NZD/USD: general analysis

11 December 2019, 09:06

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.6520 |

| Take Profit | 0.6430 |

| Stop Loss | 0.6570 |

| Key Levels | 0.6430, 0.6520, 0.6570, 0.6700 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.6570 |

| Take Profit | 0.6700 |

| Stop Loss | 0.6510 |

| Key Levels | 0.6430, 0.6520, 0.6570, 0.6700 |

Current trend

Most investors wait for the conclusion of the US-China trade agreement, US President Donald Trump said on his Twitter that the United States–Mexico–Canada Agreement (USMCA) would be the most important deal in the history of the country. This positive news was received ambiguously since investors still hoped for a solution to the issue with the PRC in the near future. Today at the FOMC meeting, a decision on the imposition of sanctions against China may be made, which will result in negative consequences for the economies of both countries.

The eruption of Whakaari volcano in New Zealand could turn into a global natural disaster, which would cause enormous damage to the poor state economy. Positive statistics on retail sales, which showed an increase of 5.1% against the forecast of 0.5%, could not affect the price, and the pair continues to decline.

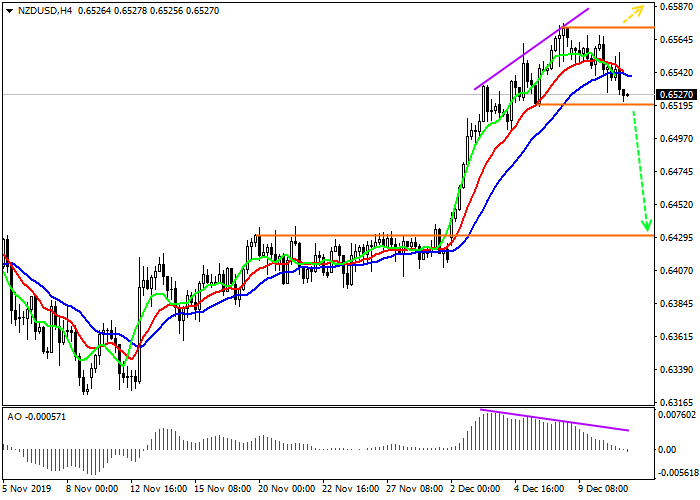

Support and resistance

Without crossing the global resistance line of the upward channel, the pair reverses again and prepares to start a new cycle of decline. The Alligator indicator has almost issued a signal for the intersection of the EMMA, which will let start the sales. The AO oscillator has already begun to work out the divergence signal. The market majority prefers active selling.

Resistance levels: 0.6570, 0.6700.

Support levels: 0.6520, 0.6430.

Trading tips

If the asset continues to decline and the price consolidates below the local minimum at 0.6520, it is better to open sell positions with a target at 0.6430. Stop loss is behind a local maximum, around 0.6570.

In case of a reversal and growth, as well as a consolidation above 0.6570, buy positions with the target at 0.6700 will be relevant. Stop loss is below the local minimum, around 0.6510.

Implementation period: 7 days or more.

Most investors wait for the conclusion of the US-China trade agreement, US President Donald Trump said on his Twitter that the United States–Mexico–Canada Agreement (USMCA) would be the most important deal in the history of the country. This positive news was received ambiguously since investors still hoped for a solution to the issue with the PRC in the near future. Today at the FOMC meeting, a decision on the imposition of sanctions against China may be made, which will result in negative consequences for the economies of both countries.

The eruption of Whakaari volcano in New Zealand could turn into a global natural disaster, which would cause enormous damage to the poor state economy. Positive statistics on retail sales, which showed an increase of 5.1% against the forecast of 0.5%, could not affect the price, and the pair continues to decline.

Support and resistance

Without crossing the global resistance line of the upward channel, the pair reverses again and prepares to start a new cycle of decline. The Alligator indicator has almost issued a signal for the intersection of the EMMA, which will let start the sales. The AO oscillator has already begun to work out the divergence signal. The market majority prefers active selling.

Resistance levels: 0.6570, 0.6700.

Support levels: 0.6520, 0.6430.

Trading tips

If the asset continues to decline and the price consolidates below the local minimum at 0.6520, it is better to open sell positions with a target at 0.6430. Stop loss is behind a local maximum, around 0.6570.

In case of a reversal and growth, as well as a consolidation above 0.6570, buy positions with the target at 0.6700 will be relevant. Stop loss is below the local minimum, around 0.6510.

Implementation period: 7 days or more.

No comments:

Write comments