GBP/USD: the pound is strengthening

12 December 2019, 09:33

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3250 |

| Take Profit | 1.3349, 1.3380 |

| Stop Loss | 1.3160 |

| Key Levels | 1.3060, 1.3100, 1.3148, 1.3195, 1.3245, 1.3300, 1.3349 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3190, 1.3155 |

| Take Profit | 1.3060, 1.3011, 1.3000 |

| Stop Loss | 1.3245, 1.3270 |

| Key Levels | 1.3060, 1.3100, 1.3148, 1.3195, 1.3245, 1.3300, 1.3349 |

Current trend

GBP remains upward in trading against USD. During the Asian session, the instrument adds about 0.16%, again updating record highs of the end of March. British investors are focused on the parliamentary elections in the UK, which will be held today. The markets expect a confident victory for the Conservative Party led by Prime Minister Boris Johnson, which is likely to allow unhindered ratification of the agreement with the EU. However, the updated polls from YouGov reduced optimism regarding the confident victory of the conservatives, as they indicated a sharp reduction in the leadership of the party of Boris Johnson.

Support and resistance

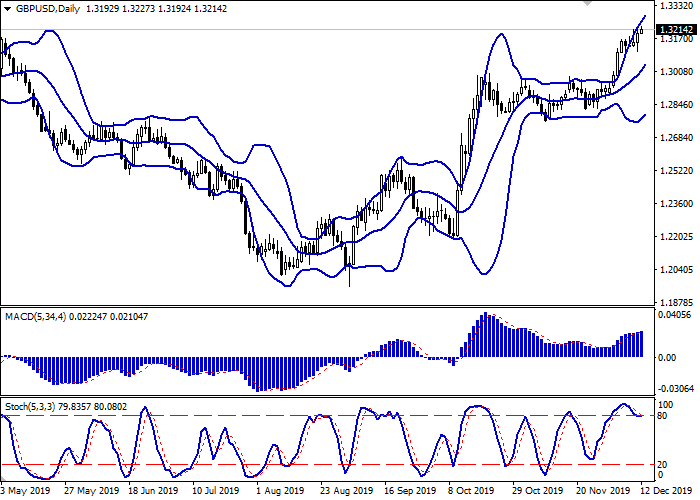

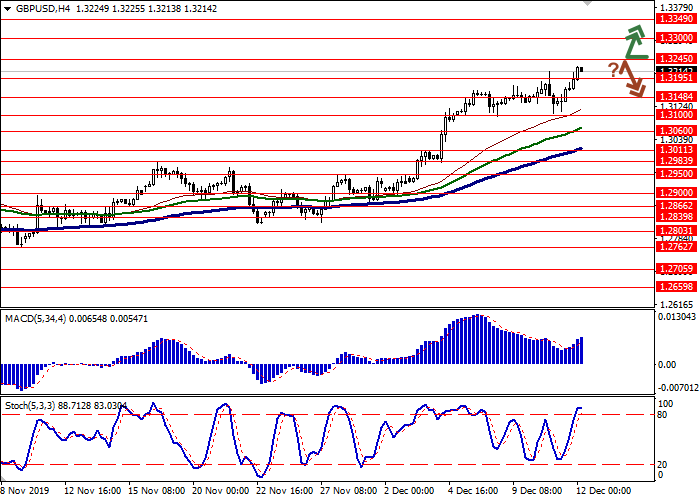

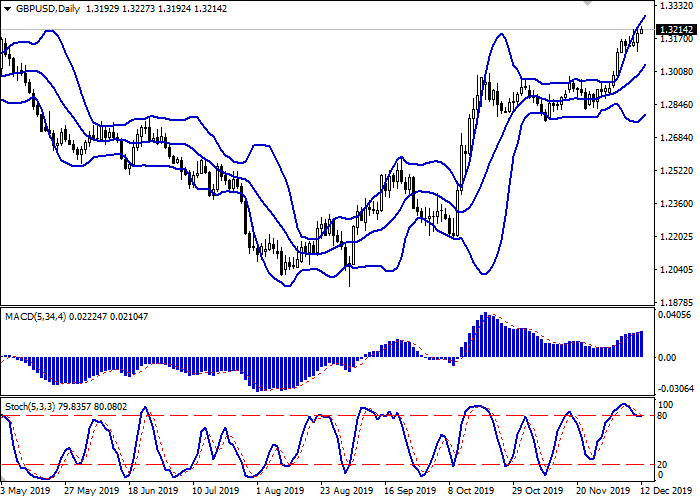

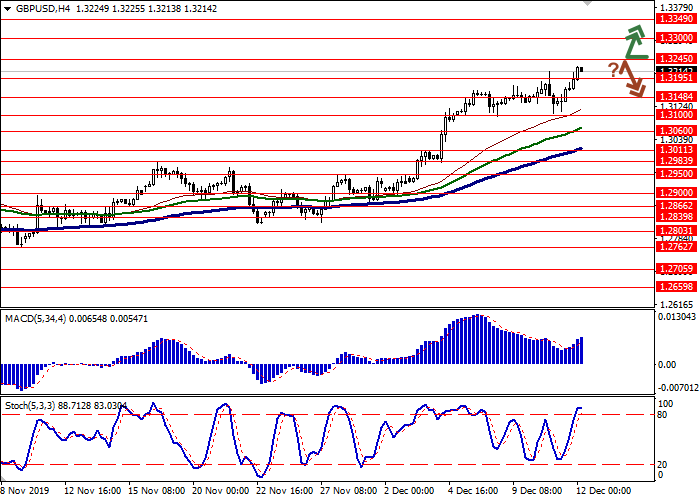

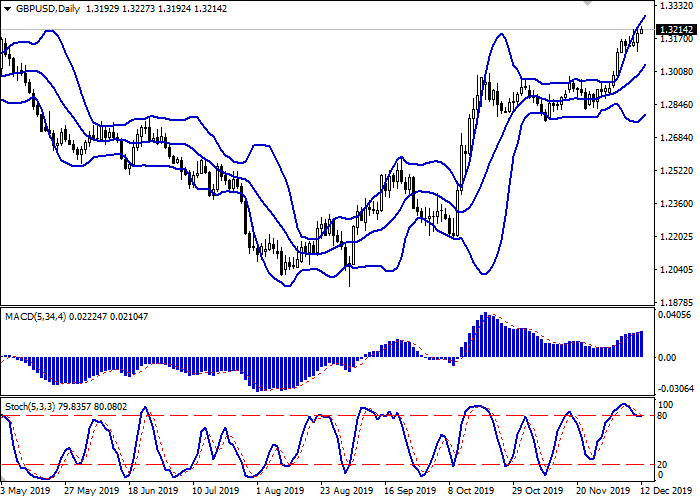

Bollinger Bands in D1 chart show stable growth. The price range expands, freeing a path to new local highs for the “bulls”. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic, having retreated from its highs, reversed into a horizontal plane near the level of 80, reflecting the recovery of the uptrend in the ultra-short term.

Technical indicators do not contradict the further development of the uptrend in the short and/or ultra-short term.

Resistance levels: 1.3245, 1.3300, 1.3349.

Support levels: 1.3195, 1.3148, 1.3100, 1.3060.

Trading tips

To open long positions, one can rely on the breakout of 1.3245. Take profit – 1.3349 or 1.3380. Stop loss – 1.3160.

The rebound from 1.3245 as from resistance with the subsequent breakdown of 1.3195 or 1.3160 can become a signal for new sales with target at 1.3060 or 1.3011, 1.3000. Stop loss – 1.3245 or 1.3270.

Implementation time: 2-3 days.

GBP remains upward in trading against USD. During the Asian session, the instrument adds about 0.16%, again updating record highs of the end of March. British investors are focused on the parliamentary elections in the UK, which will be held today. The markets expect a confident victory for the Conservative Party led by Prime Minister Boris Johnson, which is likely to allow unhindered ratification of the agreement with the EU. However, the updated polls from YouGov reduced optimism regarding the confident victory of the conservatives, as they indicated a sharp reduction in the leadership of the party of Boris Johnson.

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range expands, freeing a path to new local highs for the “bulls”. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic, having retreated from its highs, reversed into a horizontal plane near the level of 80, reflecting the recovery of the uptrend in the ultra-short term.

Technical indicators do not contradict the further development of the uptrend in the short and/or ultra-short term.

Resistance levels: 1.3245, 1.3300, 1.3349.

Support levels: 1.3195, 1.3148, 1.3100, 1.3060.

Trading tips

To open long positions, one can rely on the breakout of 1.3245. Take profit – 1.3349 or 1.3380. Stop loss – 1.3160.

The rebound from 1.3245 as from resistance with the subsequent breakdown of 1.3195 or 1.3160 can become a signal for new sales with target at 1.3060 or 1.3011, 1.3000. Stop loss – 1.3245 or 1.3270.

Implementation time: 2-3 days.

No comments:

Write comments