AUD/USD: Australian dollar is correcting

11 December 2019, 09:03

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6825 |

| Take Profit | 0.6864 |

| Stop Loss | 0.6800 |

| Key Levels | 0.6753, 0.6768, 0.6782, 0.6800, 0.6820, 0.6833, 0.6846, 0.6864 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6795 |

| Take Profit | 0.6768, 0.6753 |

| Stop Loss | 0.6820 |

| Key Levels | 0.6753, 0.6768, 0.6782, 0.6800, 0.6820, 0.6833, 0.6846, 0.6864 |

Current trend

AUD is showing moderate growth against USD during today's Asian session, correcting after a moderate decline of the instrument at the beginning of the week, which led to the renewal of local lows of December 2. The Australian dollar is adding about 0.19%.

Macroeconomic statistics from Australia and China released on Tuesday provided little support to the instrument. Australia’s House Price Index in Q3 2019 increased by 2.4% QoQ after a decline of 0.7% QoQ in the previous quarter. Analysts had expected growth rate at 0.2% QoQ only. NAB Business Survey in November remained at the same level of 4 points, contrary to forecasts of a decline to 2 points. Chinese statistics showed growth in annual dynamics of consumer prices. In November, CPI accelerated from 3.8% YoY to 4.5% YoY, being better than its forecast of 4.2% YoY.

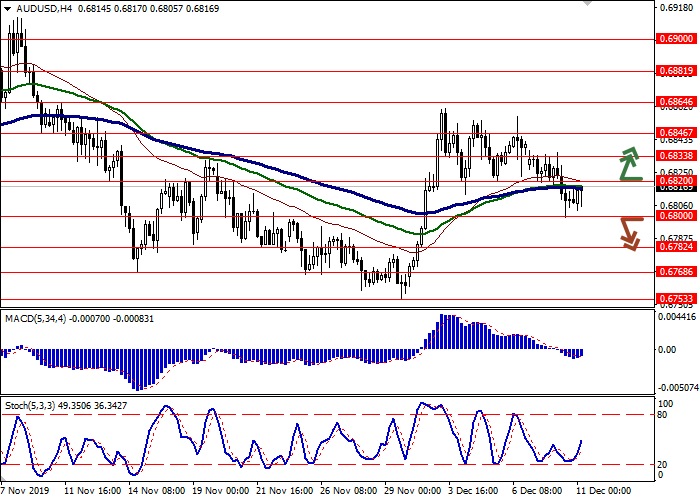

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD is declining keeping a weak sell signal (located below the signal line). The indicator is about to test the zero line for a breakdown. Stochastic keeps a confident downward direction but is already approaching its lows, which indicates the descending risks of oversold instrument in the ultra-short term.

One should keep existing short positions in the short and/or ultra-short term.

Resistance levels: 0.6820, 0.6833, 0.6846, 0.6864.

Support levels: 0.6800, 0.6782, 0.6768, 0.6753.

Trading tips

To open long positions, one can rely on the breakout of 0.6820. Take profit – 0.6864. Stop loss – 0.6800.

A breakdown of 0.6800 may be a signal for new sales with target at 0.6768 or 0.6753. Stop loss – 0.6820.

Implementation time: 2-3 days.

AUD is showing moderate growth against USD during today's Asian session, correcting after a moderate decline of the instrument at the beginning of the week, which led to the renewal of local lows of December 2. The Australian dollar is adding about 0.19%.

Macroeconomic statistics from Australia and China released on Tuesday provided little support to the instrument. Australia’s House Price Index in Q3 2019 increased by 2.4% QoQ after a decline of 0.7% QoQ in the previous quarter. Analysts had expected growth rate at 0.2% QoQ only. NAB Business Survey in November remained at the same level of 4 points, contrary to forecasts of a decline to 2 points. Chinese statistics showed growth in annual dynamics of consumer prices. In November, CPI accelerated from 3.8% YoY to 4.5% YoY, being better than its forecast of 4.2% YoY.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD is declining keeping a weak sell signal (located below the signal line). The indicator is about to test the zero line for a breakdown. Stochastic keeps a confident downward direction but is already approaching its lows, which indicates the descending risks of oversold instrument in the ultra-short term.

One should keep existing short positions in the short and/or ultra-short term.

Resistance levels: 0.6820, 0.6833, 0.6846, 0.6864.

Support levels: 0.6800, 0.6782, 0.6768, 0.6753.

Trading tips

To open long positions, one can rely on the breakout of 0.6820. Take profit – 0.6864. Stop loss – 0.6800.

A breakdown of 0.6800 may be a signal for new sales with target at 0.6768 or 0.6753. Stop loss – 0.6820.

Implementation time: 2-3 days.

No comments:

Write comments