USD/CAD: the instrument is strengthening

08 August 2019, 09:49

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.3325, 1.3345 |

| Take Profit | 1.3401, 1.3420 |

| Stop Loss | 1.3300, 1.3280 |

| Key Levels | 1.3163, 1.3200, 1.3241, 1.3264, 1.3320, 1.3343, 1.3401 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3260, 1.3235 |

| Take Profit | 1.3134, 1.3100 |

| Stop Loss | 1.3300, 1.3320 |

| Key Levels | 1.3163, 1.3200, 1.3241, 1.3264, 1.3320, 1.3343, 1.3401 |

Current trend

Yesterday, in the morning, the USD/CAD pair was actively growing, renewing highs since June 19. However, with the opening of the European session, the “bears” returned to the market. USD is under pressure of the tightening of the trade relations between the United States and China. In addition, the market fears new easing of the Fed’s monetary policy.

Macroeconomic statistics released on Wednesday moderately supported only the Canadian dollar. Thus, July Ivey index of business activity in Canada rose from 52.4 to 54.2 points, which turned out to be better than market forecasts of 53.0 points.

Today, investors are awaiting the publication of US Nonfarm Payrolls data and the Canadian June housing price index on the primary market.

Support and resistance

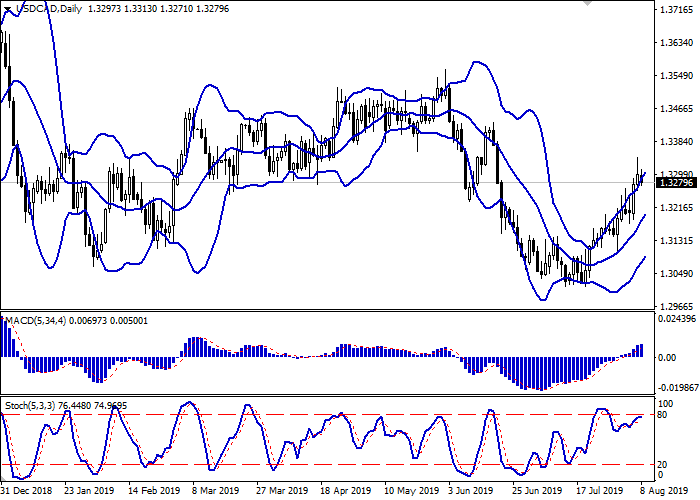

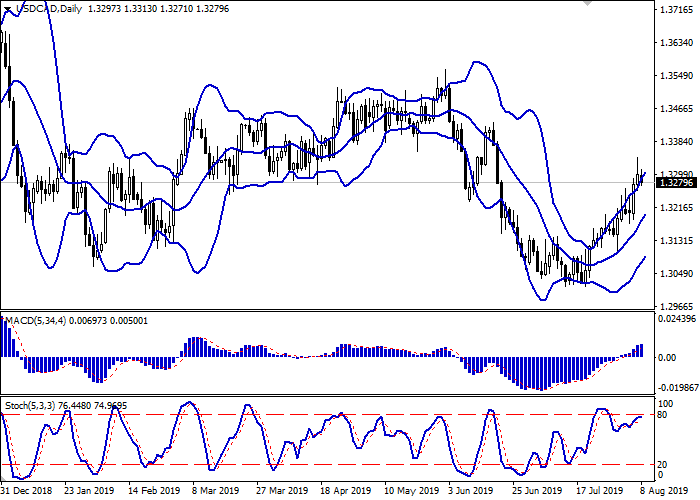

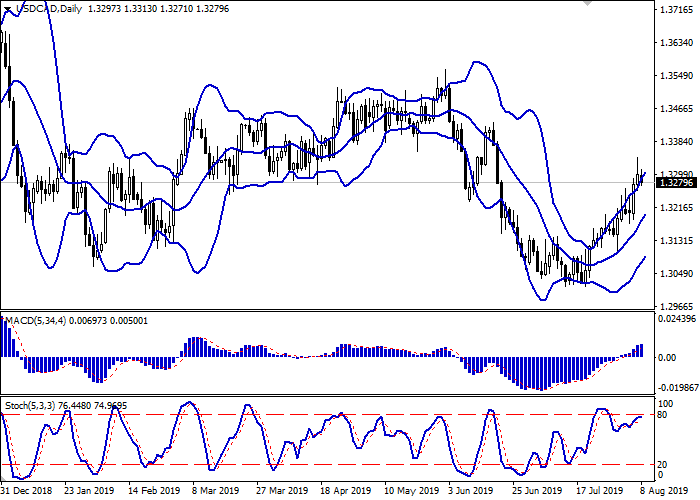

On the daily chart, Bollinger bands are growing steadily. The price range narrows slightly, reflecting the tendency to reverse into the horizontal plane. The MACD indicator is growing, keeping a moderate buy signal (the histogram is above the signal line). Stochastic, approaching its highs, is reversing into a horizontal plane, indicating that the dollar may become overbought in the ultra-short term.

Current indicators do not contradict the further development of the uptrend in the short and/or ultra-short term.

Resistance levels: 1.3320, 1.3343, 1.3401.

Support levels: 1.3264, 1.3241, 1.3200, 1.3163.

Trading tips

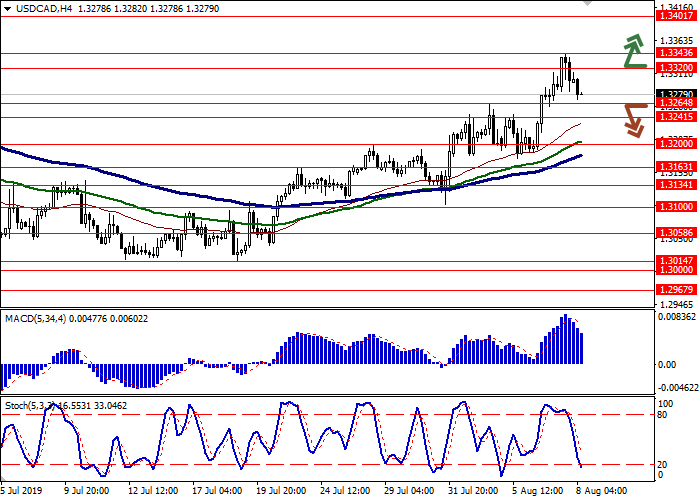

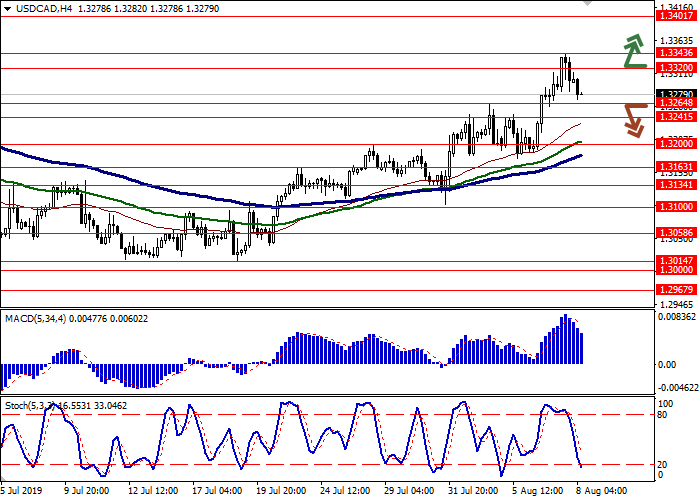

Long positions can be opened after the breakout of the levels of 1.3320–1.3343 with the target at 1.3401 or 1.3420. Stop loss – 1.3300 or 1.3280.

Short positions can be opened after the breakdown of the levels of 1.3264–1.3241 with the target at 1.3134 or 1.3100. Stop loss – 1.3300 or 1.3320.

Implementation period: 2–3 days.

Yesterday, in the morning, the USD/CAD pair was actively growing, renewing highs since June 19. However, with the opening of the European session, the “bears” returned to the market. USD is under pressure of the tightening of the trade relations between the United States and China. In addition, the market fears new easing of the Fed’s monetary policy.

Macroeconomic statistics released on Wednesday moderately supported only the Canadian dollar. Thus, July Ivey index of business activity in Canada rose from 52.4 to 54.2 points, which turned out to be better than market forecasts of 53.0 points.

Today, investors are awaiting the publication of US Nonfarm Payrolls data and the Canadian June housing price index on the primary market.

Support and resistance

On the daily chart, Bollinger bands are growing steadily. The price range narrows slightly, reflecting the tendency to reverse into the horizontal plane. The MACD indicator is growing, keeping a moderate buy signal (the histogram is above the signal line). Stochastic, approaching its highs, is reversing into a horizontal plane, indicating that the dollar may become overbought in the ultra-short term.

Current indicators do not contradict the further development of the uptrend in the short and/or ultra-short term.

Resistance levels: 1.3320, 1.3343, 1.3401.

Support levels: 1.3264, 1.3241, 1.3200, 1.3163.

Trading tips

Long positions can be opened after the breakout of the levels of 1.3320–1.3343 with the target at 1.3401 or 1.3420. Stop loss – 1.3300 or 1.3280.

Short positions can be opened after the breakdown of the levels of 1.3264–1.3241 with the target at 1.3134 or 1.3100. Stop loss – 1.3300 or 1.3320.

Implementation period: 2–3 days.

No comments:

Write comments