XAU/USD: prices are consolidating

04 July 2019, 09:50

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1425.10, 1430.10 |

| Take Profit | 1455.00 |

| Stop Loss | 1410.00, 1415.00 |

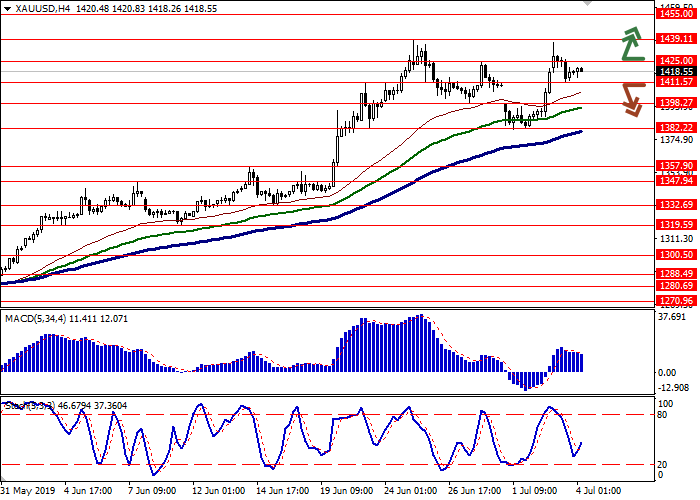

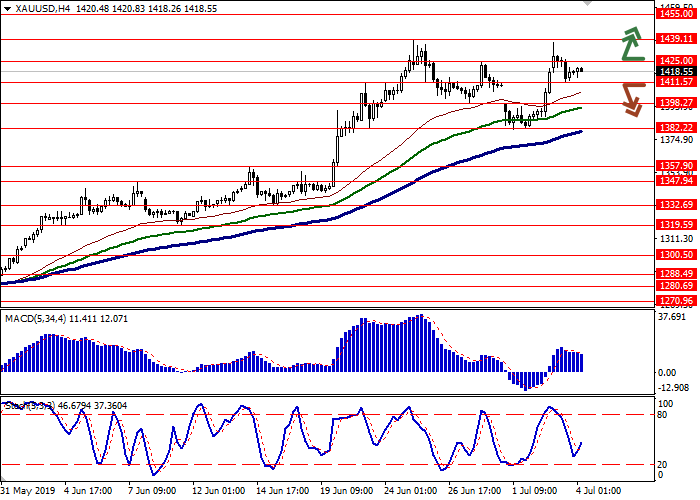

| Key Levels | 1357.90, 1382.22, 1398.27, 1411.57, 1425.00, 1439.11, 1455.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1411.50 |

| Take Profit | 1382.22, 1365.00 |

| Stop Loss | 1430.00 |

| Key Levels | 1357.90, 1382.22, 1398.27, 1411.57, 1425.00, 1439.11, 1455.00 |

Current trend

Gold prices showed a moderate rise on Wednesday, again approaching the record highs, updated on June 25.

The instrument failed to consolidate there and the pair had returned to the red zone. Gold continues to be supported by a soft monetary policy of the Fed and the ECB and by growing concerns about global economic growth. Yesterday, it became known that IMF’s head Christine Lagarde would be the successor of Mario Draghi as head of the ECB, which heightened concerns about monetary easing in Europe. Meanwhile, US President Donald Trump continues to pressure the Fed, demanding lower interest rates and the weaker dollar. In his opinion, China and Europe are actively manipulating the rates of national currencies, which allows them to attract additional investment in their economies. Analysts believe that in the near future, the US administration may conduct a series of direct foreign exchange interventions, which will result in a devaluation of USD.

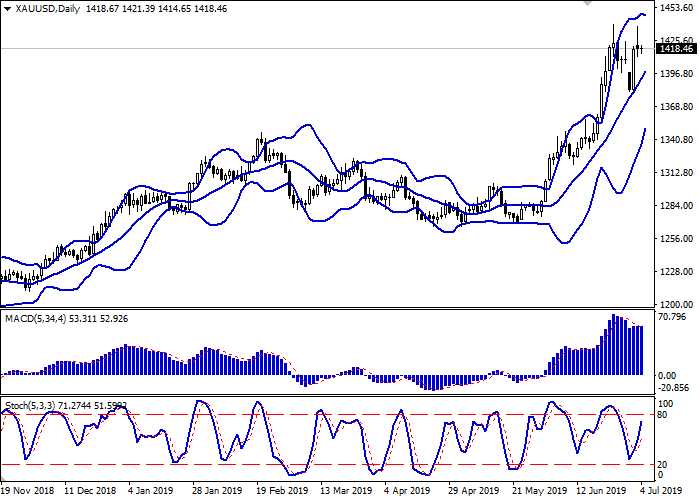

Support and resistance

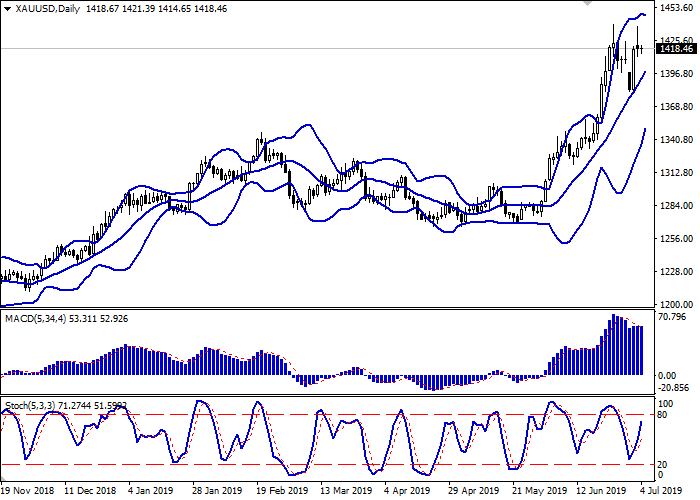

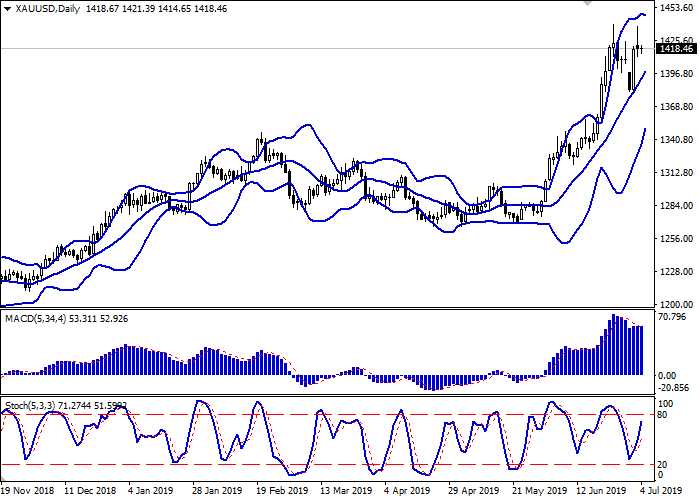

Bollinger Bands on the D1 chart show active growth. The price range is narrowing, reflecting the ambiguous dynamics of trading in the last two weeks. MACD is still going down preserving a weak sell signal (being located under the signal line). Stochastic shows steady growth and is currently approaching its maxima, which somewhat limits the possible development of an ultra-short uptrend.

To open new transactions, one should wait for clarification.

Resistance levels: 1425.00, 1439.11, 1455.00.

Support levels: 1411.57, 1398.27, 1382.22, 1357.90.

Trading tips

To open long positions, one can rely on the breakout of 1425.00 or 1430.00. Take-profit – 1455.00. Stop loss – 1410.00 or 1415.00. Implementation period: 1-2 days.

A confident breakdown of 1411.57 may serve as a signal to return to sales with the target at 1382.22 or 1365.00. Stop loss – 1430.00. Implementation period: 2-3 days.

Gold prices showed a moderate rise on Wednesday, again approaching the record highs, updated on June 25.

The instrument failed to consolidate there and the pair had returned to the red zone. Gold continues to be supported by a soft monetary policy of the Fed and the ECB and by growing concerns about global economic growth. Yesterday, it became known that IMF’s head Christine Lagarde would be the successor of Mario Draghi as head of the ECB, which heightened concerns about monetary easing in Europe. Meanwhile, US President Donald Trump continues to pressure the Fed, demanding lower interest rates and the weaker dollar. In his opinion, China and Europe are actively manipulating the rates of national currencies, which allows them to attract additional investment in their economies. Analysts believe that in the near future, the US administration may conduct a series of direct foreign exchange interventions, which will result in a devaluation of USD.

Support and resistance

Bollinger Bands on the D1 chart show active growth. The price range is narrowing, reflecting the ambiguous dynamics of trading in the last two weeks. MACD is still going down preserving a weak sell signal (being located under the signal line). Stochastic shows steady growth and is currently approaching its maxima, which somewhat limits the possible development of an ultra-short uptrend.

To open new transactions, one should wait for clarification.

Resistance levels: 1425.00, 1439.11, 1455.00.

Support levels: 1411.57, 1398.27, 1382.22, 1357.90.

Trading tips

To open long positions, one can rely on the breakout of 1425.00 or 1430.00. Take-profit – 1455.00. Stop loss – 1410.00 or 1415.00. Implementation period: 1-2 days.

A confident breakdown of 1411.57 may serve as a signal to return to sales with the target at 1382.22 or 1365.00. Stop loss – 1430.00. Implementation period: 2-3 days.

No comments:

Write comments