NZD/USD: general analysis

11 July 2019, 12:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6681 |

| Take Profit | 0.6726 |

| Stop Loss | 0.6648 |

| Key Levels | 0.6567, 0.6595, 0.6631, 0.6648, 0.6681, 0.6694, 0.6708, 0.6726 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6630 |

| Take Profit | 0.6570 |

| Stop Loss | 0.6670 |

| Key Levels | 0.6567, 0.6595, 0.6631, 0.6648, 0.6681, 0.6694, 0.6708, 0.6726 |

Current trend

The NZD/USD pair is falling against the background of the weakness of the US dollar, caused by the Fed's speech, which increased the risks of a rate cut during a regulator meeting on July 30–31. Statistics released in New Zealand today was ambiguous: growth in Electronic Card Retail Sales slowed down in June against to the previous month, reaching 0.0% but in annual terms, the indicator increased by 1.1%, which is a positive factor for the national currency.

Today, the market is waiting for the publication of data from the United States on the change in the consumer price index, excluding food and energy, at 14:30 (GMT+2), high volatility is predicted on the market.

Support and resistance

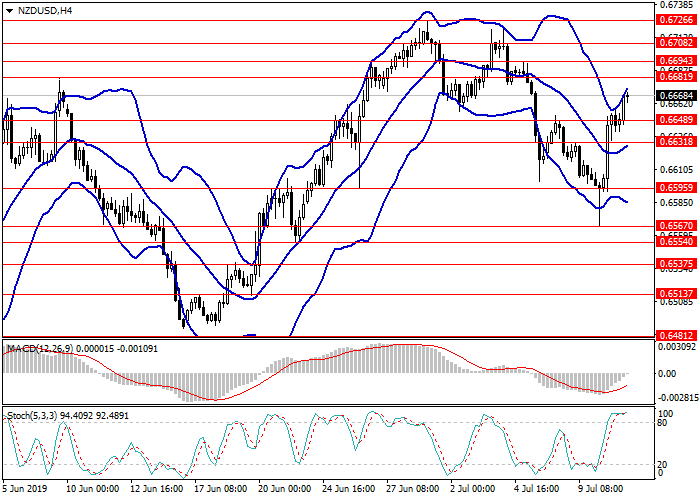

On the 4-hour chart, the pair is growing along the upper border of Bollinger bands, the price range is expanded, which indicates a likely continuation of the upward movement. The MACD histogram is in the negative region, the signal for opening short positions weakens.

Resistance levels: 0.6681, 0.6694, 0.6708, 0.6726.

Support levels: 0.6648, 0.6631, 0.6595, 0.6567.

Trading tips

Long positions can be opened from the level of 0.6681 with the target at 0.6726 and stop loss 0.6648.

Short positions can be opened from the level of 0.6630 with the target at 0.6570 and stop loss 0.6670.

Implementation period: 1–3 days.

The NZD/USD pair is falling against the background of the weakness of the US dollar, caused by the Fed's speech, which increased the risks of a rate cut during a regulator meeting on July 30–31. Statistics released in New Zealand today was ambiguous: growth in Electronic Card Retail Sales slowed down in June against to the previous month, reaching 0.0% but in annual terms, the indicator increased by 1.1%, which is a positive factor for the national currency.

Today, the market is waiting for the publication of data from the United States on the change in the consumer price index, excluding food and energy, at 14:30 (GMT+2), high volatility is predicted on the market.

Support and resistance

On the 4-hour chart, the pair is growing along the upper border of Bollinger bands, the price range is expanded, which indicates a likely continuation of the upward movement. The MACD histogram is in the negative region, the signal for opening short positions weakens.

Resistance levels: 0.6681, 0.6694, 0.6708, 0.6726.

Support levels: 0.6648, 0.6631, 0.6595, 0.6567.

Trading tips

Long positions can be opened from the level of 0.6681 with the target at 0.6726 and stop loss 0.6648.

Short positions can be opened from the level of 0.6630 with the target at 0.6570 and stop loss 0.6670.

Implementation period: 1–3 days.

No comments:

Write comments