USD/JPY: Murrey analysis

05 July 2019, 11:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 108.15 |

| Take Profit | 108.60, 109.37 |

| Stop Loss | 108.80 |

| Key Levels | 106.25, 107.03, 107.81, 108.60, 109.37 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 107.55 |

| Take Profit | 107.03, 106.25 |

| Stop Loss | 107.90 |

| Key Levels | 106.25, 107.03, 107.81, 108.60, 109.37 |

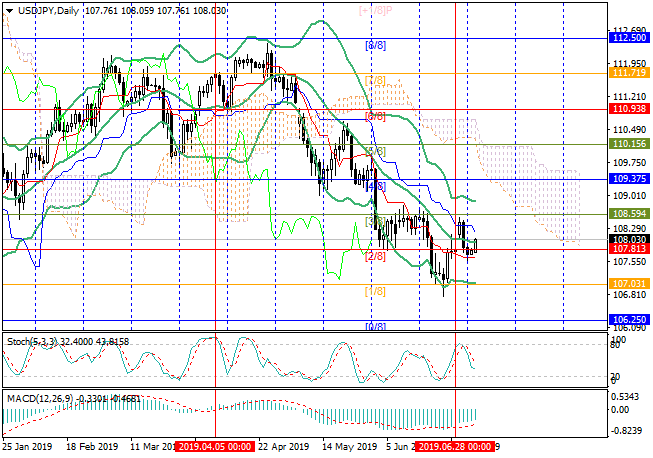

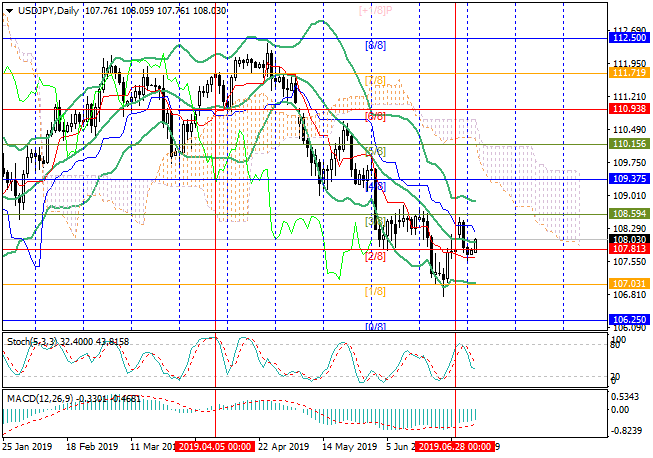

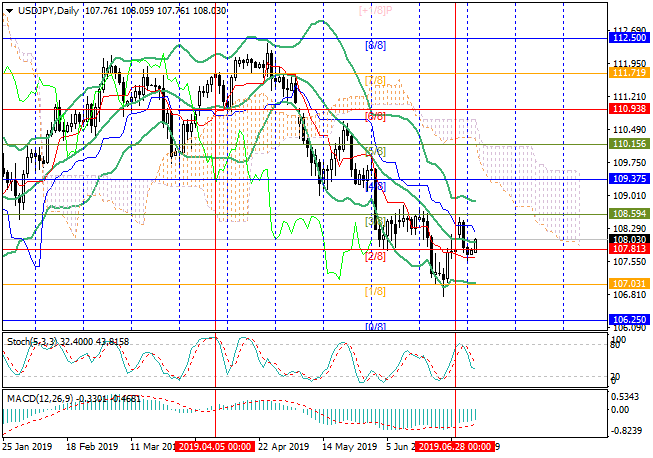

This week, the USD/JPY pair was corrected to the level of 107.81 ([2/8]) but

failed to consolidate below it and is now trying to grow. If the price

consolidates above the middle line of Bollinger bands around 108.00, it can rise

to the levels of 108.60 ([3/8]) and 109.37 ([4/8]). In case of a reverse

consolidation of the rate below 107.81, it may return to the level 107.03

([1/8]) or reach the level of 106.25 ([0/8]).

Technical indicators do not give a clear signal. Bollinger bands are reversing horizontally. Stochastic is directed downwards. The MACD histogram is reducing in the negative zone. In general, the upward movement towards the middle of the Murrey trading range seems more likely in the medium term.

Support and resistance

Resistance levels: 108.60, 109.37.

Support levels: 107.81, 107.03, 106.25.

Trading tips

Long positions can be opened above the level of 108.00 with the targets at 108.60, 109.37 and stop loss around 108.80.

Short positions can be opened after the consolidation below the level of 107.81 with the targets at 107.03, 106.25 and stop loss around 107.90.

Implementation period: 3–4 days.

Technical indicators do not give a clear signal. Bollinger bands are reversing horizontally. Stochastic is directed downwards. The MACD histogram is reducing in the negative zone. In general, the upward movement towards the middle of the Murrey trading range seems more likely in the medium term.

Support and resistance

Resistance levels: 108.60, 109.37.

Support levels: 107.81, 107.03, 106.25.

Trading tips

Long positions can be opened above the level of 108.00 with the targets at 108.60, 109.37 and stop loss around 108.80.

Short positions can be opened after the consolidation below the level of 107.81 with the targets at 107.03, 106.25 and stop loss around 107.90.

Implementation period: 3–4 days.

No comments:

Write comments