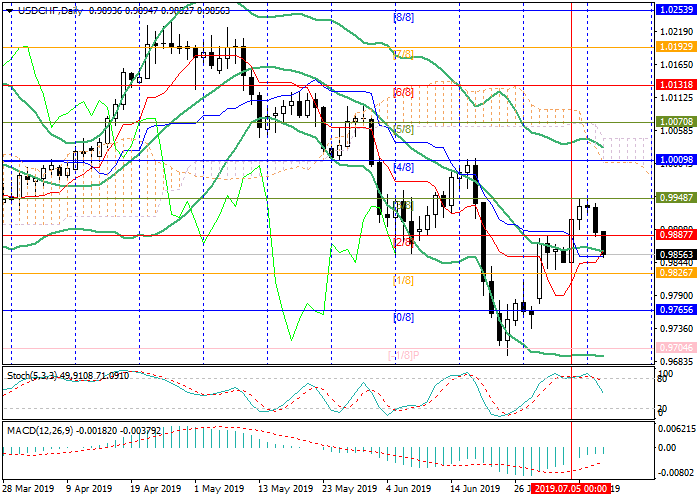

USD/CHF: Murrey analysis

11 July 2019, 11:50

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 0.9850 |

| Take Profit | 0.9765, 0.9705 |

| Stop Loss | 0.9890 |

| Key Levels | 0.9705, 0.9765, 0.9948, 1.0010, 1.0070 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.9955 |

| Take Profit | 1.0010, 1.0070 |

| Stop Loss | 0.9915 |

| Key Levels | 0.9705, 0.9765, 0.9948, 1.0010, 1.0070 |

This week, the price reached 0.9948 ([3/8]), from which it corrected

downwards, breaking down the level of 0.9887 ([2/8]) and the midline of

Bollinger Bands. Further decline is possible to the lower border of the trading

range near 0.9765 ([0/8]) and to 0.9705 ([-1/8]). The level of 0.9948 ([4/8]) is

the key for the "bulls". After the consolidation above it, the price will return

to the central Murrey channel and may rise to the levels of 1.0010 ([4/8]) and

1.0070 ([5/8]). Technical indicators don't provide a clear signal: Bollinger

Bands are moving horizontally, MACD histogram has stabilized in the negative

zone, and Stochastic has left the overbought zone, forming a sell signal.

Support and resistance

Resistance levels: 0.9948, 1.0010, 1.0070.

Support levels: 0.9765, 0.9705.

Trading tips

Short positions may be opened from 0.9850 with targets at 0.9765, 0.9705 and stop loss at 0.9890.

Long positions may be opened above 0.9948 with targets at 1.0010, 1.0070 and stop loss at 0.9915.

Implementation period: 3-4 days.

Support and resistance

Resistance levels: 0.9948, 1.0010, 1.0070.

Support levels: 0.9765, 0.9705.

Trading tips

Short positions may be opened from 0.9850 with targets at 0.9765, 0.9705 and stop loss at 0.9890.

Long positions may be opened above 0.9948 with targets at 1.0010, 1.0070 and stop loss at 0.9915.

Implementation period: 3-4 days.

No comments:

Write comments