GBP/USD: general analysis

08 August 2019, 14:39

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.2080 |

| Take Profit | 1.1962, 1.1870 |

| Stop Loss | 1.2140 |

| Key Levels | 1.1870, 1.1962, 1.2085, 1.2207, 1.2330, 1.2450 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2210 |

| Take Profit | 1.2330, 1.2450 |

| Stop Loss | 1.2130 |

| Key Levels | 1.1870, 1.1962, 1.2085, 1.2207, 1.2330, 1.2450 |

Current trend

Since the beginning of the month, the GBP/USD pair has been consolidating around 1.2150. This week, it was supported by strong UK Service PMI (growth to 51.4 points) and poor US Non-manufacturing PMI (decrease to 53.1 points). However, in general, the situation remains negative for GBP, since the risk of a hard Brexit remains. According to the calculations of the British government, the absence of the deal will lead to interruptions in the supply of 40% to 60% of goods to the country, which can lead to food shortages. The government is now looking for ways to speed up border checks that may arise in the future, and may also suspend a number of provisions of the competition law to enable food companies to coordinate their actions.

Tomorrow, GBP may become under new pressure after the publication of Q2 2019 GDP data. Concerning the uncertainty with Brexit, GDP growth is expected to slow further and decrease from 0.5% to 0.0% QoQ and from 1.8% to 1.4% YoY.

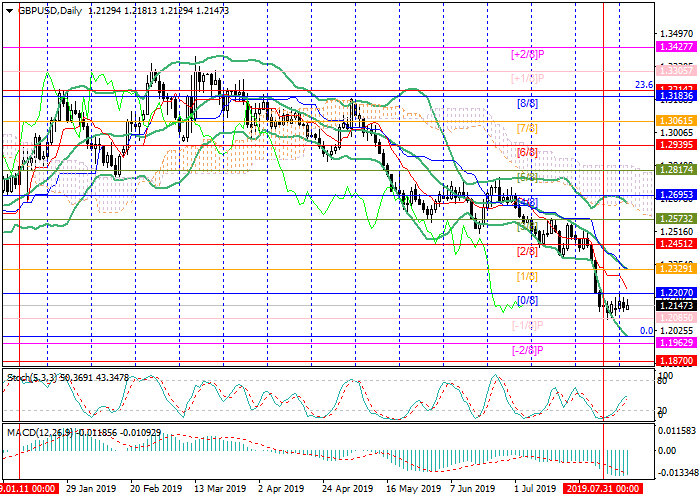

Support and resistance

The price is in the range 1.2207–1.2085 (Murrey [0/8]–[–1/8]), waiting for new drivers. A breakout of 1.2207 will return the instrument to Murray trading range, and it may rise to 1.2330 (Murrey [1/8], Bollinger bands’ midline) and 1.2450 (Murrey [2/8]). However, the resumption of decline to 1.1962 (Murrey [–2/8]) and 1.1870 seems more likely.

Resistance levels: 1.2207, 1.2330, 1.2450.

Support levels: 1.2085, 1.1962, 1.1870.

Trading tips

Short positions can be opened below 1.2085 with the targets at 1.1962, 1.1870 and stop loss 1.2140.

Long positions can be opened above 1.2207 with the targets at 1.2330, 1.2450 and stop loss 1.2130.

Implementation period: 3–4 days.

Since the beginning of the month, the GBP/USD pair has been consolidating around 1.2150. This week, it was supported by strong UK Service PMI (growth to 51.4 points) and poor US Non-manufacturing PMI (decrease to 53.1 points). However, in general, the situation remains negative for GBP, since the risk of a hard Brexit remains. According to the calculations of the British government, the absence of the deal will lead to interruptions in the supply of 40% to 60% of goods to the country, which can lead to food shortages. The government is now looking for ways to speed up border checks that may arise in the future, and may also suspend a number of provisions of the competition law to enable food companies to coordinate their actions.

Tomorrow, GBP may become under new pressure after the publication of Q2 2019 GDP data. Concerning the uncertainty with Brexit, GDP growth is expected to slow further and decrease from 0.5% to 0.0% QoQ and from 1.8% to 1.4% YoY.

Support and resistance

The price is in the range 1.2207–1.2085 (Murrey [0/8]–[–1/8]), waiting for new drivers. A breakout of 1.2207 will return the instrument to Murray trading range, and it may rise to 1.2330 (Murrey [1/8], Bollinger bands’ midline) and 1.2450 (Murrey [2/8]). However, the resumption of decline to 1.1962 (Murrey [–2/8]) and 1.1870 seems more likely.

Resistance levels: 1.2207, 1.2330, 1.2450.

Support levels: 1.2085, 1.1962, 1.1870.

Trading tips

Short positions can be opened below 1.2085 with the targets at 1.1962, 1.1870 and stop loss 1.2140.

Long positions can be opened above 1.2207 with the targets at 1.2330, 1.2450 and stop loss 1.2130.

Implementation period: 3–4 days.

No comments:

Write comments