EUR/USD: general review

12 December 2019, 10:12

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.1150 |

| Take Profit | 1.1250 |

| Stop Loss | 1.1100 |

| Key Levels | 1.1000, 1.1110, 1.1150, 1.1250 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1110 |

| Take Profit | 1.1000 |

| Stop Loss | 1.1150 |

| Key Levels | 1.1000, 1.1110, 1.1150, 1.1250 |

Current trend

Yesterday, the GBP/USD and EUR/USD pairs moved in inverse correlation to each other, which alerted institutional investors operating in the arbitrage position of the spread between these instruments. The divergence reached 2000 points, from which operations to narrow the range are usually performed. Since the beginning of October, EUR has been missing almost 700 points, so the spread will inevitably decrease. The growth potential of EUR is estimated to be much higher than the further growth of GBP.

Earlier this week, EUR was supported by positive reports from ZEW. German Economic Sentiment rose to 10.7 points, exceeding expectations of 1.1 points. The EU Economic Sentiment also rose to 11.2 points, with expectations for a decline to –17.7 points.

Today, the main event for the instrument will be the ECB interest rate decision and the subsequent press conference. Despite the positive Fed's report and maintaining the interest rate at the level of 1.75%, the market reacted negatively to the results of the meeting of the American regulator, and USD weakened against a basket of world currencies, triggering a pair growth above the level of 1.1100.

Support and resistance

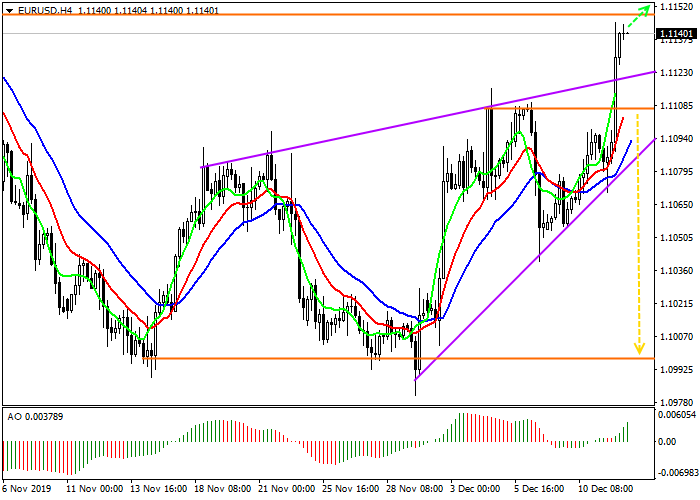

Local resistance at 1.1110 is broken out, and the price continues to rise. The Alligator indicator strengthened the buy signal, which, along with the steady growth of the AO oscillator, gives positive prospects for continued growth.

Resistance levels: 1.1150, 1.1250.

Support levels: 1.1110, 1.1000.

Trading tips

If the asset continues growing and the price consolidates above 1.1150, buy positions with the target of 1.1250 will be relevant. Stop loss – 1.1100.

If the asset reverses and declines, and the price consolidates below the local resistance at 1.1110, sell positions can be opened with the target at 1.1000. Stop loss – 1.1150.

Implementation time: 7 days and more.

Yesterday, the GBP/USD and EUR/USD pairs moved in inverse correlation to each other, which alerted institutional investors operating in the arbitrage position of the spread between these instruments. The divergence reached 2000 points, from which operations to narrow the range are usually performed. Since the beginning of October, EUR has been missing almost 700 points, so the spread will inevitably decrease. The growth potential of EUR is estimated to be much higher than the further growth of GBP.

Earlier this week, EUR was supported by positive reports from ZEW. German Economic Sentiment rose to 10.7 points, exceeding expectations of 1.1 points. The EU Economic Sentiment also rose to 11.2 points, with expectations for a decline to –17.7 points.

Today, the main event for the instrument will be the ECB interest rate decision and the subsequent press conference. Despite the positive Fed's report and maintaining the interest rate at the level of 1.75%, the market reacted negatively to the results of the meeting of the American regulator, and USD weakened against a basket of world currencies, triggering a pair growth above the level of 1.1100.

Support and resistance

Local resistance at 1.1110 is broken out, and the price continues to rise. The Alligator indicator strengthened the buy signal, which, along with the steady growth of the AO oscillator, gives positive prospects for continued growth.

Resistance levels: 1.1150, 1.1250.

Support levels: 1.1110, 1.1000.

Trading tips

If the asset continues growing and the price consolidates above 1.1150, buy positions with the target of 1.1250 will be relevant. Stop loss – 1.1100.

If the asset reverses and declines, and the price consolidates below the local resistance at 1.1110, sell positions can be opened with the target at 1.1000. Stop loss – 1.1150.

Implementation time: 7 days and more.

No comments:

Write comments