EUR/USD: EUR is corrected

11 December 2019, 09:00

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1100 |

| Take Profit | 1.1139, 1.1150 |

| Stop Loss | 1.1062 |

| Key Levels | 1.1024, 1.1038, 1.1062, 1.1080, 1.1096, 1.1115, 1.1139 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1075 |

| Take Profit | 1.1038, 1.1024 |

| Stop Loss | 1.1105, 1.1115 |

| Key Levels | 1.1024, 1.1038, 1.1062, 1.1080, 1.1096, 1.1115, 1.1139 |

Current trend

EUR is relatively stable against USD during today’s Asian session. The instrument is trading near the level of 1.1096, a local high of December 6 updated the day before. Moderate growth of the instrument on Tuesday was facilitated by rather optimistic European macroeconomic statistics. ZEW Economic Sentiment in December increased from –1 to 11.2 points, which turned out to be much better than expectations (–17.7 points). Investors were pleased with the German data from ZEW. German ZEW Current Conditions in December rose from –24.7 to –19.9 points, which turned out to be better than the forecasts at –22.3 points. German ZEW Economic Sentiment for the same period rose from –2.1 to 10.7 points, while the growth forecast was only to zero.

Today, investors expect the publication of statistics from the US on consumer inflation. The key event on Wednesday will be the Fed meeting on interest rates followed by a press conference.

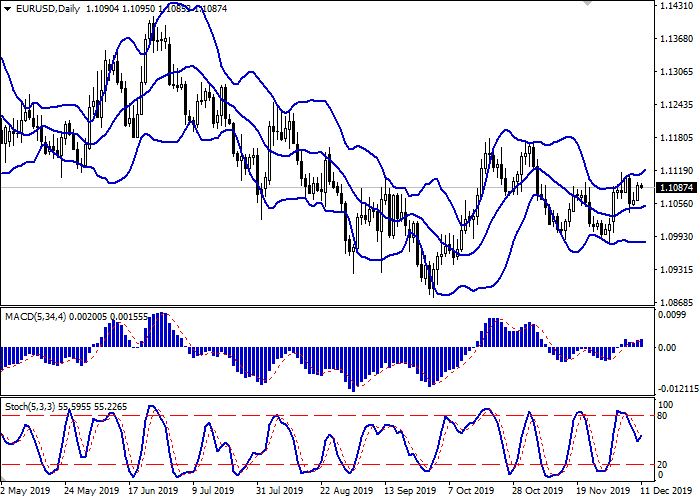

Support and resistance

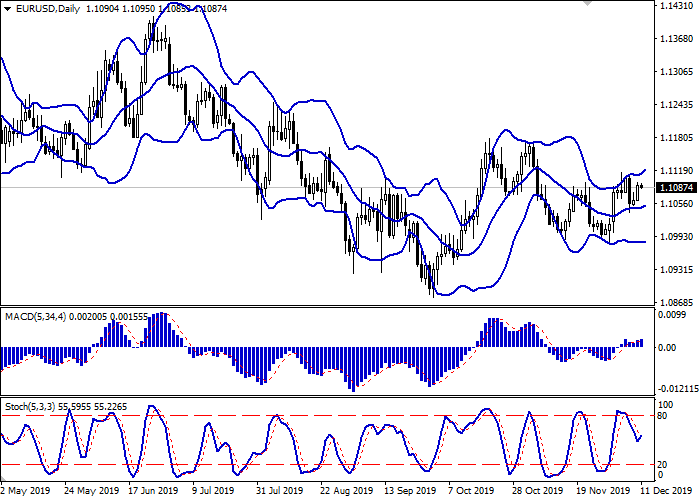

Bollinger Bands in D1 chart show moderate growth. The price range expands from above, freeing a path to new local highs for the “bulls”. MACD indicator is growing preserving a moderate buy signal (located above the signal line). Stochastic is reversing upwards after quite an active decline at the end of last week.

Technical indicators do not contradict the further development of the uptrend in the short and/or ultra-short term.

Resistance levels: 1.1096, 1.1115, 1.1139.

Support levels: 1.1080, 1.1062, 1.1038, 1.1024.

Trading tips

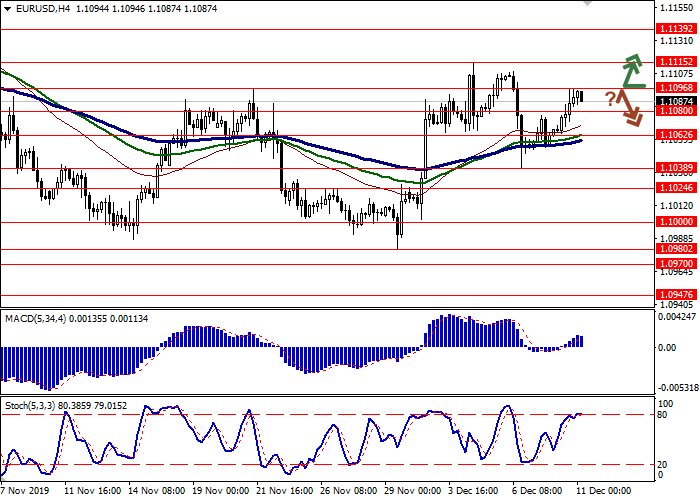

To open long positions, one can rely on the breakout of 1.1096. Take profit – 1.1139 or 1.1150. Stop loss – 1.1062.

The rebound from 1.1096 as from resistance, with the subsequent breakdown of 1.1080 can become a signal to new sales with target at 1.1038 or 1.1024. Stop loss – 1.1105 or 1.1115.

Implementation time: 2-3 days.

EUR is relatively stable against USD during today’s Asian session. The instrument is trading near the level of 1.1096, a local high of December 6 updated the day before. Moderate growth of the instrument on Tuesday was facilitated by rather optimistic European macroeconomic statistics. ZEW Economic Sentiment in December increased from –1 to 11.2 points, which turned out to be much better than expectations (–17.7 points). Investors were pleased with the German data from ZEW. German ZEW Current Conditions in December rose from –24.7 to –19.9 points, which turned out to be better than the forecasts at –22.3 points. German ZEW Economic Sentiment for the same period rose from –2.1 to 10.7 points, while the growth forecast was only to zero.

Today, investors expect the publication of statistics from the US on consumer inflation. The key event on Wednesday will be the Fed meeting on interest rates followed by a press conference.

Support and resistance

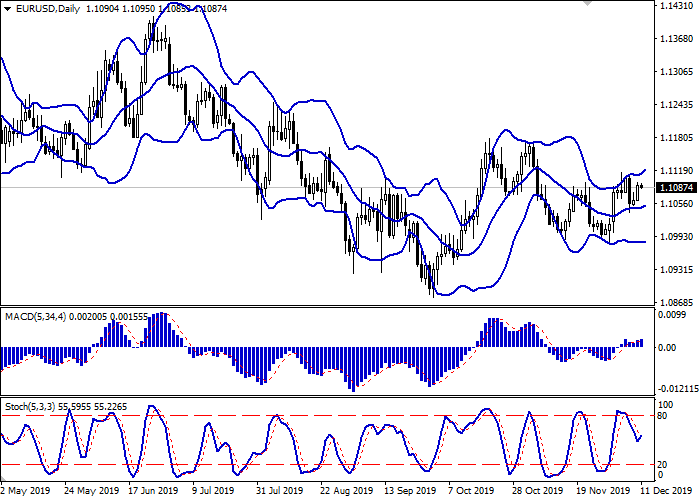

Bollinger Bands in D1 chart show moderate growth. The price range expands from above, freeing a path to new local highs for the “bulls”. MACD indicator is growing preserving a moderate buy signal (located above the signal line). Stochastic is reversing upwards after quite an active decline at the end of last week.

Technical indicators do not contradict the further development of the uptrend in the short and/or ultra-short term.

Resistance levels: 1.1096, 1.1115, 1.1139.

Support levels: 1.1080, 1.1062, 1.1038, 1.1024.

Trading tips

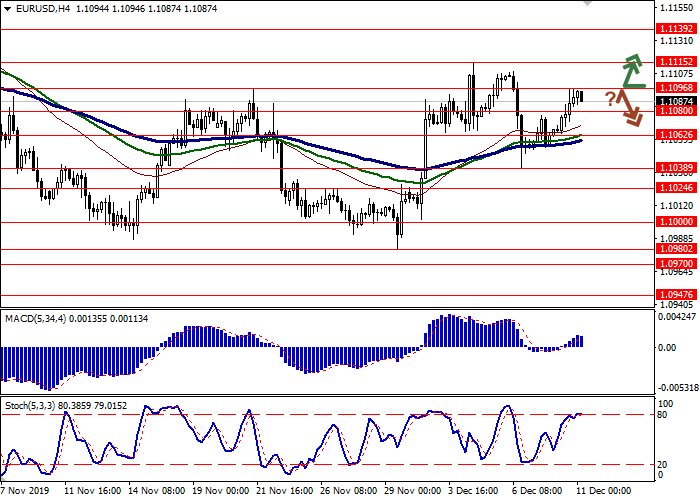

To open long positions, one can rely on the breakout of 1.1096. Take profit – 1.1139 or 1.1150. Stop loss – 1.1062.

The rebound from 1.1096 as from resistance, with the subsequent breakdown of 1.1080 can become a signal to new sales with target at 1.1038 or 1.1024. Stop loss – 1.1105 or 1.1115.

Implementation time: 2-3 days.

No comments:

Write comments