Brent Crude Oil: general analysis

12 December 2019, 09:35

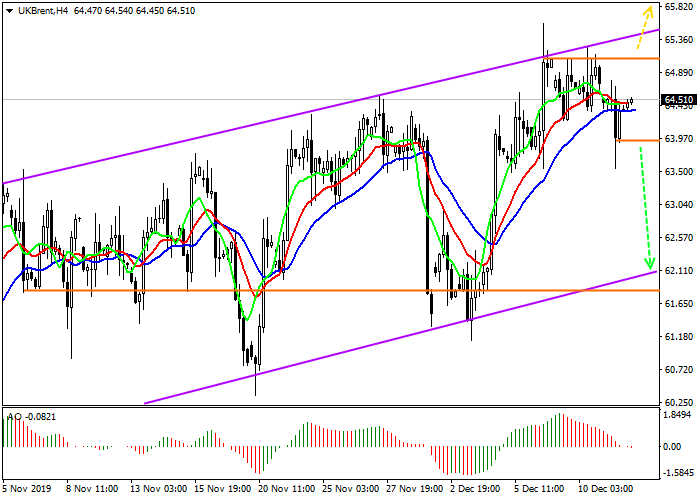

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 64.00 |

| Take Profit | 62.10 |

| Stop Loss | 65.10 |

| Key Levels | 62.10, 64.00, 65.10, 70.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 65.10 |

| Take Profit | 70.00 |

| Stop Loss | 64.50 |

| Key Levels | 62.10, 64.00, 65.10, 70.00 |

Current trend

Last week’s positive from the first decline in “black gold” reserves was interrupted by a drop in quotations by $1.5 due to another increase in reserves from the EIA by 0.822M against the forecast of –2.763M. The spread in the arbitrage position between WTI Crude Oil and Brent is again approaching the average annual value of $6 and currently stands at $5.5, which indicates a decrease in trading volumes and a reduction in large positions.

The Tadawul stock exchange recorded an unprecedented placement of the Saudi Aramco oil company, whose share price increased by 10% and amounted to just over 32 riyals in the first hours of trading. The company's capitalization is estimated at $1.7 trillion, which is much more than the value of the five leading world oil companies. The market has not yet sufficiently reacted to this news, as investors need time to assess the prospects for such global changes.

Support and resistance

Despite all the fundamental fluctuations, the price moves within the upward sideways channel, comfortable for traders, as confirmed by the spread size (about 6 dollars). It may leave it with a strong narrowing or expansion of this spread. In the short term, it is better to focus on the potential signal from the Alligator indicator, which is reversing.

Resistance levels: 65.10, 70.00.

Support levels: 64.00, 62.10.

Trading tips

After decline and consolidation below the local minimum around 64.00, it is better to open sell positions with a target at 62.10. Stop loss is above the local maximum, around 65.10.

After price reversal and growth, and consolidation above 65.10, buy positions with the target at 70.00 will be relevant. Stop loss is below the resistance line, around 64.50.

Implementation period: 7 days or more.

Last week’s positive from the first decline in “black gold” reserves was interrupted by a drop in quotations by $1.5 due to another increase in reserves from the EIA by 0.822M against the forecast of –2.763M. The spread in the arbitrage position between WTI Crude Oil and Brent is again approaching the average annual value of $6 and currently stands at $5.5, which indicates a decrease in trading volumes and a reduction in large positions.

The Tadawul stock exchange recorded an unprecedented placement of the Saudi Aramco oil company, whose share price increased by 10% and amounted to just over 32 riyals in the first hours of trading. The company's capitalization is estimated at $1.7 trillion, which is much more than the value of the five leading world oil companies. The market has not yet sufficiently reacted to this news, as investors need time to assess the prospects for such global changes.

Support and resistance

Despite all the fundamental fluctuations, the price moves within the upward sideways channel, comfortable for traders, as confirmed by the spread size (about 6 dollars). It may leave it with a strong narrowing or expansion of this spread. In the short term, it is better to focus on the potential signal from the Alligator indicator, which is reversing.

Resistance levels: 65.10, 70.00.

Support levels: 64.00, 62.10.

Trading tips

After decline and consolidation below the local minimum around 64.00, it is better to open sell positions with a target at 62.10. Stop loss is above the local maximum, around 65.10.

After price reversal and growth, and consolidation above 65.10, buy positions with the target at 70.00 will be relevant. Stop loss is below the resistance line, around 64.50.

Implementation period: 7 days or more.

No comments:

Write comments