USD/CAD: US dollar remains under pressure

12 December 2019, 08:42

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3195 |

| Take Profit | 1.3250, 1.3269 |

| Stop Loss | 1.3150 |

| Key Levels | 1.3070, 1.3100, 1.3132, 1.3157, 1.3189, 1.3221, 1.3269, 1.3300 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3150 |

| Take Profit | 1.3100, 1.3070 |

| Stop Loss | 1.3200 |

| Key Levels | 1.3070, 1.3100, 1.3132, 1.3157, 1.3189, 1.3221, 1.3269, 1.3300 |

Current trend

Today, during the Asian session, the USD/CAD pair is falling slightly, losing about 0.11%.

The instrument is consolidating near local lows at 1.3161, renewed yesterday when the US currency came under pressure after the publication of the Fed protocols. As expected, the regulator did not change the parameters of monetary policy and kept the rate at 1.75%. At the same time, the Fed made it clear that the current rates’ levels will remain unchanged for a sufficiently long time. Target inflation levels are still not achieved but forecasts for the near future do not suggest that it will happen soon.

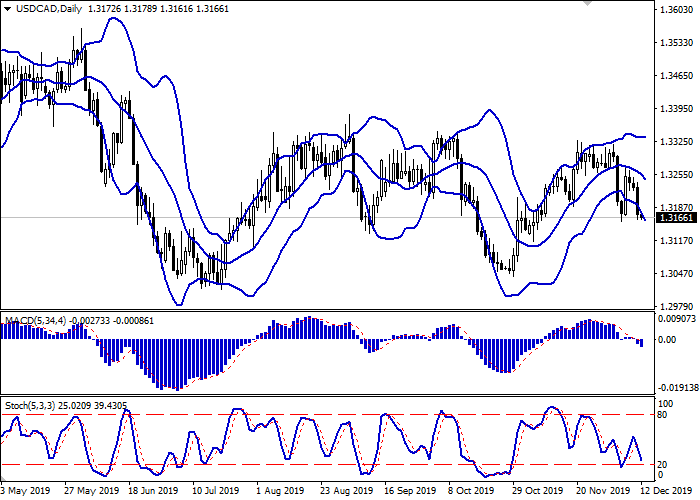

Support and resistance

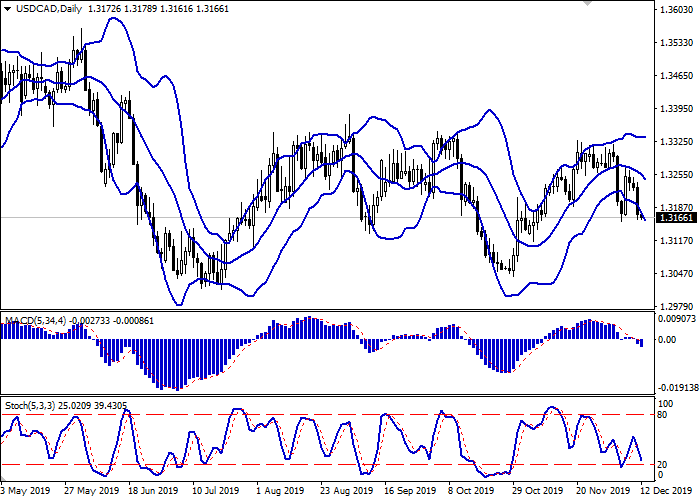

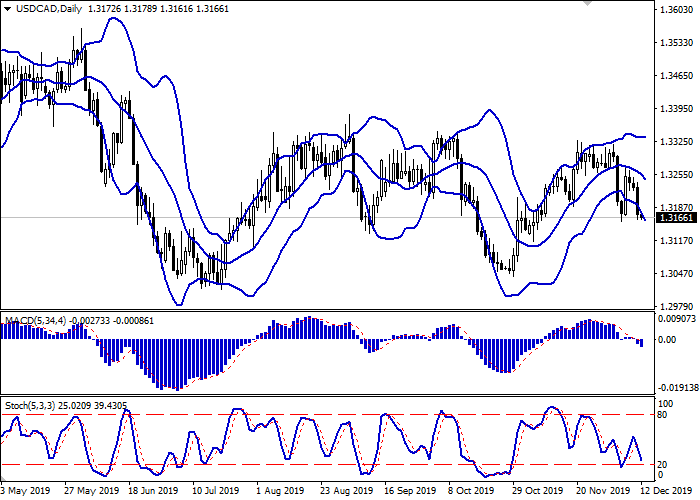

On the daily chart, Bollinger bands are steadily declining. The price range is expanding from below but not as fast as the “bearish” moods develop. The MACD indicator goes down, maintaining a strong sell signal (the histogram is below the signal line). Also, the indicator is trying to consolidate below the zero line. Stochastic has returned to decline and is again approaching its lows, which may indicate that the instrument may become oversold in the ultra-short term.

It is better to keep the current sport positions in the short and/or ultra-short term until the market situation is clarified.

Resistance levels: 1.3189, 1.3221, 1.3269, 1.3300.

Support levels: 1.3157, 1.3132, 1.3100, 1.3070.

Trading tips

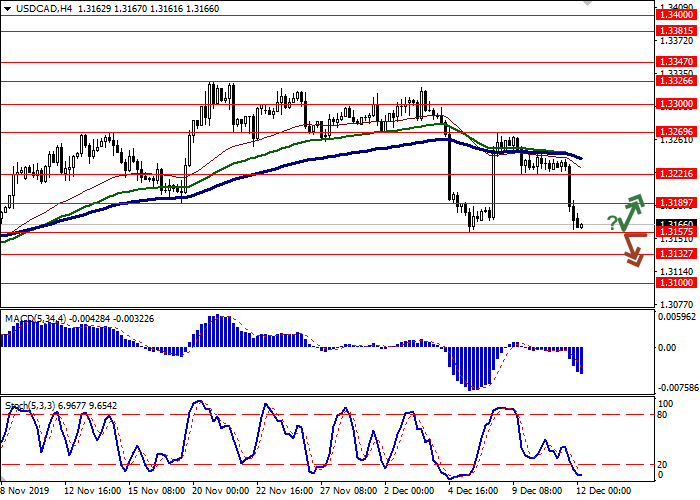

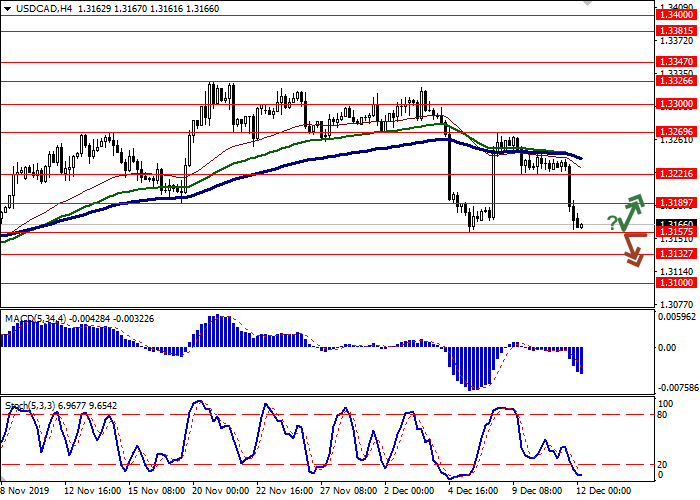

Long positions may be opened after a rebound from the level of 1.3157 and a breakout of the level of 1.3189 with the targets at 1.3250–1.3269. Stop loss – 1.3150. Implementation period: 2–3 days.

Short positions may be opened after the breakdown of the level of 1.3157 with the target at 1.3100 or 1.3070. Stop loss – 1.3200. Implementation period: 1–2 days.

Today, during the Asian session, the USD/CAD pair is falling slightly, losing about 0.11%.

The instrument is consolidating near local lows at 1.3161, renewed yesterday when the US currency came under pressure after the publication of the Fed protocols. As expected, the regulator did not change the parameters of monetary policy and kept the rate at 1.75%. At the same time, the Fed made it clear that the current rates’ levels will remain unchanged for a sufficiently long time. Target inflation levels are still not achieved but forecasts for the near future do not suggest that it will happen soon.

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is expanding from below but not as fast as the “bearish” moods develop. The MACD indicator goes down, maintaining a strong sell signal (the histogram is below the signal line). Also, the indicator is trying to consolidate below the zero line. Stochastic has returned to decline and is again approaching its lows, which may indicate that the instrument may become oversold in the ultra-short term.

It is better to keep the current sport positions in the short and/or ultra-short term until the market situation is clarified.

Resistance levels: 1.3189, 1.3221, 1.3269, 1.3300.

Support levels: 1.3157, 1.3132, 1.3100, 1.3070.

Trading tips

Long positions may be opened after a rebound from the level of 1.3157 and a breakout of the level of 1.3189 with the targets at 1.3250–1.3269. Stop loss – 1.3150. Implementation period: 2–3 days.

Short positions may be opened after the breakdown of the level of 1.3157 with the target at 1.3100 or 1.3070. Stop loss – 1.3200. Implementation period: 1–2 days.

No comments:

Write comments