XAG/USD: silver prices are rising

11 July 2019, 10:15

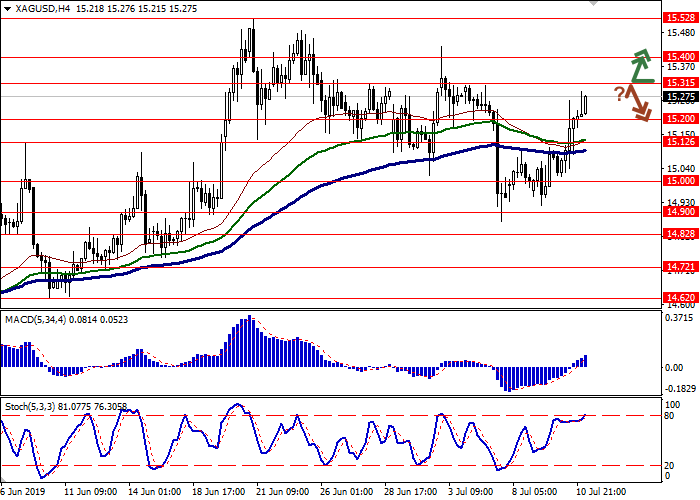

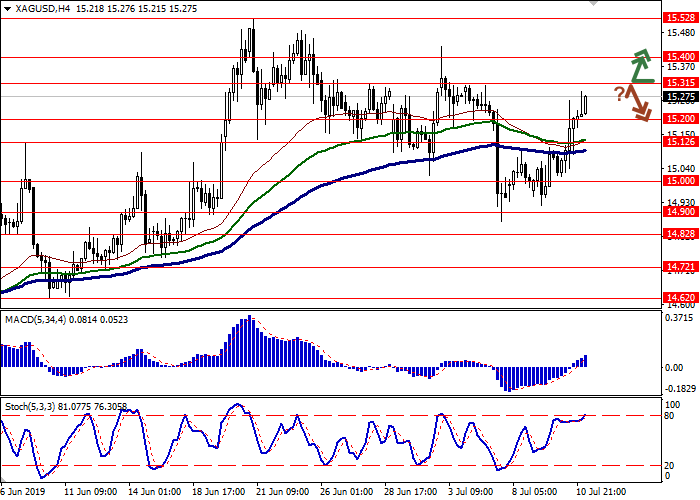

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 15.31 |

| Take Profit | 15.52 |

| Stop Loss | 15.20 |

| Key Levels | 14.90, 15.00, 15.12, 15.20, 15.31, 15.40, 15.52 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 15.20 |

| Take Profit | 15.00 |

| Stop Loss | 15.31 |

| Key Levels | 14.90, 15.00, 15.12, 15.20, 15.31, 15.40, 15.52 |

Current trend

Yesterday, silver prices rose sharply, responding to the speech of Fed Chairman Jerome Powell, who focused on risks for the American economy and promoted higher expectations of lowering the interest rate of the Fed during the meeting on July 30–31. At the moment, the lack of visible progress in trade negotiations between the United States and China, which resumed this week, also supports the price.

On Thursday, investors are focused on is a large block of macroeconomic statistics from the United States. Traders are awaiting the publication of data on consumer inflation in the US for June. Also, the market will follow the performance of representatives of the US Federal Reserve Williams, Bostic and Barkin. Closer to the end of the daily session, the US will publish a monthly report on the state of the budget.

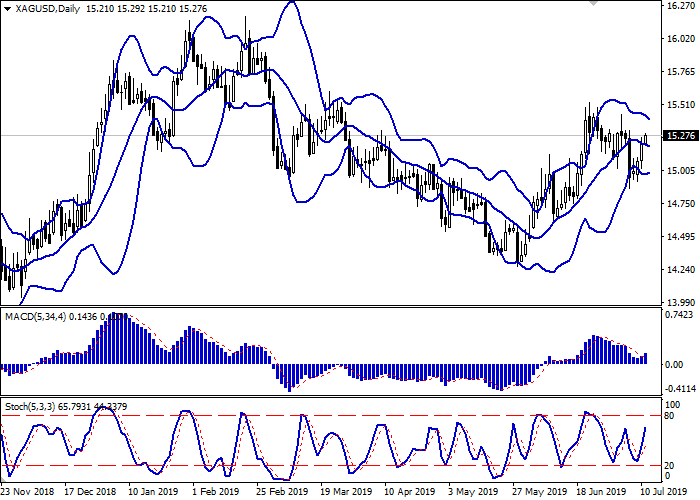

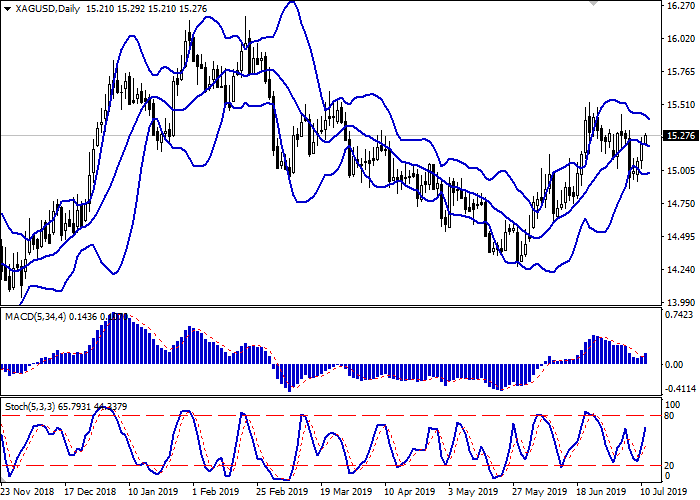

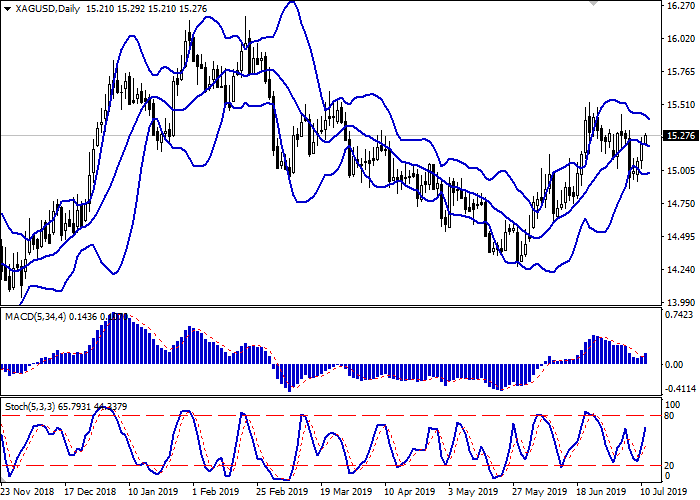

Support and resistance

On the daily chart, Bollinger bands are moving flat. The price range narrows, reflecting the ambiguous nature of the trades in the short term. The MACD indicator reversed upwards, forming a poor buy signal (the histogram is above the signal line). Stochastic is pointed upwards, rapidly approaching its highs, which indicates that the instrument may become overbought in the super short term.

It is better to keep current long positions until the market situation becomes clearer.

Resistance levels: 15.31, 15.40, 15.52.

Support levels: 15.20, 15.12, 15.00, 14.90.

Trading tips

Long positions can be opened after the breakout of 15.31 with the target at 15.52. Stop loss is 15.20. Implementation period: 1–2 days.

Short positions can be opened after the rebound from 15.31 and the breakdown of 15.20 with the target at 15.00. Stop loss is 15.31. Implementation period: 2–3 days.

Yesterday, silver prices rose sharply, responding to the speech of Fed Chairman Jerome Powell, who focused on risks for the American economy and promoted higher expectations of lowering the interest rate of the Fed during the meeting on July 30–31. At the moment, the lack of visible progress in trade negotiations between the United States and China, which resumed this week, also supports the price.

On Thursday, investors are focused on is a large block of macroeconomic statistics from the United States. Traders are awaiting the publication of data on consumer inflation in the US for June. Also, the market will follow the performance of representatives of the US Federal Reserve Williams, Bostic and Barkin. Closer to the end of the daily session, the US will publish a monthly report on the state of the budget.

Support and resistance

On the daily chart, Bollinger bands are moving flat. The price range narrows, reflecting the ambiguous nature of the trades in the short term. The MACD indicator reversed upwards, forming a poor buy signal (the histogram is above the signal line). Stochastic is pointed upwards, rapidly approaching its highs, which indicates that the instrument may become overbought in the super short term.

It is better to keep current long positions until the market situation becomes clearer.

Resistance levels: 15.31, 15.40, 15.52.

Support levels: 15.20, 15.12, 15.00, 14.90.

Trading tips

Long positions can be opened after the breakout of 15.31 with the target at 15.52. Stop loss is 15.20. Implementation period: 1–2 days.

Short positions can be opened after the rebound from 15.31 and the breakdown of 15.20 with the target at 15.00. Stop loss is 15.31. Implementation period: 2–3 days.

No comments:

Write comments