GBP/USD: GBP is correcting

05 July 2019, 09:40

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 1.2605 |

| Take Profit | 1.2659, 1.2680 |

| Stop Loss | 1.2560, 1.2550 |

| Key Levels | 1.2504, 1.2533, 1.2555, 1.2600, 1.2624, 1.2640, 1.2659 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2550 |

| Take Profit | 1.2504 |

| Stop Loss | 1.2580 |

| Key Levels | 1.2504, 1.2533, 1.2555, 1.2600, 1.2624, 1.2640, 1.2659 |

Current trend

The pound slightly strengthened against the US dollar on Thursday, interrupting the development of the "bearish" trend since July 1. The growth of the British currency was facilitated by the closed US markets on the occasion of the national holiday, while the macroeconomic background remained ambiguous. In addition, investors are increasingly worried about the exacerbation of the situation around Brexit. Yesterday, Prime Minister Theresa May said that the current stalemate is a serious problem for the whole kingdom. The solution of the border issue with Northern Ireland was never found, and now, after May’s resignation, her successor will have to deal with its decision. There's little hope that this can be done within the allotted timeframe, therefore, markets are more often discussing the prospects of a "tough" Brexit.

Support and resistance

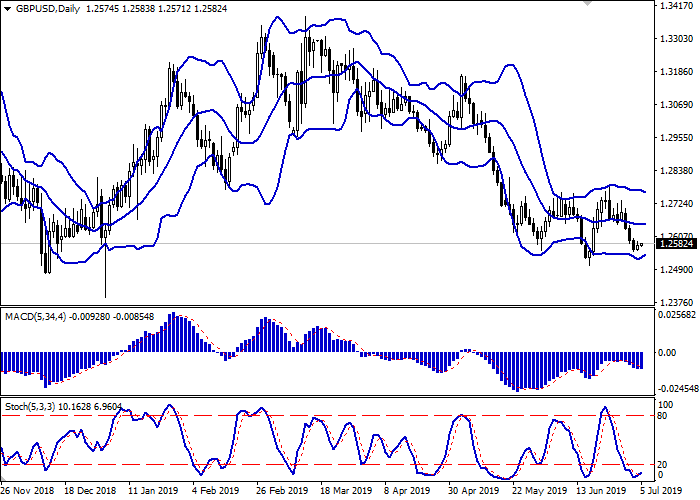

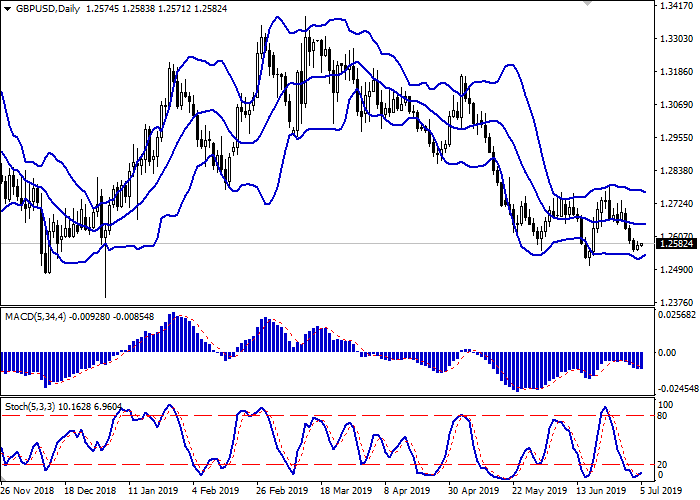

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range is narrowing, reflecting the emergence of the correctional dynamics in the ultra-short term. MACD is reversing upwards preserving a sell signal (being located under the signal line). Stochastic, having reached its minima, is preparing for an upward reversal, indicating the oversold pound in the ultra-short term.

There's a possibility of the full-scale correctional growth in the short term.

Resistance levels: 1.2600, 1.2624, 1.2640, 1.2659.

Support levels: 1.2555, 1.2533, 1.2504.

Trading tips

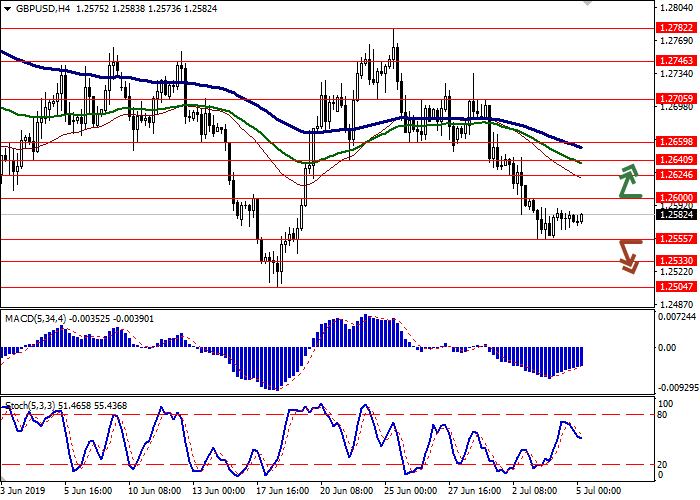

To open long positions, one can rely on the breakout of 1.2600. Take profit – 1.2659 or 1.2680. Stop loss – 1.2560–1.2550. Implementation period: 2-3 days.

A confident breakdown of 1.2555 may serve as a signal to start sales with the target at 1.2504. Stop loss – 1.2580. Implementation period: 1-2 days.

The pound slightly strengthened against the US dollar on Thursday, interrupting the development of the "bearish" trend since July 1. The growth of the British currency was facilitated by the closed US markets on the occasion of the national holiday, while the macroeconomic background remained ambiguous. In addition, investors are increasingly worried about the exacerbation of the situation around Brexit. Yesterday, Prime Minister Theresa May said that the current stalemate is a serious problem for the whole kingdom. The solution of the border issue with Northern Ireland was never found, and now, after May’s resignation, her successor will have to deal with its decision. There's little hope that this can be done within the allotted timeframe, therefore, markets are more often discussing the prospects of a "tough" Brexit.

Support and resistance

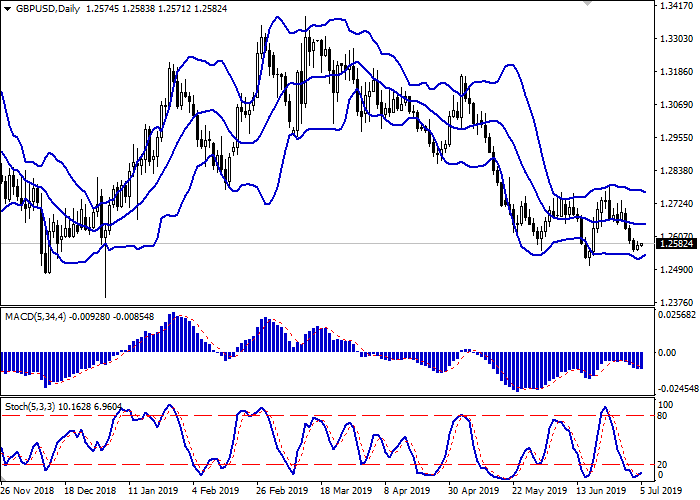

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range is narrowing, reflecting the emergence of the correctional dynamics in the ultra-short term. MACD is reversing upwards preserving a sell signal (being located under the signal line). Stochastic, having reached its minima, is preparing for an upward reversal, indicating the oversold pound in the ultra-short term.

There's a possibility of the full-scale correctional growth in the short term.

Resistance levels: 1.2600, 1.2624, 1.2640, 1.2659.

Support levels: 1.2555, 1.2533, 1.2504.

Trading tips

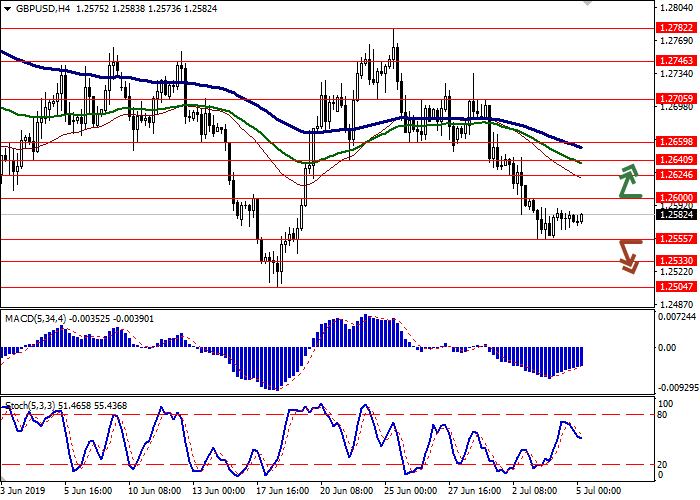

To open long positions, one can rely on the breakout of 1.2600. Take profit – 1.2659 or 1.2680. Stop loss – 1.2560–1.2550. Implementation period: 2-3 days.

A confident breakdown of 1.2555 may serve as a signal to start sales with the target at 1.2504. Stop loss – 1.2580. Implementation period: 1-2 days.

No comments:

Write comments