USD/CAD: the dollar grows

02 July 2019, 09:46

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3155, 1.3170 |

| Take Profit | 1.3283, 1.3320 |

| Stop Loss | 1.3100 |

| Key Levels | 1.3000, 1.3058, 1.3100, 1.3149, 1.3200, 1.3228, 1.3283 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3095 |

| Take Profit | 1.3000 |

| Stop Loss | 1.3149 |

| Key Levels | 1.3000, 1.3058, 1.3100, 1.3149, 1.3200, 1.3228, 1.3283 |

Current trend

Yesterday, the USD/CAD pair rose significantly, departing from the local lows renewed the day before. USD was supported by the agreements reached between Donald Trump and Xi Jinping at the negotiations within the G20 summit. In addition, on Monday, markets in Canada were closed due to a national holiday, so there was a lack of new drivers. US macroeconomic statistics moderately supported the instrument. Thus, the Markit Manufacturing PMI in June rose from 50.5 to 50.6 points, with a forecast of a decline to 50.1 points. ISM Manufacturing PMI in June fell from 52.1 to 51.7 points, which, however, was better than market expectations of 51.0 points.

Today, investors are focused on another block of statistics from the US on retail sales and business conditions in New York. Canada will publish June Manufacturing PMI.

Support and resistance

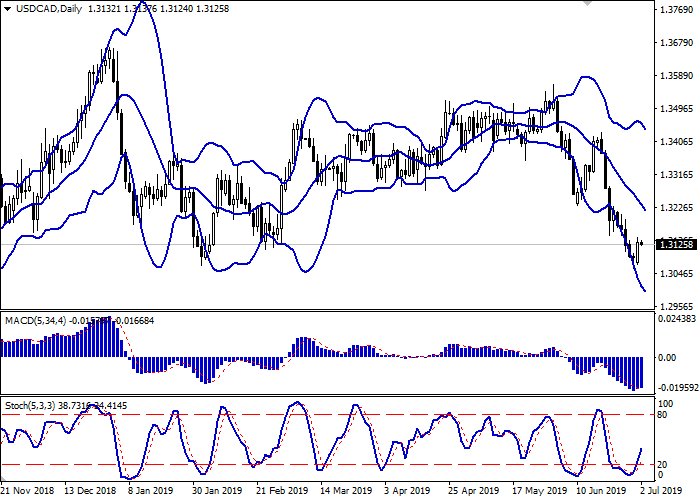

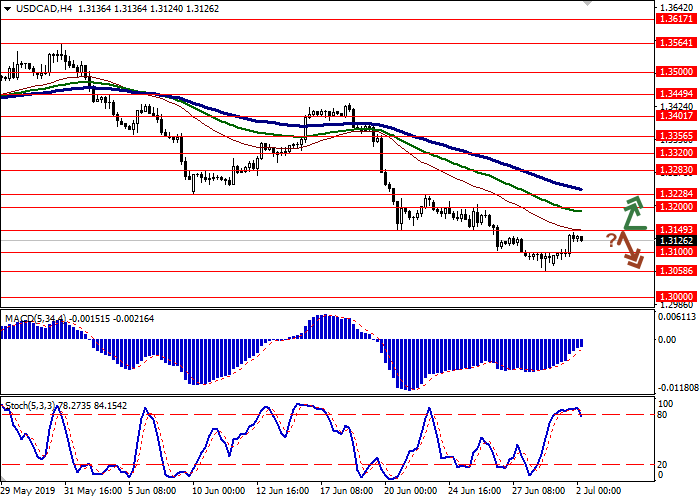

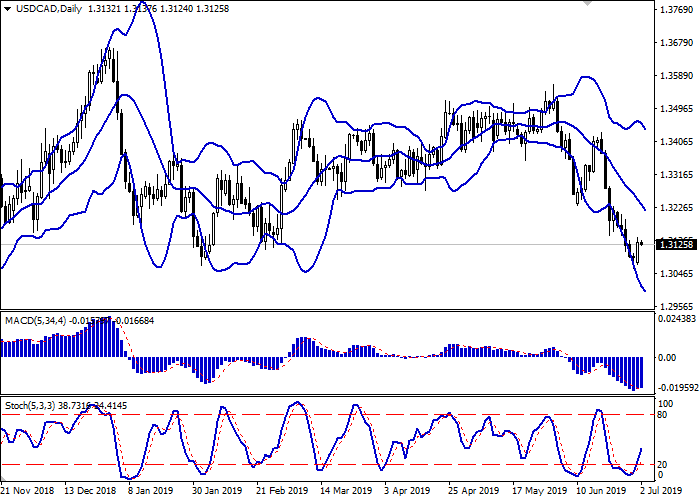

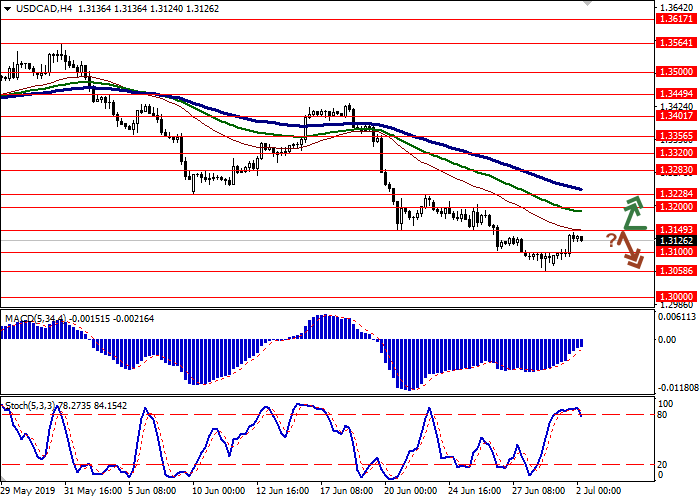

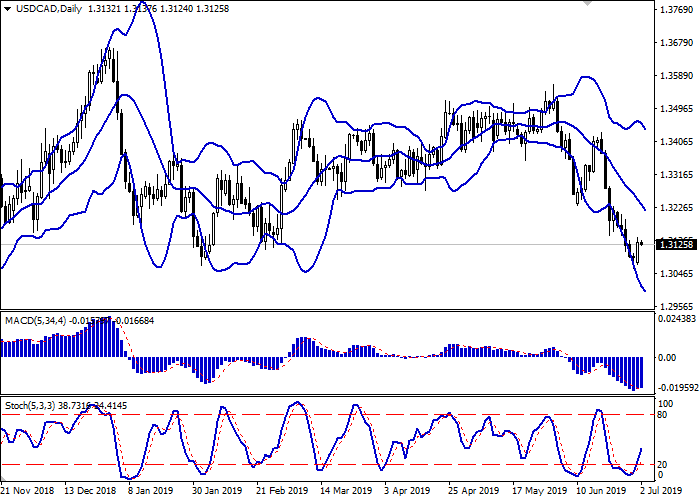

On the daily chart, Bollinger bands steadily decline. The price range hardly responds to the correctional dynamics and remains very wide. The MACD reverses upwards; forming a new buy signal (the histogram should be located above the signal line). Stochastic, departing from its lows, is pointed upwards, reflecting the development of corrective growth.

Further development of the "bullish" trend is possible in the short and/or super short term.

Resistance levels: 1.3149, 1.3200, 1.3228, 1.3283.

Support levels: 1.3100, 1.3058, 1.3000.

Trading tips

Long positions can be opened after the breakout of 1.3149–1.3165 with the target at 1.3283 or 1.3320. Stop loss is no further than 1.3100. Implementation period: 2–3 days.

Short positions can be opened after a rebound from 1.3149 and a breakdown of the level of 1.3100 with the target at 1.3000. Stop loss is 1.3149. Implementation period: 1–2 days.

Yesterday, the USD/CAD pair rose significantly, departing from the local lows renewed the day before. USD was supported by the agreements reached between Donald Trump and Xi Jinping at the negotiations within the G20 summit. In addition, on Monday, markets in Canada were closed due to a national holiday, so there was a lack of new drivers. US macroeconomic statistics moderately supported the instrument. Thus, the Markit Manufacturing PMI in June rose from 50.5 to 50.6 points, with a forecast of a decline to 50.1 points. ISM Manufacturing PMI in June fell from 52.1 to 51.7 points, which, however, was better than market expectations of 51.0 points.

Today, investors are focused on another block of statistics from the US on retail sales and business conditions in New York. Canada will publish June Manufacturing PMI.

Support and resistance

On the daily chart, Bollinger bands steadily decline. The price range hardly responds to the correctional dynamics and remains very wide. The MACD reverses upwards; forming a new buy signal (the histogram should be located above the signal line). Stochastic, departing from its lows, is pointed upwards, reflecting the development of corrective growth.

Further development of the "bullish" trend is possible in the short and/or super short term.

Resistance levels: 1.3149, 1.3200, 1.3228, 1.3283.

Support levels: 1.3100, 1.3058, 1.3000.

Trading tips

Long positions can be opened after the breakout of 1.3149–1.3165 with the target at 1.3283 or 1.3320. Stop loss is no further than 1.3100. Implementation period: 2–3 days.

Short positions can be opened after a rebound from 1.3149 and a breakdown of the level of 1.3100 with the target at 1.3000. Stop loss is 1.3149. Implementation period: 1–2 days.

No comments:

Write comments