EUR/USD: pair is falling

05 July 2019, 11:29

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 1.1264 |

| Take Profit | 1.1200, 1.1115 |

| Stop Loss | 1.1295 |

| Key Levels | 1.1000, 1.1050, 1.1100, 1.1115, 1.1200, 1.1260, 1.1315, 1.1345, 1.1390, 1.1415, 1.1450, 1.1515 |

Current trend

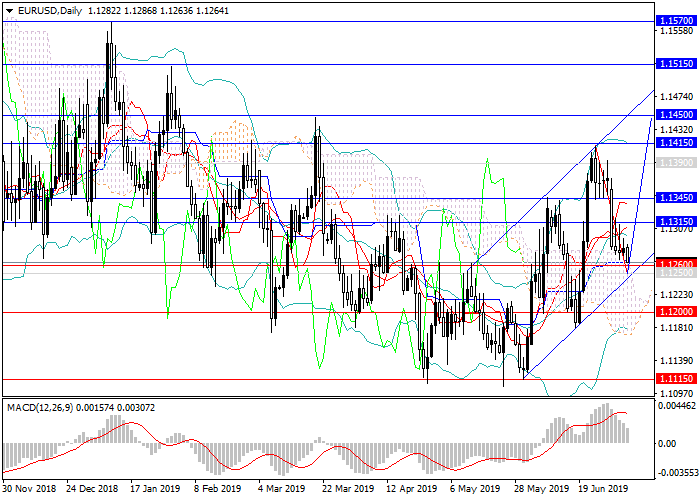

The EUR/USD pair reversed at the upper border of the ascending channel at the level of 1.1415 and began to decline rapidly. In less than two trading weeks, the price has lost 150 points, still staying within the upward channel. The instrument is now approaching its lower border at 1.1260. The weakening was due to negative EU data on major indices and retail sales.

Today, the traders will pay attention to the US labor market: unemployment rate and Nonfarm Payrolls releases.

Support and resistance

If the macroeconomic data supports USD, the rate can break the lower border of the current channel and reverse downwards. The targets of the movement will be the levels of 1.1200, 1.1115 (local lows of April and May of the current year). If the price stays within the wide upward channel, it will form a new upward wave with the target at 1.1450.

Technical indicators on the daily chart and above confirm the forecast of a decline to the lows: the volumes of long MACD positions are decreasing, the volumes of short positions are growing, and Bollinger bands are pointing downwards.

Resistance levels: 1.1315, 1.1345, 1.1390, 1.1415, 1.1450, 1.1515.

Support levels: 1.1260, 1.1200, 1.1115, 1.1100, 1.1050, 1.1000.

Trading tips

Short positions can be opened from the current level with the targets at 1.1200, 1.1115 and stop loss 1.1295.

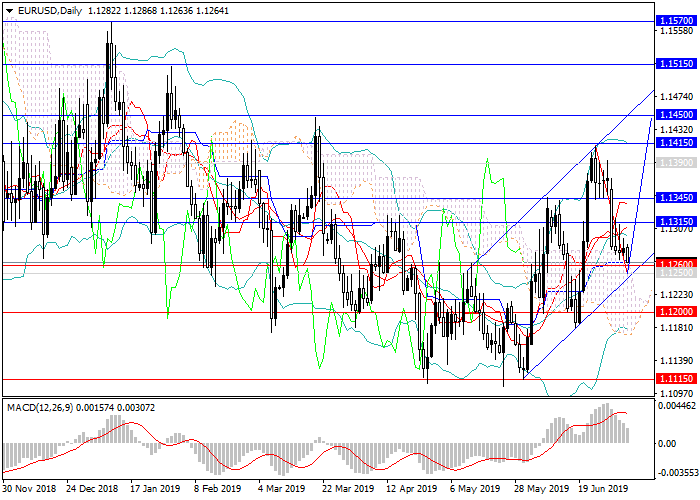

The EUR/USD pair reversed at the upper border of the ascending channel at the level of 1.1415 and began to decline rapidly. In less than two trading weeks, the price has lost 150 points, still staying within the upward channel. The instrument is now approaching its lower border at 1.1260. The weakening was due to negative EU data on major indices and retail sales.

Today, the traders will pay attention to the US labor market: unemployment rate and Nonfarm Payrolls releases.

Support and resistance

If the macroeconomic data supports USD, the rate can break the lower border of the current channel and reverse downwards. The targets of the movement will be the levels of 1.1200, 1.1115 (local lows of April and May of the current year). If the price stays within the wide upward channel, it will form a new upward wave with the target at 1.1450.

Technical indicators on the daily chart and above confirm the forecast of a decline to the lows: the volumes of long MACD positions are decreasing, the volumes of short positions are growing, and Bollinger bands are pointing downwards.

Resistance levels: 1.1315, 1.1345, 1.1390, 1.1415, 1.1450, 1.1515.

Support levels: 1.1260, 1.1200, 1.1115, 1.1100, 1.1050, 1.1000.

Trading tips

Short positions can be opened from the current level with the targets at 1.1200, 1.1115 and stop loss 1.1295.

No comments:

Write comments