NZD/USD: general review

04 December 2019, 09:45

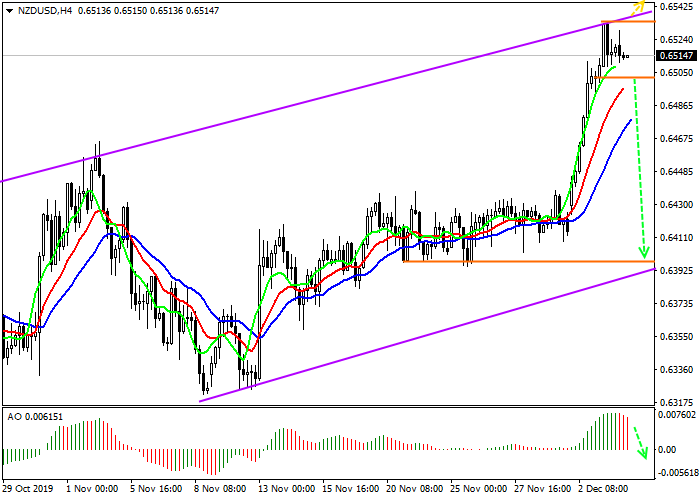

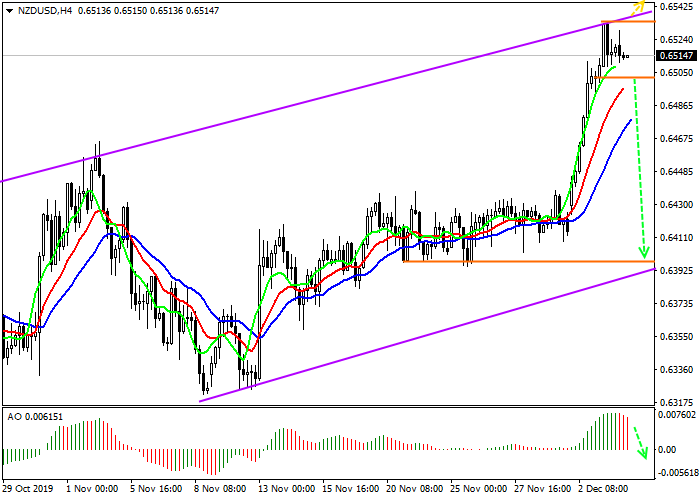

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.6500 |

| Take Profit | 0.6400 |

| Stop Loss | 0.6540 |

| Key Levels | 0.6400, 0.6500, 0.6530, 0.6600 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.6530 |

| Take Profit | 0.6600 |

| Stop Loss | 0.6500 |

| Key Levels | 0.6400, 0.6500, 0.6530, 0.6600 |

Current trend

The Reserve Bank of New Zealand said it did not intend to continue the cycle of lowering interest rates in the near future, citing the fact that there was no effect from the previous reduction in interest rates.

Due to the absence of statistics from New Zealand this week, the US dollar, which continues to decline against world currencies, will come to the forefront. And the expectations of positive data on employment in the main sectors of the economy, which will be published on Friday, do not add optimism to the currency pair.

Support and resistance

The price continues to be within a fairly wide upward channel, reaching its resistance line. At these peaks, growth stopped, and the market is waiting for new volumes. Despite the fact that the Alligator indicator is still holding a steady buy signal, a downward sentiment is already prevailing on the AO oscillator.

Resistance levels: 0.6530, 0.6600.

Support levels: 0.6500, 0.6400.

Trading tips

If the asset declines and the price consolidates below the local low at 0.6500, short positions can be opened with the target at 0.6400. Stop loss should be placed beyond the local high, at 0.6540.

If the asset continues growing and the price consolidates above 0.6530, buy positions with the target at 0.6600 will be relevant. It is advisable to place the stop loss below the local low at 0.6500.

Implementation time: 7 days and more.

The Reserve Bank of New Zealand said it did not intend to continue the cycle of lowering interest rates in the near future, citing the fact that there was no effect from the previous reduction in interest rates.

Due to the absence of statistics from New Zealand this week, the US dollar, which continues to decline against world currencies, will come to the forefront. And the expectations of positive data on employment in the main sectors of the economy, which will be published on Friday, do not add optimism to the currency pair.

Support and resistance

The price continues to be within a fairly wide upward channel, reaching its resistance line. At these peaks, growth stopped, and the market is waiting for new volumes. Despite the fact that the Alligator indicator is still holding a steady buy signal, a downward sentiment is already prevailing on the AO oscillator.

Resistance levels: 0.6530, 0.6600.

Support levels: 0.6500, 0.6400.

Trading tips

If the asset declines and the price consolidates below the local low at 0.6500, short positions can be opened with the target at 0.6400. Stop loss should be placed beyond the local high, at 0.6540.

If the asset continues growing and the price consolidates above 0.6530, buy positions with the target at 0.6600 will be relevant. It is advisable to place the stop loss below the local low at 0.6500.

Implementation time: 7 days and more.

No comments:

Write comments