EUR/USD: trading is ambiguous

01 July 2019, 09:39

| Scenario | |

|---|---|

| Timeframe | Intraday |

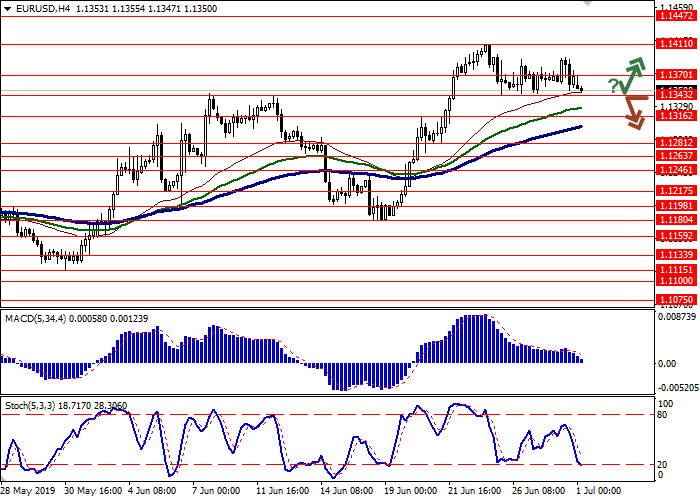

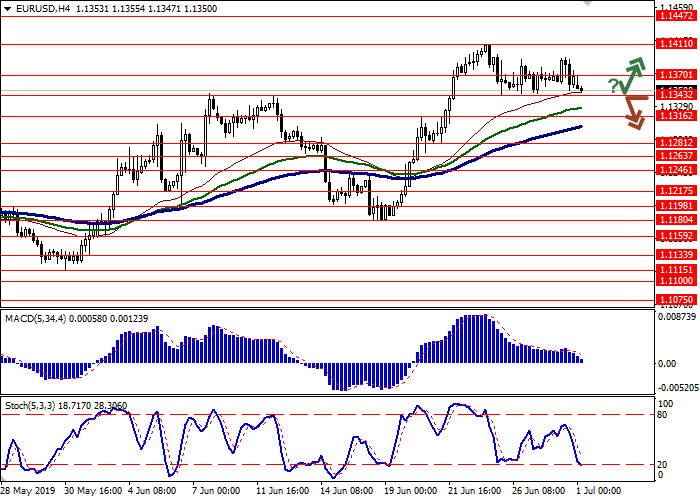

| Recommendation | BUY STOP |

| Entry Point | 1.1375, 1.1395 |

| Take Profit | 1.1471 |

| Stop Loss | 1.1330, 1.1310 |

| Key Levels | 1.1263, 1.1281, 1.1316, 1.1343, 1.1370, 1.1411, 1.1447, 1.1471 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 1.1329 |

| Take Profit | 1.1263, 1.1246 |

| Stop Loss | 1.1380 |

| Key Levels | 1.1263, 1.1281, 1.1316, 1.1343, 1.1370, 1.1411, 1.1447, 1.1471 |

Current trend

EUR showed ambiguous dynamics against USD on June 28. Investors didn't want to open new positions at the end of the week amid the passing G20 summit, at which, in particular, a meeting between US President Donald Trump and Chinese President Xi Jinping was awaited. The negotiations ended quite positively. Trump noted that they were "better than expected" and encouraged the markets with optimistic forecasts for the final deal between the countries. The United States decided not to introduce new import duties and allowed American companies to deal with Huawei if this does not pose a threat to the US security.

Moderate support for the euro on Friday was provided by preliminary data on consumer inflation. In June, the core CPI accelerated from 0.8% to 1.1% YoY, with a forecast of growth to 1.0% YoY. At the start of the week, European statistics on consumer lending and unemployment for May is expected.

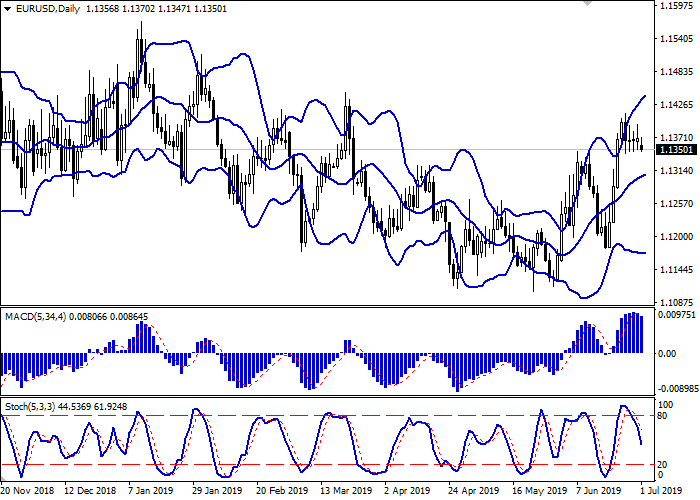

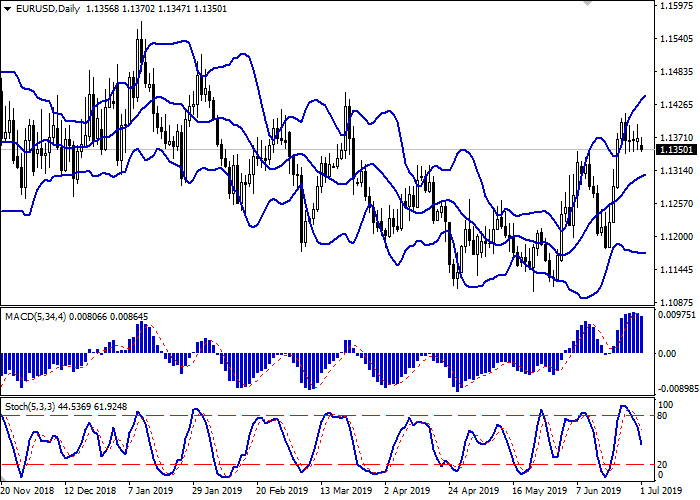

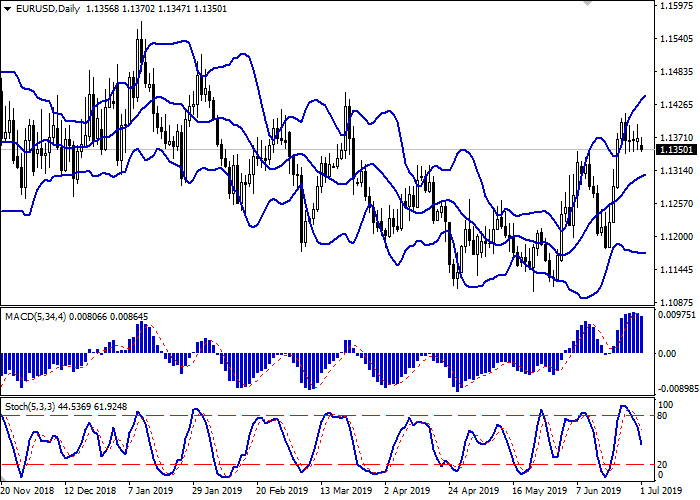

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range expands from above, freeing a path to new local highs for the "bulls". MACD is reversing down and forming a sell signal (being located under the signal line). Stochastic is declining slightly more actively, being located just below the middle of its working area.

There's a possibility of a correctional decline in the short and/or ultra-short term.

Resistance levels: 1.1370, 1.1411, 1.1447, 1.1471.

Support levels: 1.1343, 1.1316, 1.1281, 1.1263.

Trading tips

Long positions should be opened if the price moves away from the support level of 1.1343 followed by the breakout of 1.1370–1.1390. Take-profit – 1.1471. Stop loss – 1.1330–1.1310.

A confident breakdown of 1.1343 may serve as a signal to further sales with the target at 1.1263 or 1.1246. Stop loss – 1.1380.

Implementation period: 2-3 days.

EUR showed ambiguous dynamics against USD on June 28. Investors didn't want to open new positions at the end of the week amid the passing G20 summit, at which, in particular, a meeting between US President Donald Trump and Chinese President Xi Jinping was awaited. The negotiations ended quite positively. Trump noted that they were "better than expected" and encouraged the markets with optimistic forecasts for the final deal between the countries. The United States decided not to introduce new import duties and allowed American companies to deal with Huawei if this does not pose a threat to the US security.

Moderate support for the euro on Friday was provided by preliminary data on consumer inflation. In June, the core CPI accelerated from 0.8% to 1.1% YoY, with a forecast of growth to 1.0% YoY. At the start of the week, European statistics on consumer lending and unemployment for May is expected.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range expands from above, freeing a path to new local highs for the "bulls". MACD is reversing down and forming a sell signal (being located under the signal line). Stochastic is declining slightly more actively, being located just below the middle of its working area.

There's a possibility of a correctional decline in the short and/or ultra-short term.

Resistance levels: 1.1370, 1.1411, 1.1447, 1.1471.

Support levels: 1.1343, 1.1316, 1.1281, 1.1263.

Trading tips

Long positions should be opened if the price moves away from the support level of 1.1343 followed by the breakout of 1.1370–1.1390. Take-profit – 1.1471. Stop loss – 1.1330–1.1310.

A confident breakdown of 1.1343 may serve as a signal to further sales with the target at 1.1263 or 1.1246. Stop loss – 1.1380.

Implementation period: 2-3 days.

No comments:

Write comments