XAU/USD: technical analysis

02 July 2019, 10:45

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1398.20 |

| Take Profit | 1424.65 |

| Stop Loss | 1381.84 |

| Key Levels | 1311.14, 1319.73, 1332.83, 1344.71, 1360.41, 1381.84, 1398.20, 1412.12, 1424.65, 1439.74 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1381.50 |

| Take Profit | 1360.50 |

| Stop Loss | 1398.20 |

| Key Levels | 1311.14, 1319.73, 1332.83, 1344.71, 1360.41, 1381.84, 1398.20, 1412.12, 1424.65, 1439.74 |

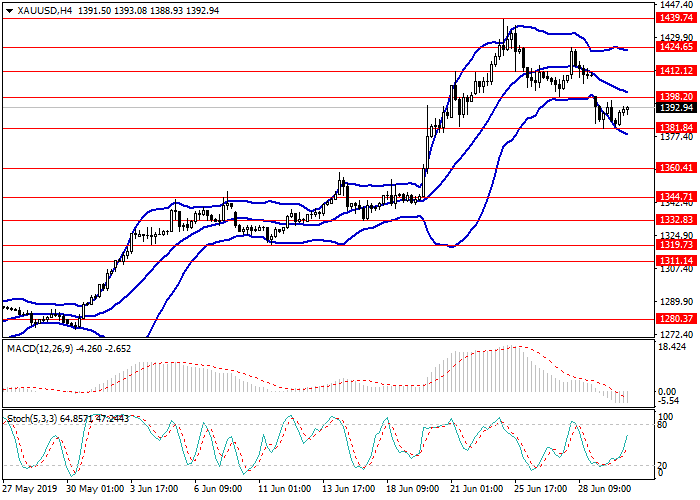

XAU/USD, H4

On the 4-hour chart, the instrument trades within a sideways channel formed by the middle line and the lower border of Bollinger bands, the price range is expanding. The MACD histogram is in the negative area, the signal line crosses the zero line and the body of the histogram downwards, forming a signal for opening short positions. Stochastic is in the neutral zone, the lines of the oscillator are directed upwards.

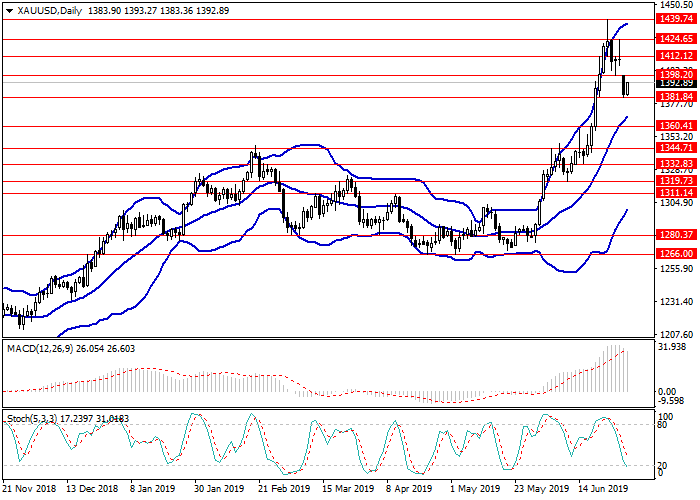

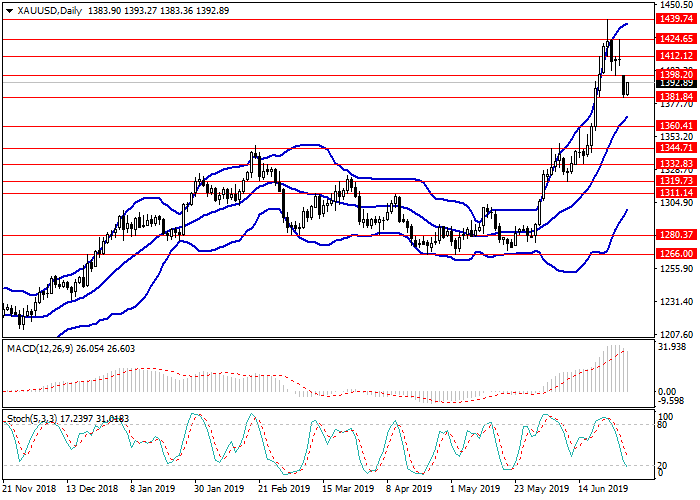

XAU/USD, D1

On the daily chart, an upward movement correction is observed, the instrument is trading between the upper border and the middle line of Bollinger bands, the indicator cloud has been greatly expanded, indicating a likely resumption of growth after the correction. The MACD histogram is in the positive area, the signal line crosses the body of the histogram upwards, forming a strong signal for opening long orders. Stochastic is in the neutral zone, the lines of the oscillator are directed downwards.

Key levels

Resistance levels: 1398.20, 1412.12, 1424.65, 1439.74.

Support levels: 1381.84, 1360.41, 1344.71, 1332.83, 1319.73, 1311.14.

Trading tips

Long positions can be opened from the level of 1398.20 with the target at 1424.65 and stop loss 1381.84.

Short positions can be opened from the level of 1381.50 with the target at 1360.50. Stop loss is 1398.20.

Implementation period: 1–3 days.

On the 4-hour chart, the instrument trades within a sideways channel formed by the middle line and the lower border of Bollinger bands, the price range is expanding. The MACD histogram is in the negative area, the signal line crosses the zero line and the body of the histogram downwards, forming a signal for opening short positions. Stochastic is in the neutral zone, the lines of the oscillator are directed upwards.

XAU/USD, D1

On the daily chart, an upward movement correction is observed, the instrument is trading between the upper border and the middle line of Bollinger bands, the indicator cloud has been greatly expanded, indicating a likely resumption of growth after the correction. The MACD histogram is in the positive area, the signal line crosses the body of the histogram upwards, forming a strong signal for opening long orders. Stochastic is in the neutral zone, the lines of the oscillator are directed downwards.

Key levels

Resistance levels: 1398.20, 1412.12, 1424.65, 1439.74.

Support levels: 1381.84, 1360.41, 1344.71, 1332.83, 1319.73, 1311.14.

Trading tips

Long positions can be opened from the level of 1398.20 with the target at 1424.65 and stop loss 1381.84.

Short positions can be opened from the level of 1381.50 with the target at 1360.50. Stop loss is 1398.20.

Implementation period: 1–3 days.

No comments:

Write comments