USD/JPY: USD remains under pressure

08 August 2019, 09:59

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 106.50 |

| Take Profit | 107.52, 107.78 |

| Stop Loss | 106.00 |

| Key Levels | 105.23, 105.48, 105.77, 106.00, 106.44, 106.75, 107.20, 107.52 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 105.95, 105.70 |

| Take Profit | 105.23, 105.00 |

| Stop Loss | 106.15, 106.30 |

| Key Levels | 105.23, 105.48, 105.77, 106.00, 106.44, 106.75, 107.20, 107.52 |

Current trend

USD maintains an uncertain downtrend against JPY, still locating near local lows since the beginning of the year. JPY is in demand amid growing market turmoil triggered by a sharp deterioration in US-China trade relations. In addition, the market fears new steps from the Fed aimed at easing monetary policy, especially given the constant pressure on the regulator from Donald Trump. The Bank of Japan, in turn, took a wait-and-see approach. According to its latest protocols, the Japanese regulator notes the continued upward momentum for inflation and has not yet considered the possibility of additional stimulus for the next meetings.

Today, the instrument is trading in both directions reacting to the publication of ambiguous macroeconomic statistics from Japan. Foreign Investments in Japanese Stocks for the week as of August 2 reduced by JPY 339.9B. Foreign Bonds Buying increased by JPY 286.2B.

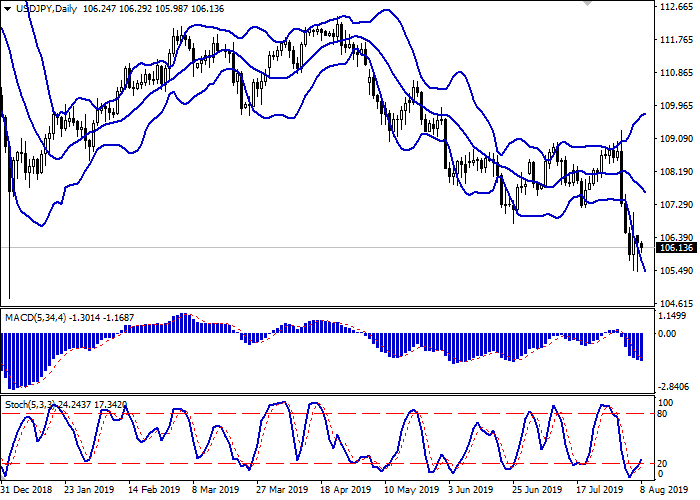

Support and resistance

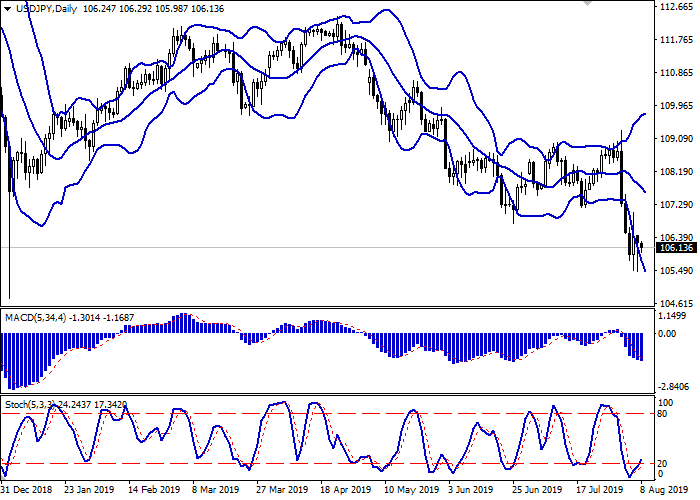

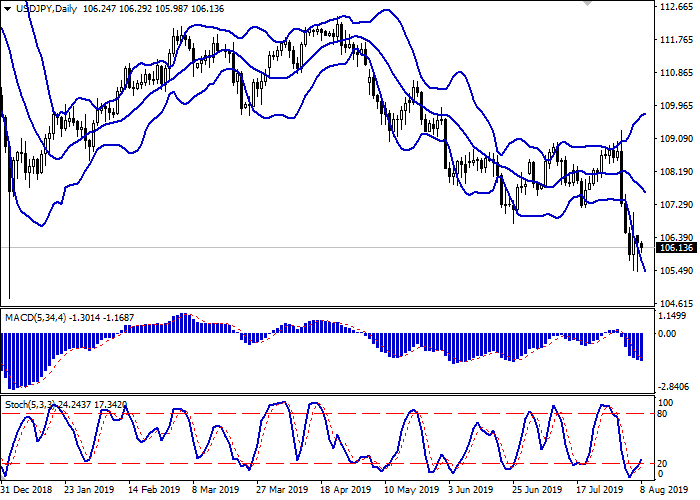

Bollinger Bands in D1 chart decrease. The price range is expanding, indicating the preservation of a significant "bearish" impulse in the short term. MACD is declining keeping a stable sell signal (located below the signal line). Stochastic has retreated from its lows and maintains a moderate uptrend, pointing to the previous risks of the oversold dollar in the ultra-short term.

Opening corrective long orders is possible at the end of the current trading week.

Resistance levels: 106.44, 106.75, 107.20, 107.52.

Support levels: 106.00, 105.77, 105.48, 105.23.

Trading tips

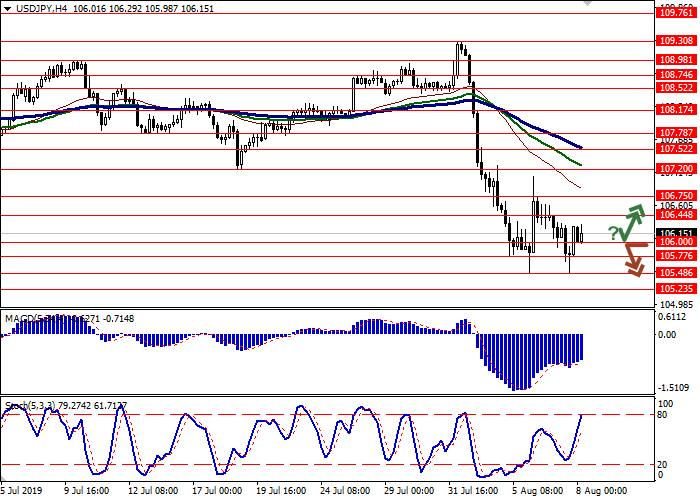

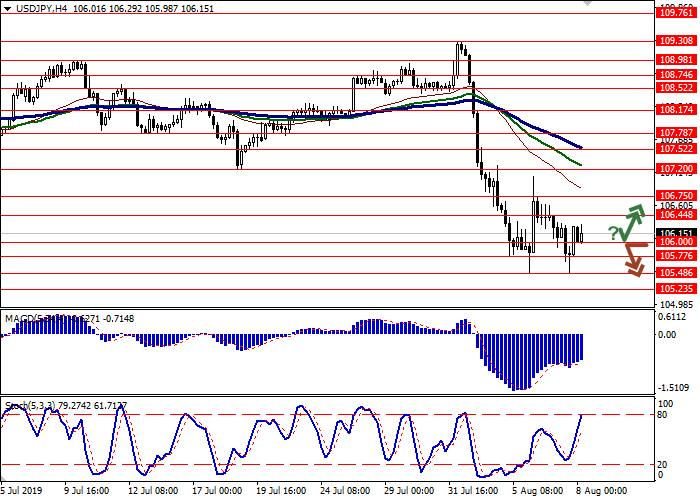

To open long positions, one can rely on the rebound from the support level of 106.00 with the subsequent breakout of 106.44. Take profit — 107.52 or 107.78. Stop loss — 106.00. Implementation time: 2-3 days.

A breakdown of 106.00 or 105.77 may be a signal for new sales with target at 105.23 or 105.00. Stop loss — 106.15–106.30. Implementation time: 1-2 days.

USD maintains an uncertain downtrend against JPY, still locating near local lows since the beginning of the year. JPY is in demand amid growing market turmoil triggered by a sharp deterioration in US-China trade relations. In addition, the market fears new steps from the Fed aimed at easing monetary policy, especially given the constant pressure on the regulator from Donald Trump. The Bank of Japan, in turn, took a wait-and-see approach. According to its latest protocols, the Japanese regulator notes the continued upward momentum for inflation and has not yet considered the possibility of additional stimulus for the next meetings.

Today, the instrument is trading in both directions reacting to the publication of ambiguous macroeconomic statistics from Japan. Foreign Investments in Japanese Stocks for the week as of August 2 reduced by JPY 339.9B. Foreign Bonds Buying increased by JPY 286.2B.

Support and resistance

Bollinger Bands in D1 chart decrease. The price range is expanding, indicating the preservation of a significant "bearish" impulse in the short term. MACD is declining keeping a stable sell signal (located below the signal line). Stochastic has retreated from its lows and maintains a moderate uptrend, pointing to the previous risks of the oversold dollar in the ultra-short term.

Opening corrective long orders is possible at the end of the current trading week.

Resistance levels: 106.44, 106.75, 107.20, 107.52.

Support levels: 106.00, 105.77, 105.48, 105.23.

Trading tips

To open long positions, one can rely on the rebound from the support level of 106.00 with the subsequent breakout of 106.44. Take profit — 107.52 or 107.78. Stop loss — 106.00. Implementation time: 2-3 days.

A breakdown of 106.00 or 105.77 may be a signal for new sales with target at 105.23 or 105.00. Stop loss — 106.15–106.30. Implementation time: 1-2 days.

No comments:

Write comments