WTI Crude Oil: prices consolidate

11 December 2019, 08:55

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 59.50 |

| Take Profit | 60.00, 60.50 |

| Stop Loss | 59.00, 58.80 |

| Key Levels | 56.82, 57.25, 58.03, 58.62, 59.00, 59.45, 60.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 58.60 |

| Take Profit | 57.25 |

| Stop Loss | 59.20, 59.45 |

| Key Levels | 56.82, 57.25, 58.03, 58.62, 59.00, 59.45, 60.00 |

Current trend

Today, during the Asian session, oil prices are relatively stable, being slightly corrected downward after a moderate increase yesterday.

Quotes are still supported by the positive outcome of the OPEC+ meeting at the end of last week. The participating countries agreed to expand the current program of oil production reducing from 1.2 million barrels per day to 1.7 million barrels per day to further stabilize supply and demand in the market.

On Wednesday, the instrument is under slight pressure by the report of the American Petroleum Institute for Oil Reserves. For the week of December 6, oil reserves rose 1.41 million barrels after a decrease of 3.72 million barrels over the past week.

Support and resistance

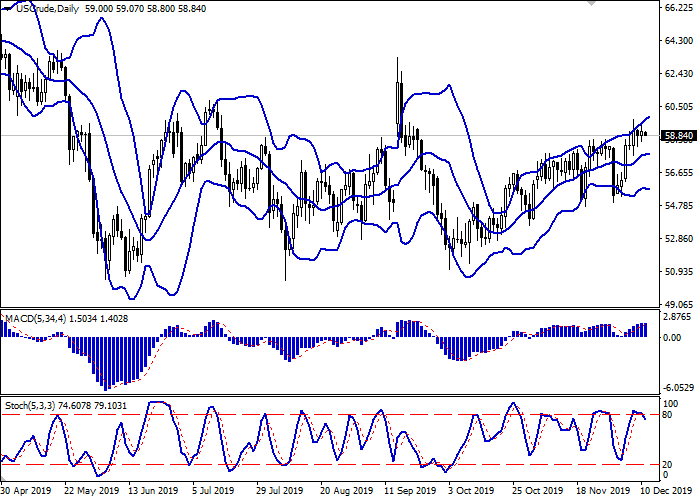

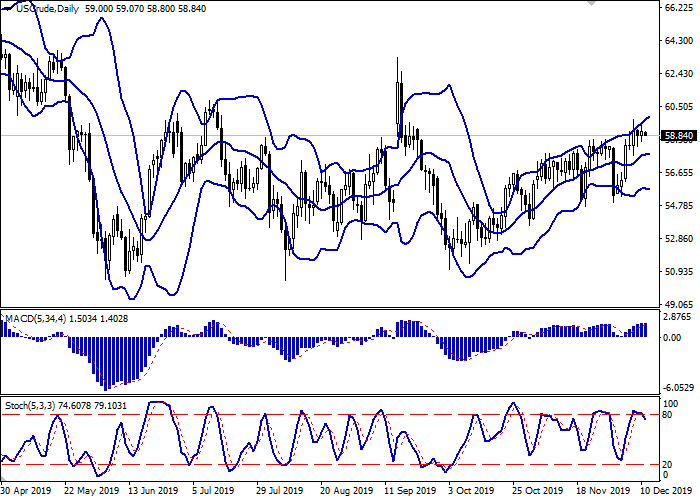

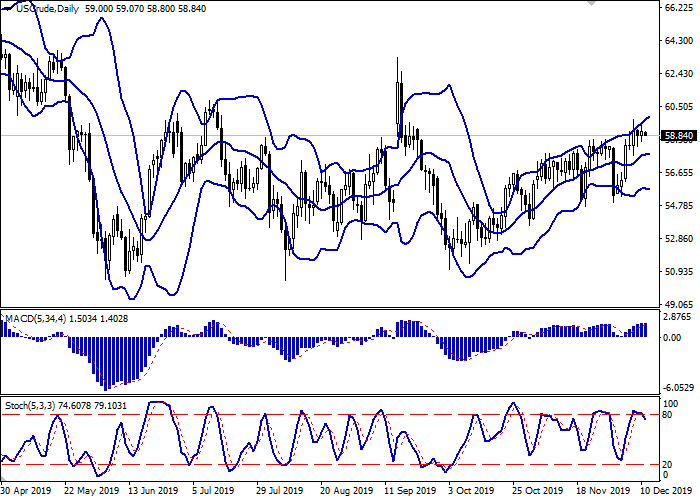

On the daily chart, Bollinger bands are growing moderately. The price range is actively expanding from above, letting the “bulls” renew local highs. The MACD indicator is growing, maintaining a poor buy signal (the histogram is above the signal line). Stochastic, approaching its highs, is inclined to reverse in a downward plane, signaling the risks associated with the overbought instrument in the ultra-short term.

The developing of a correctional decline in the short and/or ultra-short term is possible before the end of the current trading week.

Resistance levels: 59.00, 59.45, 60.00.

Support levels: 58.62, 58.03, 57.25, 56.82.

Trading tips

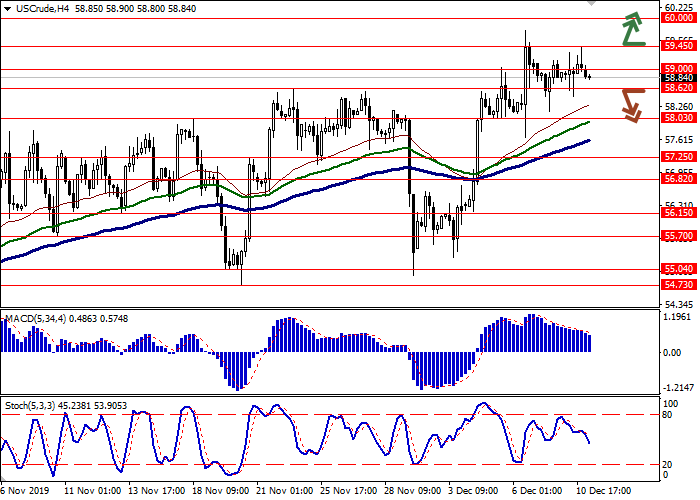

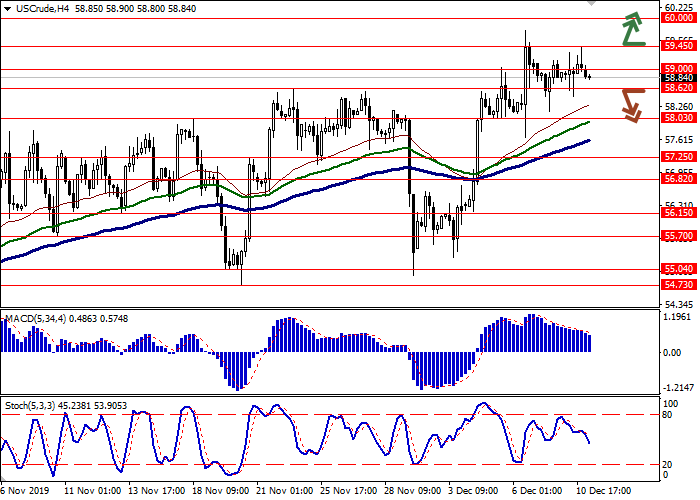

Long positions may be opened after the breakout of the level of 59.45 with the target at 60.00 or 60.50. Stop loss – 59.00 or 58.80.

Short positions may be opened after the breakdown of the level of 58.62 with the target at 57.25. Stop loss – 59.20–59.45.

Implementation period: 2–3 days.

Today, during the Asian session, oil prices are relatively stable, being slightly corrected downward after a moderate increase yesterday.

Quotes are still supported by the positive outcome of the OPEC+ meeting at the end of last week. The participating countries agreed to expand the current program of oil production reducing from 1.2 million barrels per day to 1.7 million barrels per day to further stabilize supply and demand in the market.

On Wednesday, the instrument is under slight pressure by the report of the American Petroleum Institute for Oil Reserves. For the week of December 6, oil reserves rose 1.41 million barrels after a decrease of 3.72 million barrels over the past week.

Support and resistance

On the daily chart, Bollinger bands are growing moderately. The price range is actively expanding from above, letting the “bulls” renew local highs. The MACD indicator is growing, maintaining a poor buy signal (the histogram is above the signal line). Stochastic, approaching its highs, is inclined to reverse in a downward plane, signaling the risks associated with the overbought instrument in the ultra-short term.

The developing of a correctional decline in the short and/or ultra-short term is possible before the end of the current trading week.

Resistance levels: 59.00, 59.45, 60.00.

Support levels: 58.62, 58.03, 57.25, 56.82.

Trading tips

Long positions may be opened after the breakout of the level of 59.45 with the target at 60.00 or 60.50. Stop loss – 59.00 or 58.80.

Short positions may be opened after the breakdown of the level of 58.62 with the target at 57.25. Stop loss – 59.20–59.45.

Implementation period: 2–3 days.

No comments:

Write comments