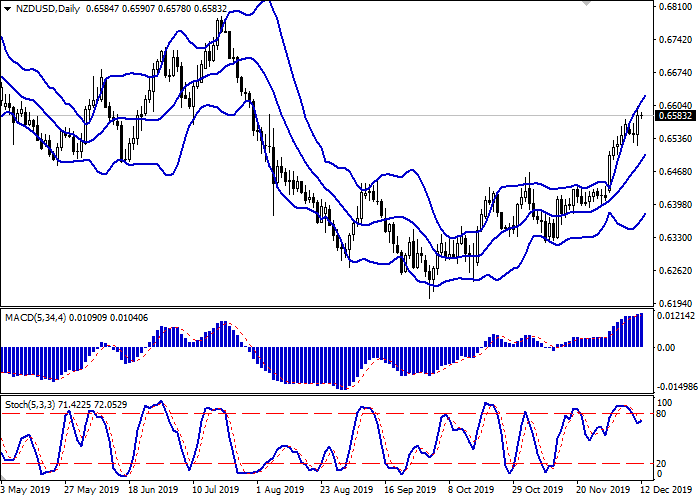

On the daily chart, Bollinger bands grow steadily. The price range expands from above, remaining spacious enough for the current level of market activity. MACD grows, maintaining a poor buy signal (the histogram is above the signal line), recovered due to the yesterday’s active growth. Stochastic grows, reversing upwards near its highs.

It is better to keep part of the current long positions in the short and/or ultra-short term and do not open new positions until the situation is clear.

Resistance levels: 0.6602, 0.6640, 0.6680, 0.6700.

Support levels: 0.6575, 0.6539, 0.6521, 0.6500.

Trading tips

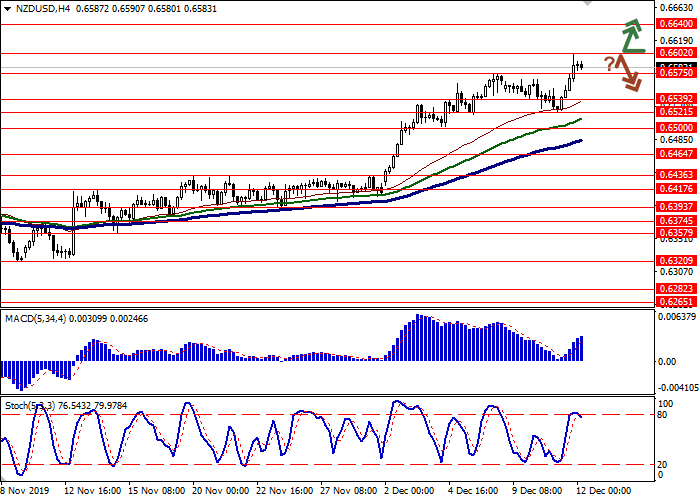

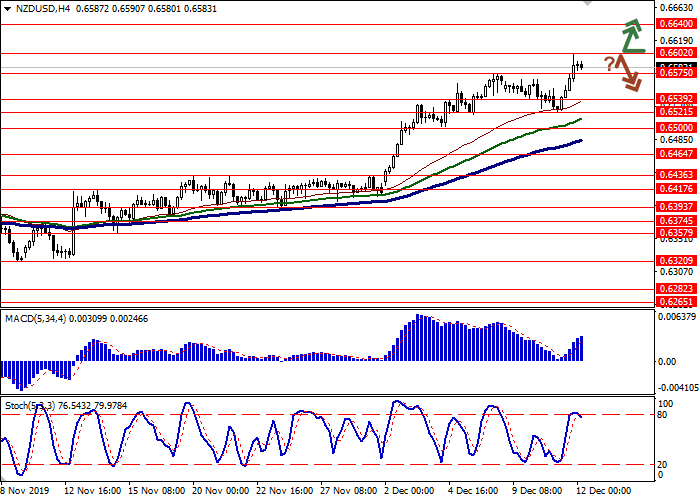

Long positions may be opened after the breakout of 0.6602 with the target at 0.6680. Stop loss – 0.6560–0.6550.

Short positions may be opened after a rebound from 0.6602 and a breakdown of 0.6575 with the target at 0.6500 or 0.6480. Stop loss – 0.6620.

Implementation period: 2–3 days.

Today, during the Asian session, the NZD/USD pair is relatively stable and is consolidating near local maximums (0.6602), renewed the day before. Yesterday, the instrument was strongly supported by the publication of strong data on Retail Sales in New Zealand, as well as the expected results of the Fed meeting on the interest rate. Electronic Cards Retail Sales for November grew by 2.6% MoM and 5.1% YoY, which was significantly better than market forecasts (0.5% MoM and 1.5% YoY). Today, published macroeconomic statistics from New Zealand is not so positive. Thus, the Food Price Index for November fell by 0.7% MoM after a decline of 0.3% MoM last month. Analysts had expected a decrease of 0.1% MoM. The growth in the number of Visitors Arrivals for October slowed down from 1.4% YoY to 0.1% YoY with a forecast of 0.4% YoY.

Support and resistance

On the daily chart, Bollinger bands grow steadily. The price range expands from above, remaining spacious enough for the current level of market activity. MACD grows, maintaining a poor buy signal (the histogram is above the signal line), recovered due to the yesterday’s active growth. Stochastic grows, reversing upwards near its highs.

It is better to keep part of the current long positions in the short and/or ultra-short term and do not open new positions until the situation is clear.

Resistance levels: 0.6602, 0.6640, 0.6680, 0.6700.

Support levels: 0.6575, 0.6539, 0.6521, 0.6500.

Trading tips

Long positions may be opened after the breakout of 0.6602 with the target at 0.6680. Stop loss – 0.6560–0.6550.

Short positions may be opened after a rebound from 0.6602 and a breakdown of 0.6575 with the target at 0.6500 or 0.6480. Stop loss – 0.6620.

Implementation period: 2–3 days.

No comments:

Write comments