GBP/USD: the pound remains pressured

02 July 2019, 09:42

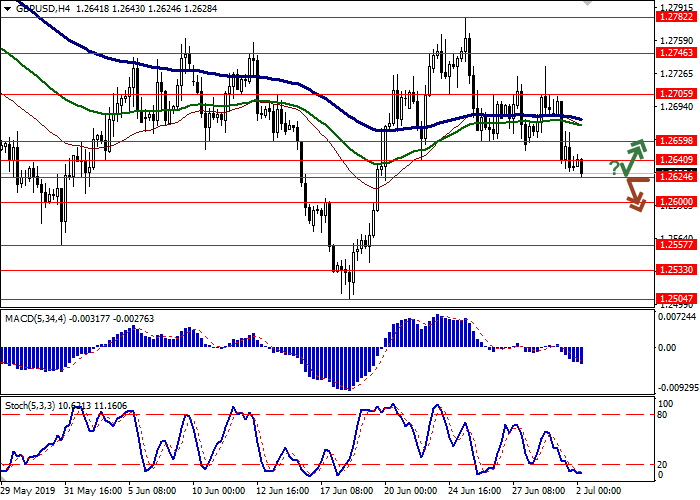

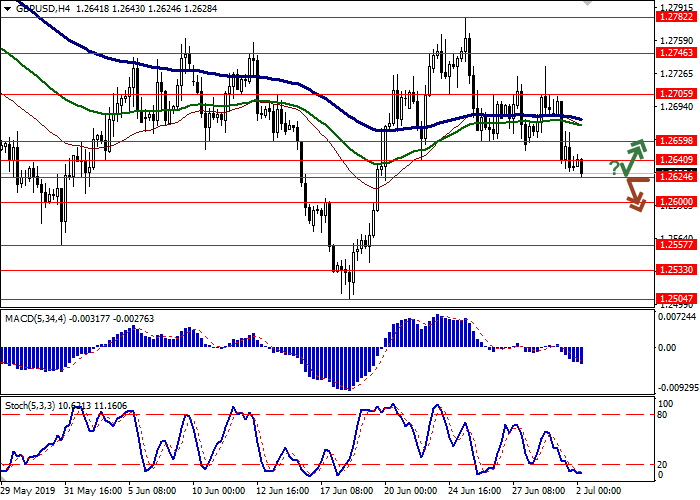

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2665 |

| Take Profit | 1.2746 |

| Stop Loss | 1.2624 |

| Key Levels | 1.2533, 1.2557, 1.2600, 1.2624, 1.2640, 1.2659, 1.2705, 1.2746 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2620 |

| Take Profit | 1.2557, 1.2533 |

| Stop Loss | 1.2659 |

| Key Levels | 1.2533, 1.2557, 1.2600, 1.2624, 1.2640, 1.2659, 1.2705, 1.2746 |

Current trend

At the beginning of the week, GBP fell against USD updating local lows of June 20. Traders returned to active sales of the pound amid the publication of weak macroeconomic statistics from the UK. In addition, as the trade conflict between the USA and China gradually fades, more and more investors are following the uncertain prospects for Brexit. The Markit Manufacturing PMI in June fell from 49.4 to 48.0 points, with a forecast of a decline to 49.2 points. Consumer lending in May slowed from 0.968 billion to 0.822 billion pounds, which turned out to be worse than market expectations of 0.967 billion. The number of approved mortgage applications in May also showed a decline from 66.045 to 65.409 thousand (forecast 65.600K). On Tuesday, investors expect the publication of the Construction PMI, as well as speech by the Bank of England head Mark Carney.

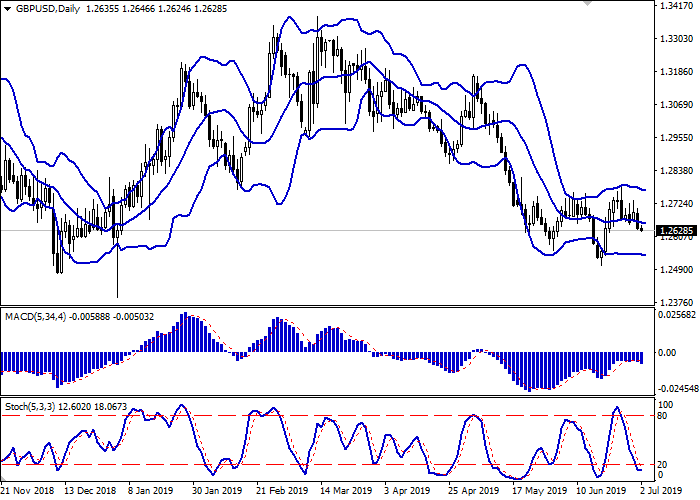

Support and resistance

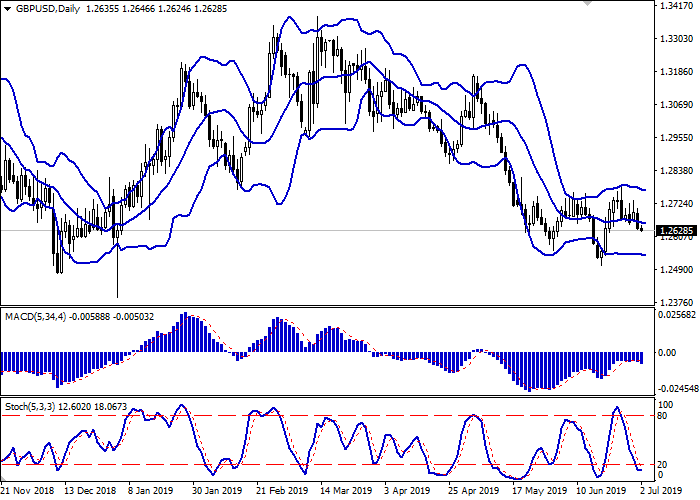

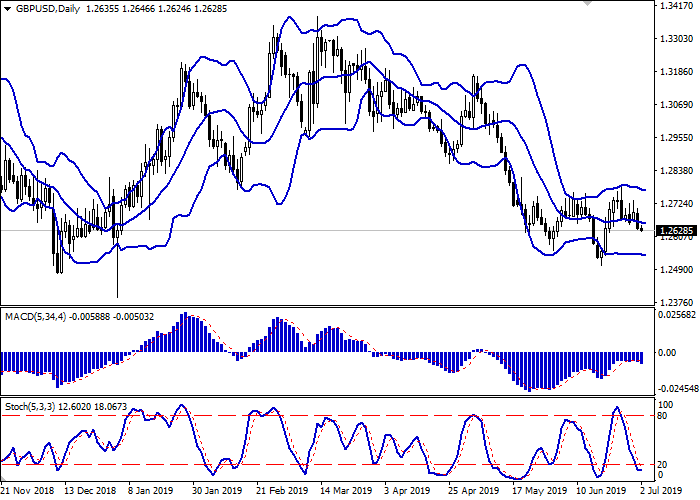

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range is gradually narrowing, but it remains rather spacious given the trade dynamics in the market. MACD is reversing down and forming a sell signal (being located under the signal line). Stochastic, approaching its maximum levels, is reversing horizontally, signaling the risks of the oversold pound in the ultra-short term.

There's a possibility of a correctional growth in the short and/or ultra-short term.

Resistance levels: 1.2640, 1.2659, 1.2705, 1.2746.

Support levels: 1.2624, 1.2600, 1.2557, 1.2533.

Trading tips

Long positions may be opened if the instrument moves away from 1.2624, as from support, followed by the breakout of 1.2659. Take-profit – 1.2746. Stop loss – 1.2624. Implementation period: 2-3 days.

A confident breakdown of 1.2624 may serve as a signal to further sales with the target at 1.2557–1.2533. Stop loss – 1.2659. Implementation period: 1-2 days.

At the beginning of the week, GBP fell against USD updating local lows of June 20. Traders returned to active sales of the pound amid the publication of weak macroeconomic statistics from the UK. In addition, as the trade conflict between the USA and China gradually fades, more and more investors are following the uncertain prospects for Brexit. The Markit Manufacturing PMI in June fell from 49.4 to 48.0 points, with a forecast of a decline to 49.2 points. Consumer lending in May slowed from 0.968 billion to 0.822 billion pounds, which turned out to be worse than market expectations of 0.967 billion. The number of approved mortgage applications in May also showed a decline from 66.045 to 65.409 thousand (forecast 65.600K). On Tuesday, investors expect the publication of the Construction PMI, as well as speech by the Bank of England head Mark Carney.

Support and resistance

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range is gradually narrowing, but it remains rather spacious given the trade dynamics in the market. MACD is reversing down and forming a sell signal (being located under the signal line). Stochastic, approaching its maximum levels, is reversing horizontally, signaling the risks of the oversold pound in the ultra-short term.

There's a possibility of a correctional growth in the short and/or ultra-short term.

Resistance levels: 1.2640, 1.2659, 1.2705, 1.2746.

Support levels: 1.2624, 1.2600, 1.2557, 1.2533.

Trading tips

Long positions may be opened if the instrument moves away from 1.2624, as from support, followed by the breakout of 1.2659. Take-profit – 1.2746. Stop loss – 1.2624. Implementation period: 2-3 days.

A confident breakdown of 1.2624 may serve as a signal to further sales with the target at 1.2557–1.2533. Stop loss – 1.2659. Implementation period: 1-2 days.

No comments:

Write comments