NZD/USD: New Zealand dollar is falling

05 July 2019, 09:44

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6700, 0.6710 |

| Take Profit | 0.6750 |

| Stop Loss | 0.6670, 0.6660 |

| Key Levels | 0.6580, 0.6610, 0.6640, 0.6655, 0.6694, 0.6707, 0.6725, 0.6750 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6650, 0.6635 |

| Take Profit | 0.6580, 0.6565 |

| Stop Loss | 0.6680 |

| Key Levels | 0.6580, 0.6610, 0.6640, 0.6655, 0.6694, 0.6707, 0.6725, 0.6750 |

Current trend

Yesterday, NZD fell against USD, losing some of the positions won the day before. The development of correctional dynamics was due to closed US markets on the occasion of the Independence Day, as well as the expectation of the publication of the June report on the US labor market on Friday. Poor statistics can have a decisive influence on the Fed in the matter of interest rate cuts during the July meeting.

According to current analysts' forecasts, Nonfarm Payrolls may increase from 75 to 160K in June. Another important factor remains the expected growth in average hourly wages from 3.1% to 3.2% YoY.

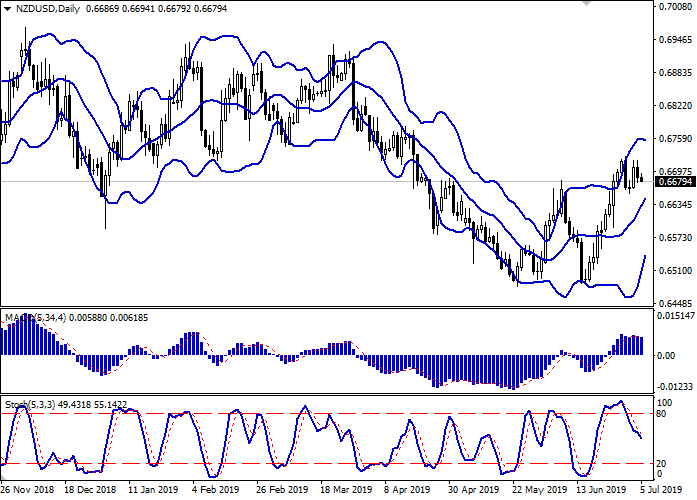

Support and resistance

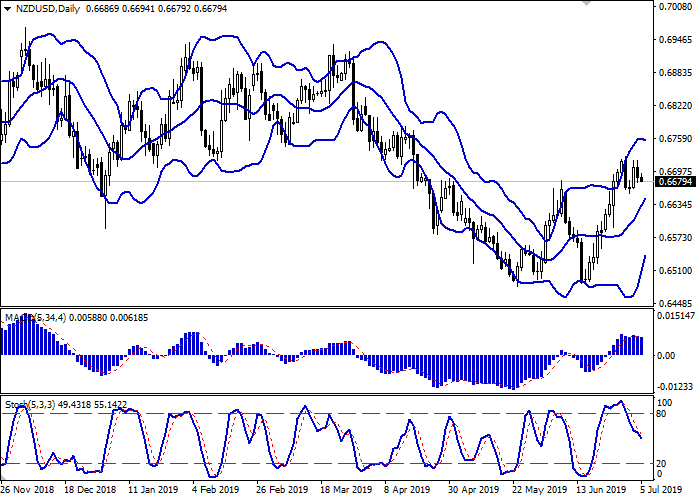

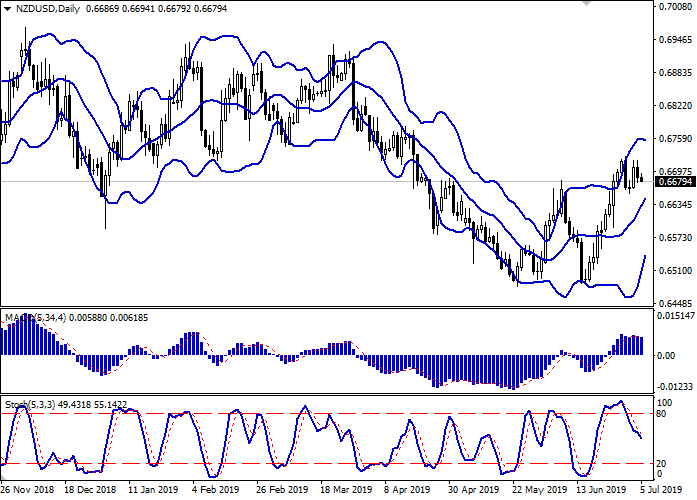

Bollinger bands are growing steadily on the daily chart. The price range narrows, reflecting the emergence of ambiguous trading dynamics in the short term. The MACD indicator is falling, keeping a poor sell signal (the histogram is below the signal line). Stochastic is falling more confidently and is currently located approximately in the center of its working area.

The current readings of technical indicators do not contradict the further development of a downtrend in the short and/or super short term.

Resistance levels: 0.6694, 0.6707, 0.6725, 0.6750.

Support levels: 0.6655, 0.6640, 0.6610, 0.6580.

Trading tips

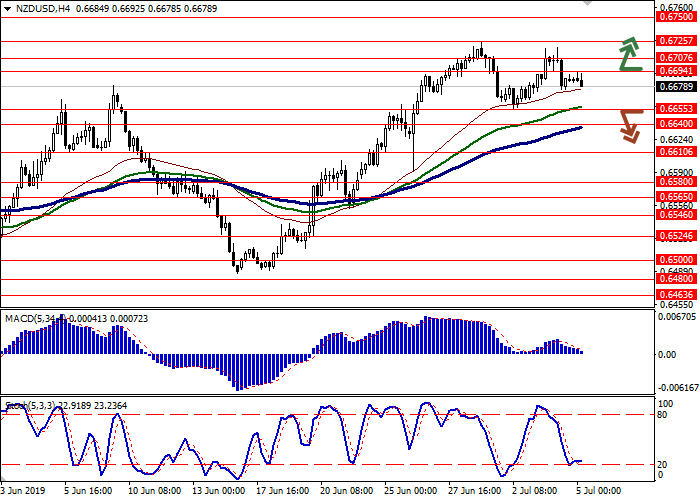

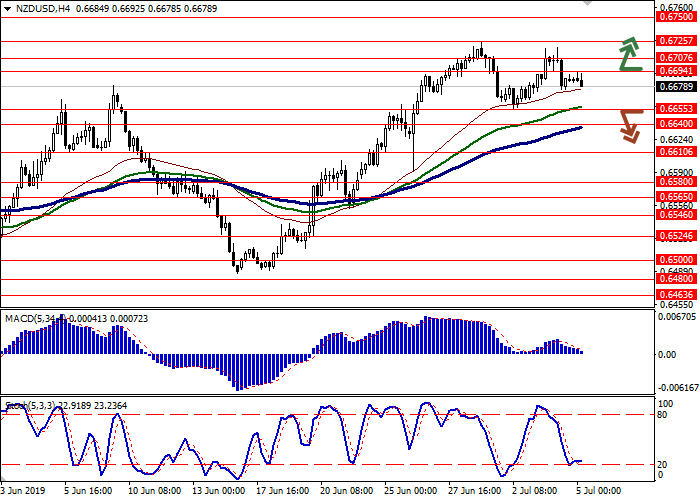

Long positions can be opened after the breakout of the level of 0.6694 or 0.6707 with the target at 0.6750. Stop loss is 0.6670–0.6660. Implementation period: 1–2 days.

Short positions can be opened after the breakdown of the levels of 0.6655–0.6640 with the target at 0.6580 or 0.6565.

Yesterday, NZD fell against USD, losing some of the positions won the day before. The development of correctional dynamics was due to closed US markets on the occasion of the Independence Day, as well as the expectation of the publication of the June report on the US labor market on Friday. Poor statistics can have a decisive influence on the Fed in the matter of interest rate cuts during the July meeting.

According to current analysts' forecasts, Nonfarm Payrolls may increase from 75 to 160K in June. Another important factor remains the expected growth in average hourly wages from 3.1% to 3.2% YoY.

Support and resistance

Bollinger bands are growing steadily on the daily chart. The price range narrows, reflecting the emergence of ambiguous trading dynamics in the short term. The MACD indicator is falling, keeping a poor sell signal (the histogram is below the signal line). Stochastic is falling more confidently and is currently located approximately in the center of its working area.

The current readings of technical indicators do not contradict the further development of a downtrend in the short and/or super short term.

Resistance levels: 0.6694, 0.6707, 0.6725, 0.6750.

Support levels: 0.6655, 0.6640, 0.6610, 0.6580.

Trading tips

Long positions can be opened after the breakout of the level of 0.6694 or 0.6707 with the target at 0.6750. Stop loss is 0.6670–0.6660. Implementation period: 1–2 days.

Short positions can be opened after the breakdown of the levels of 0.6655–0.6640 with the target at 0.6580 or 0.6565.

No comments:

Write comments