USD/JPY: USD is strengthening

02 July 2019, 09:44

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 108.60 |

| Take Profit | 109.30 |

| Stop Loss | 108.14 |

| Key Levels | 107.03, 107.45, 107.80, 108.14, 108.52, 108.79, 109.00, 109.30 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 108.10 |

| Take Profit | 107.45, 107.03 |

| Stop Loss | 108.52 |

| Key Levels | 107.03, 107.45, 107.80, 108.14, 108.52, 108.79, 109.00, 109.30 |

Current trend

The US dollar rose against the Japanese yen on Monday, updating local highs of June 19. The instrument was supported by positive results of the meeting between Donald Trump and Xi Jinping, who managed to achieve a temporary truce in a trade conflict. The yen was pressured by published macroeconomic statistics from Japan. Nikkei Manufacturing PMI in June fell from 49.8 to 49.3 points, which turned out to be worse than the expectations of 49.5 points. The consumer confidence index for the same period fell from 39.4 to 38.7 points, against the forecast of growth to 40.4 points.

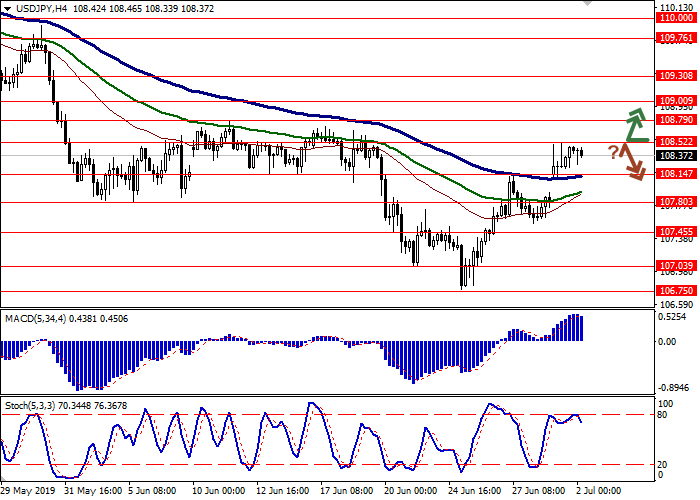

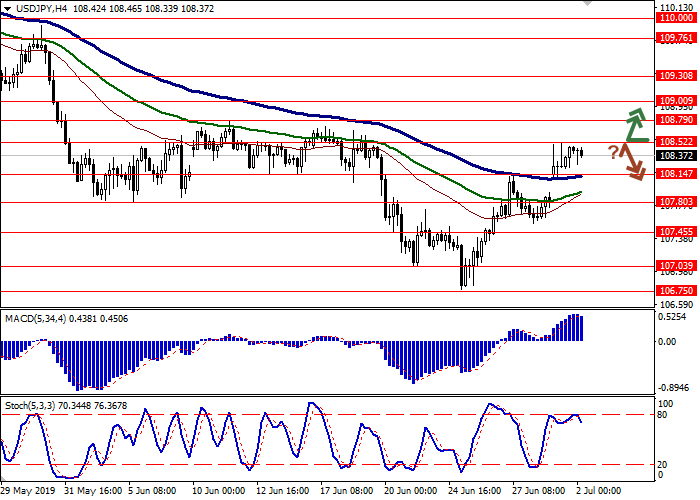

Support and resistance

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range remains fixed and practically does not respond to the upward trend at the beginning of the week. MACD indicator is growing keeping a strong buy signal (the histogram is above the signal line). Stochastic retains a stable upward direction but is rapidly approaching its maximum levels, which indicates overbought USD in the ultra-short term.

One should keep existing long positions until clarification. Currently, one should not open new positions.

Resistance levels: 108.52, 108.79, 109.00, 109.30.

Support levels: 108.14, 107.80, 107.45, 107.03.

Trading tips

To open long positions, one can rely on the breakout of 108.52. Take-profit – 109.30. Stop loss – 108.14.

A rebound from 108.52, as from resistance, followed by a breakdown of 108.14, may become a signal for corrective sales with the target at 107.45 or 107.03. Stop loss – 108.52.

Implementation period: 2-3 days.

The US dollar rose against the Japanese yen on Monday, updating local highs of June 19. The instrument was supported by positive results of the meeting between Donald Trump and Xi Jinping, who managed to achieve a temporary truce in a trade conflict. The yen was pressured by published macroeconomic statistics from Japan. Nikkei Manufacturing PMI in June fell from 49.8 to 49.3 points, which turned out to be worse than the expectations of 49.5 points. The consumer confidence index for the same period fell from 39.4 to 38.7 points, against the forecast of growth to 40.4 points.

Support and resistance

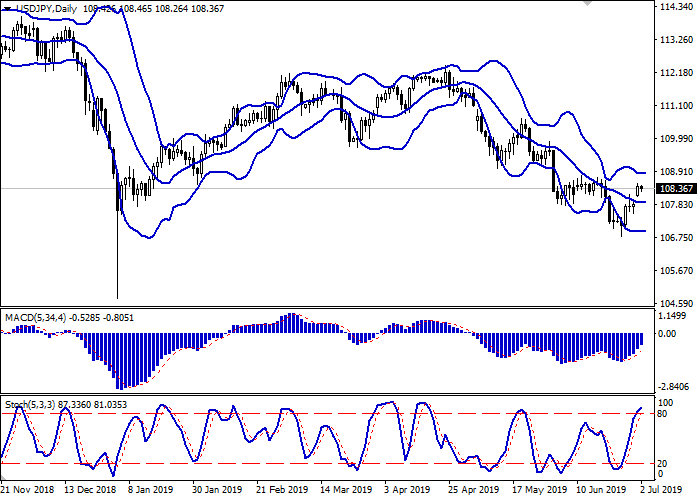

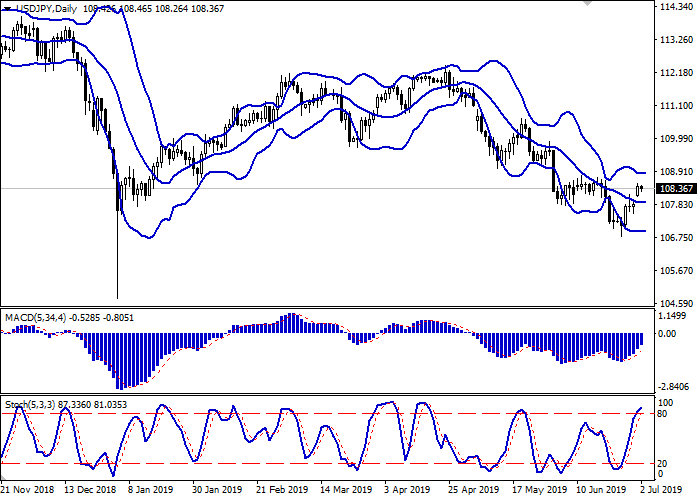

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range remains fixed and practically does not respond to the upward trend at the beginning of the week. MACD indicator is growing keeping a strong buy signal (the histogram is above the signal line). Stochastic retains a stable upward direction but is rapidly approaching its maximum levels, which indicates overbought USD in the ultra-short term.

One should keep existing long positions until clarification. Currently, one should not open new positions.

Resistance levels: 108.52, 108.79, 109.00, 109.30.

Support levels: 108.14, 107.80, 107.45, 107.03.

Trading tips

To open long positions, one can rely on the breakout of 108.52. Take-profit – 109.30. Stop loss – 108.14.

A rebound from 108.52, as from resistance, followed by a breakdown of 108.14, may become a signal for corrective sales with the target at 107.45 or 107.03. Stop loss – 108.52.

Implementation period: 2-3 days.

No comments:

Write comments