Litecoin: technical analysis

11 July 2019, 10:16

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 98.00 |

| Take Profit | 87.50, 75.00 |

| Stop Loss | 108.30 |

| Key Levels | 75.00, 87.50, 100.00, 112.50, 125.00, 137.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 114.00 |

| Take Profit | 125.00, 137.50 |

| Stop Loss | 105.00 |

| Key Levels | 75.00, 87.50, 100.00, 112.50, 125.00, 137.50 |

Current trend

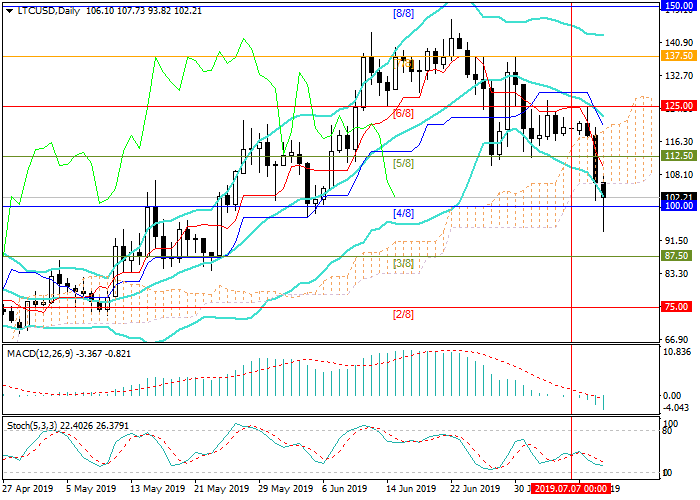

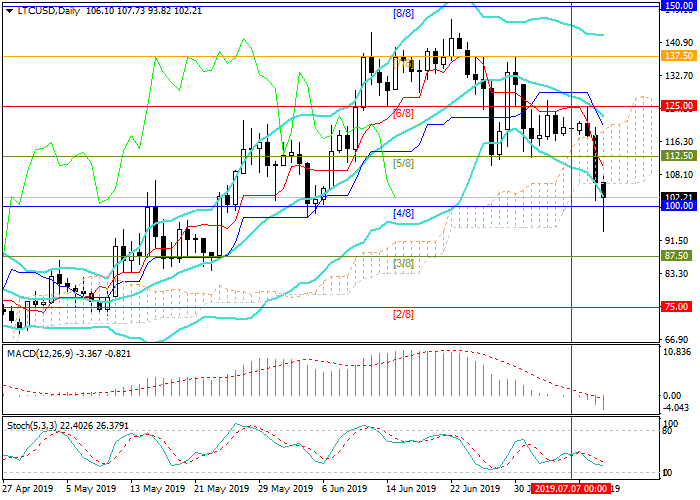

This week, LTC quotes were corrected downwards and tested the level of 100.00 in the middle of the Murrey trading range. If the price consolidates below it, a continuation of the decline to the levels of 87.50 (Murrey [3/8]) and 75.00 (Murrey [2/8]) is likely. The key "bullish" level is 112.50 (Murrey [5/8]). Its breakout will give the prospect of returning to the middle line of Bollinger bands around 125.00 (Murrey [6/8]) and higher to the level of 137.50 (Murrey [7/8]). However, while this option of price movement looks less preferable since technical indicators confirm a decline. The Bollinger bands and Stochastic reversed downwards. The MACD histogram increases in the negative zone.

Support and resistance

Resistance levels: 112.50, 125.00, 137.50.

Support levels: 100.00, 87.50, 75.00.

Trading tips

Short positions can be opened after the price consolidates below the level of 100.00 with the targets at 87.50, 75.00 and stop loss 108.30.

Long positions can be opened above the level of 112.50 with the targets at 125.00, 137.50 and stop loss 105.00.

Implementation period: 3–4 days.

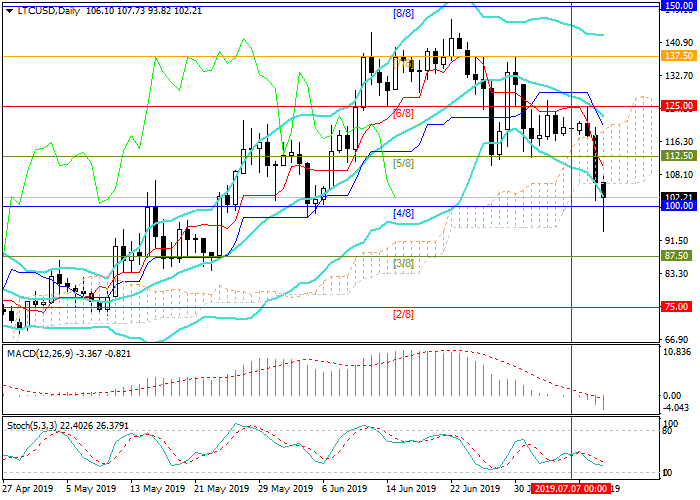

This week, LTC quotes were corrected downwards and tested the level of 100.00 in the middle of the Murrey trading range. If the price consolidates below it, a continuation of the decline to the levels of 87.50 (Murrey [3/8]) and 75.00 (Murrey [2/8]) is likely. The key "bullish" level is 112.50 (Murrey [5/8]). Its breakout will give the prospect of returning to the middle line of Bollinger bands around 125.00 (Murrey [6/8]) and higher to the level of 137.50 (Murrey [7/8]). However, while this option of price movement looks less preferable since technical indicators confirm a decline. The Bollinger bands and Stochastic reversed downwards. The MACD histogram increases in the negative zone.

Support and resistance

Resistance levels: 112.50, 125.00, 137.50.

Support levels: 100.00, 87.50, 75.00.

Trading tips

Short positions can be opened after the price consolidates below the level of 100.00 with the targets at 87.50, 75.00 and stop loss 108.30.

Long positions can be opened above the level of 112.50 with the targets at 125.00, 137.50 and stop loss 105.00.

Implementation period: 3–4 days.

No comments:

Write comments