XAG/USD: silver prices are consolidating

01 July 2019, 09:36

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 15.27 |

| Take Profit | 15.52 |

| Stop Loss | 15.12 |

| Key Levels | 14.82, 14.90, 15.00, 15.12, 15.24, 15.31, 15.40, 15.52 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 15.10 |

| Take Profit | 14.82, 14.72 |

| Stop Loss | 15.24 |

| Key Levels | 14.82, 14.90, 15.00, 15.12, 15.24, 15.31, 15.40, 15.52 |

Current trend

At the end of the last trading week, silver prices rose, as investors began to doubt the successful outcome of the meeting between Donald Trump and Xi Jinping at the G20 summit. Nevertheless, the negotiations were quite optimistic, so the price stepped back, and on Monday, the instrument opened with a negative gap. The parties agreed to continue full-format trade negotiations, and the United States also partially lifted trade restrictions with the Chinese company Huawei. On the other hand, the prospect of easing the Fed’s monetary policy as soon as during the July meeting of the regulator supports the rate of silver.

On Monday, the investors will focus on Manufacturing PMI in June. The ISM business activity index is expected to drop from 52.1 to 51.0 points, which will affect USD negatively.

Support and resistance

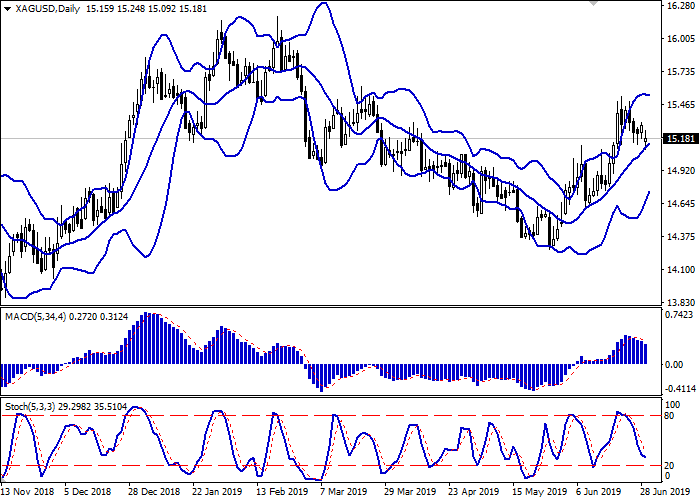

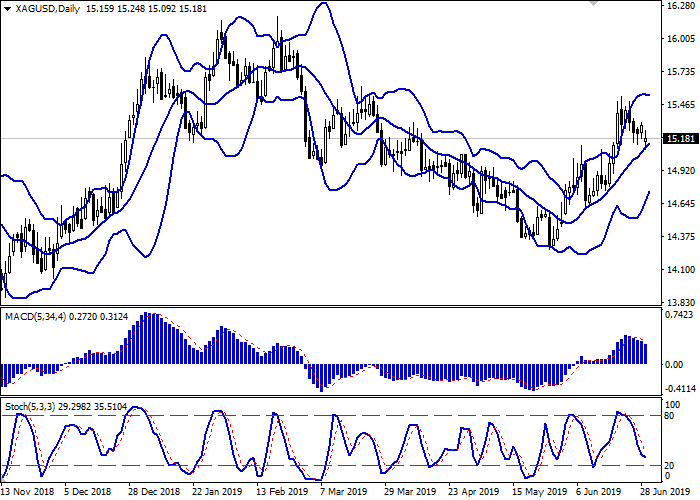

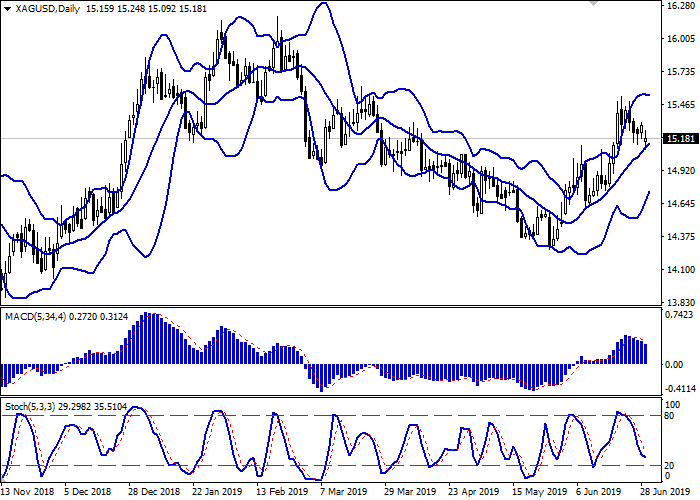

Bollinger bands grow steadily on the daily chart. The price range narrows, reflecting the emergence of multidirectional dynamics of trading in the short term. The MACD decreases, keeping a moderate sell signal (the histogram is below the signal line). Stochastic falls more actively and is currently approaching its lows, signaling that the instrument is oversold in the super short term.

It is better to keep the current short positions until the market situation becomes clearer.

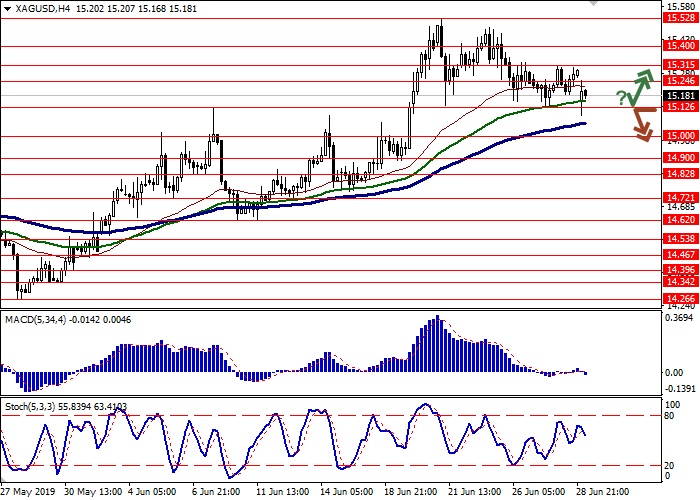

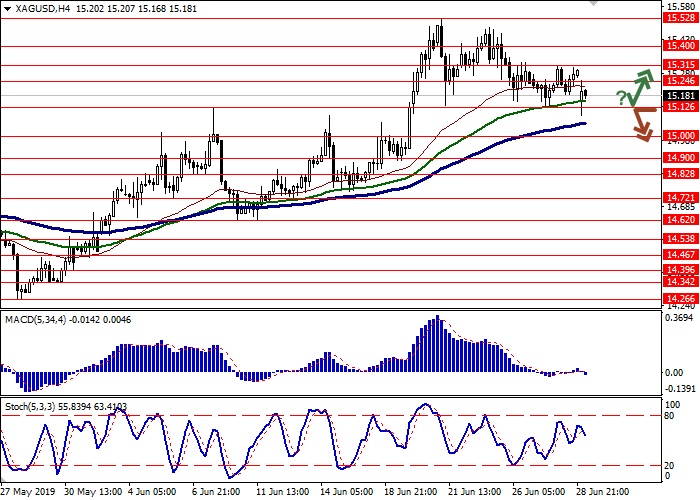

Resistance levels: 15.24, 15.31, 15.40, 15.52.

Support levels: 15.12, 15.00, 14.90, 14.82.

Trading tips

Long positions can be opened after the rebound from 15.12 and the breakout of 15.24 with the target at 15.52. Stop loss is 15.12. Implementation period: 1–2 days.

Short positions can be opened after the breakdown of 15.12 with the target at 14.82 or 14.72. Stop loss is 15.24. Implementation period: 2–3 days.

At the end of the last trading week, silver prices rose, as investors began to doubt the successful outcome of the meeting between Donald Trump and Xi Jinping at the G20 summit. Nevertheless, the negotiations were quite optimistic, so the price stepped back, and on Monday, the instrument opened with a negative gap. The parties agreed to continue full-format trade negotiations, and the United States also partially lifted trade restrictions with the Chinese company Huawei. On the other hand, the prospect of easing the Fed’s monetary policy as soon as during the July meeting of the regulator supports the rate of silver.

On Monday, the investors will focus on Manufacturing PMI in June. The ISM business activity index is expected to drop from 52.1 to 51.0 points, which will affect USD negatively.

Support and resistance

Bollinger bands grow steadily on the daily chart. The price range narrows, reflecting the emergence of multidirectional dynamics of trading in the short term. The MACD decreases, keeping a moderate sell signal (the histogram is below the signal line). Stochastic falls more actively and is currently approaching its lows, signaling that the instrument is oversold in the super short term.

It is better to keep the current short positions until the market situation becomes clearer.

Resistance levels: 15.24, 15.31, 15.40, 15.52.

Support levels: 15.12, 15.00, 14.90, 14.82.

Trading tips

Long positions can be opened after the rebound from 15.12 and the breakout of 15.24 with the target at 15.52. Stop loss is 15.12. Implementation period: 1–2 days.

Short positions can be opened after the breakdown of 15.12 with the target at 14.82 or 14.72. Stop loss is 15.24. Implementation period: 2–3 days.

No comments:

Write comments