EUR/USD: euro falls

09 July 2019, 09:39

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1235, 1.1250 |

| Take Profit | 1.1316, 1.1343 |

| Stop Loss | 1.1200 |

| Key Levels | 1.1133, 1.1159, 1.1180, 1.1206, 1.1246, 1.1267, 1.1316, 1.1343 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1200 |

| Take Profit | 1.1133 |

| Stop Loss | 1.1235 |

| Key Levels | 1.1133, 1.1159, 1.1180, 1.1206, 1.1246, 1.1267, 1.1316, 1.1343 |

Current trend

Yesterday, EUR moderately declined against USD, continuing the development of a strong "bearish" impulse formed at the end of last week. EUR reacted by sharp sales after the publication of the report on the US labor market, which indicated a much stronger increase in the number of new jobs than analysts had expected. The report also reflected the growth of the unemployment rate and a slight slowdown in wages growth. The market expects strong labor market data to help the Fed wait. Some analysts believe that the regulator will abandon the idea of lowering the interest rate in July. On Monday, investors were focused on German data on the industrial output and the trade balance for May. The industrial output grew by 0.3% MoM after a decrease of 2.0% MoM last month. However, YoY, the dynamics deteriorated markedly: −3.7% against previous −2.3%. Germany’s trade balance in May rose from 16.9 to 18.7 billion euros, which was slightly better than expected.

Support and resistance

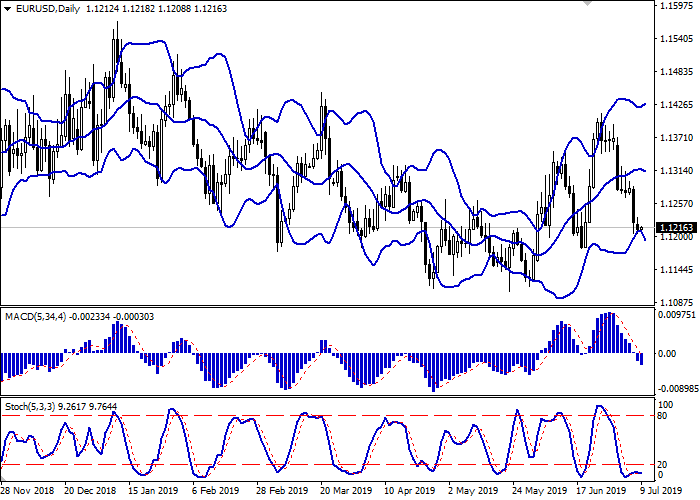

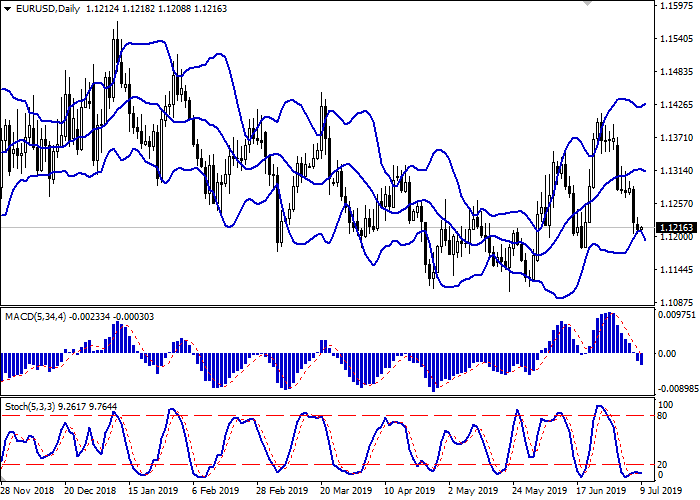

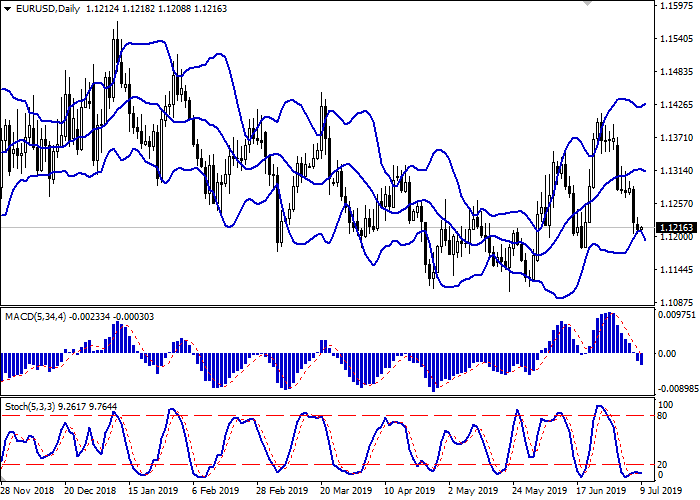

On the daily chart, Bollinger bands reverse into a downward plane. The price range actively expands, letting the “bears” renew local lows. The MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic, approaching its lows, reversed into a horizontal plane, indicating that EUR is strongly oversold the super-short term.

It is better to keep current short positions until the situation is clarified.

Resistance levels: 1.1246, 1.1267, 1.1316, 1.1343.

Support Levels: 1.1206, 1.1180, 1.1159, 1.1133.

Trading tips

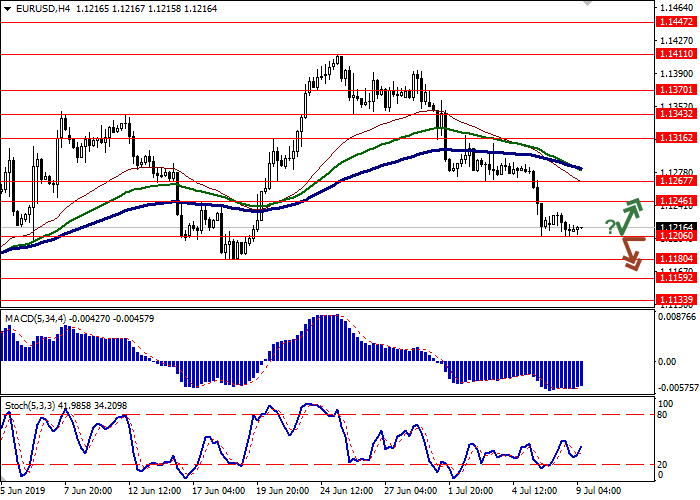

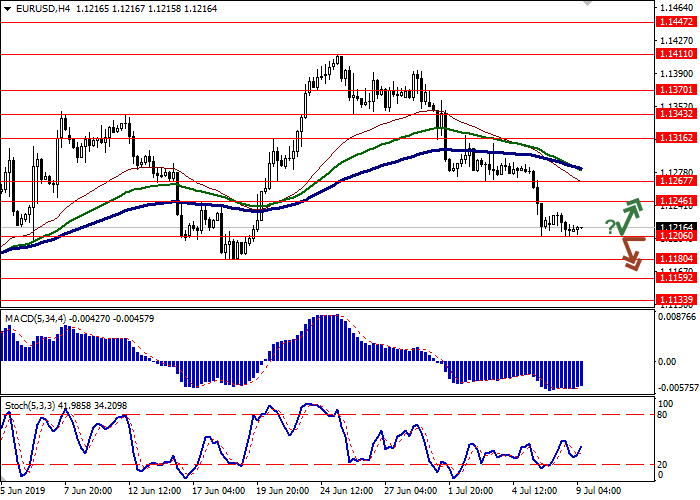

Long positions can be opened after a rebound from 1.1206 and the breakout of 1.1230–1.1246 with the targets at 1.1316–1.1343. Stop loss is 1.1200.

Short positions can be opened after the breakdown of 1.1206 with the target at 1.1133. Stop loss is 1.1235. Implementation period: 2–3 days.

Yesterday, EUR moderately declined against USD, continuing the development of a strong "bearish" impulse formed at the end of last week. EUR reacted by sharp sales after the publication of the report on the US labor market, which indicated a much stronger increase in the number of new jobs than analysts had expected. The report also reflected the growth of the unemployment rate and a slight slowdown in wages growth. The market expects strong labor market data to help the Fed wait. Some analysts believe that the regulator will abandon the idea of lowering the interest rate in July. On Monday, investors were focused on German data on the industrial output and the trade balance for May. The industrial output grew by 0.3% MoM after a decrease of 2.0% MoM last month. However, YoY, the dynamics deteriorated markedly: −3.7% against previous −2.3%. Germany’s trade balance in May rose from 16.9 to 18.7 billion euros, which was slightly better than expected.

Support and resistance

On the daily chart, Bollinger bands reverse into a downward plane. The price range actively expands, letting the “bears” renew local lows. The MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic, approaching its lows, reversed into a horizontal plane, indicating that EUR is strongly oversold the super-short term.

It is better to keep current short positions until the situation is clarified.

Resistance levels: 1.1246, 1.1267, 1.1316, 1.1343.

Support Levels: 1.1206, 1.1180, 1.1159, 1.1133.

Trading tips

Long positions can be opened after a rebound from 1.1206 and the breakout of 1.1230–1.1246 with the targets at 1.1316–1.1343. Stop loss is 1.1200.

Short positions can be opened after the breakdown of 1.1206 with the target at 1.1133. Stop loss is 1.1235. Implementation period: 2–3 days.

No comments:

Write comments