GBP/USD: general review

11 December 2019, 09:24

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.3100 |

| Take Profit | 1.2870 |

| Stop Loss | 1.3190 |

| Key Levels | 1.2870, 1.3100, 1.3180, 1.3300 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3180 |

| Take Profit | 1.3300 |

| Stop Loss | 1.3100 |

| Key Levels | 1.2870, 1.3100, 1.3180, 1.3300 |

Current trend

The small decline in the GBP/USD pair was interrupted by the publication of unexpectedly positive statistics from the UK. Thus, the quarterly GDP, despite the forecast of –0.2%, decreased by only 0.3%, reaching a value of 0.0%; manufacturing output rose above expectations and amounted to 0.2% compared with –0.4% last month. GBP was actively strengthening, even though the Bank of England postponed the date of publication of the financial stability report to December 16, after the election.

The main driver of the instrument this week will be the Fed meeting, which will be held tonight, and the British parliamentary elections scheduled for Thursday. According to recent polls, the party of Prime Minister Boris Johnson is the leader, gaining 51% of the vote.

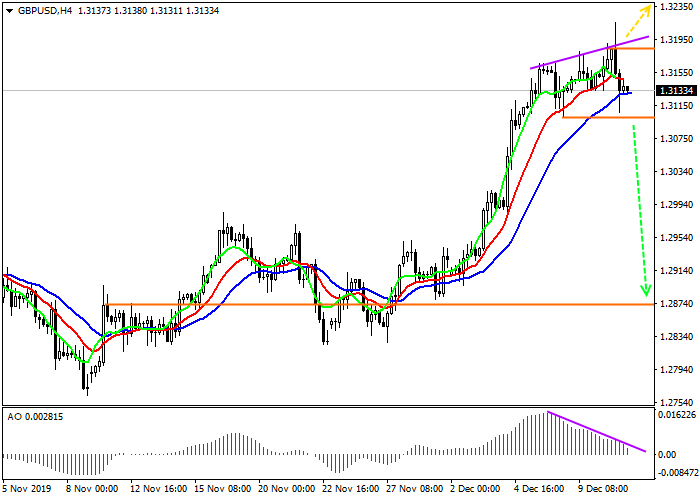

Support and resistance

The situation on the chart of the instrument is almost identical to those in which USD acts as a quoted currency, which means that the movement of the pair is almost completely subordinated to the fluctuations of the dollar. The Alligator indicator begins to hint at the intersection and fast sale. This is confirmed by the AO oscillator, which issued a divergence signal but has not yet begun to work it out.

Indications reflect that a trend change is not expected.

Resistance levels: 1.3180, 1.3300.

Support levels: 1.3100, 1.2870.

Trading tips

In case of decline consolidation below the local minimum at 1.3100, it is better to open sell positions with the target at 1.2870. Stop loss is above the local maximum, around 1.3190.

If the asset continues to grow and the price consolidates above the local maximum at 1.3180, buy positions with the target at 1.3300 will be relevant. Stop loss is below the local minimum, around 1.3100.

Implementation period: 3 days.

The small decline in the GBP/USD pair was interrupted by the publication of unexpectedly positive statistics from the UK. Thus, the quarterly GDP, despite the forecast of –0.2%, decreased by only 0.3%, reaching a value of 0.0%; manufacturing output rose above expectations and amounted to 0.2% compared with –0.4% last month. GBP was actively strengthening, even though the Bank of England postponed the date of publication of the financial stability report to December 16, after the election.

The main driver of the instrument this week will be the Fed meeting, which will be held tonight, and the British parliamentary elections scheduled for Thursday. According to recent polls, the party of Prime Minister Boris Johnson is the leader, gaining 51% of the vote.

Support and resistance

The situation on the chart of the instrument is almost identical to those in which USD acts as a quoted currency, which means that the movement of the pair is almost completely subordinated to the fluctuations of the dollar. The Alligator indicator begins to hint at the intersection and fast sale. This is confirmed by the AO oscillator, which issued a divergence signal but has not yet begun to work it out.

Indications reflect that a trend change is not expected.

Resistance levels: 1.3180, 1.3300.

Support levels: 1.3100, 1.2870.

Trading tips

In case of decline consolidation below the local minimum at 1.3100, it is better to open sell positions with the target at 1.2870. Stop loss is above the local maximum, around 1.3190.

If the asset continues to grow and the price consolidates above the local maximum at 1.3180, buy positions with the target at 1.3300 will be relevant. Stop loss is below the local minimum, around 1.3100.

Implementation period: 3 days.

No comments:

Write comments