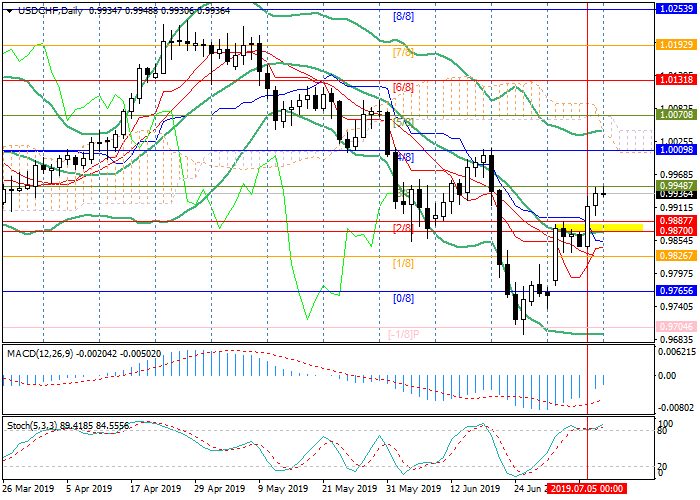

USD/CHF: Murrey analysis

09 July 2019, 11:35

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9950 |

| Take Profit | 1.0010, 1.0070 |

| Stop Loss | 0.9910 |

| Key Levels | 0.9704, 0.9765, 0.9870, 0.9948, 1.0010, 1.0070 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9865 |

| Take Profit | 0.9765, 0.9704 |

| Stop Loss | 0.9910 |

| Key Levels | 0.9704, 0.9765, 0.9870, 0.9948, 1.0010, 1.0070 |

The pair started the week with growth and is currently testing the level of

0.9948 ([3/8]), trying to return to the central Murrey channel. If successful,

growth can continue to 1.0010 ([4/8]) and 1.0070 ([5/8]). The decline will be

possible if the price manages to break down the zone of 0.9887–0.9870 ([2/8],

the midline of Bollinger Bands). In this case, the decline may continue to

0.9765 ([0/8]) and 0.9704 ([-1/8]). Technical indicators generally allow growth:

MACD histogram decreases in the negative zone, Stochastic has entered the

overbought zone but is still directed upwards.

Support and resistance

Resistance levels: 0.9948, 1.0010, 1.0070.

Support levels: 0.9870, 0.9765, 0.9704.

Trading tips

Long positions may be opened above 0.9948 with targets at 1.0010, 1.0070 and stop loss at 0.9910.

Short positions may be opened below 0.9870 with targets at 0.9765, 0.9704 and stop loss at 0.9910.

Implementation period: 3-4 days.

Support and resistance

Resistance levels: 0.9948, 1.0010, 1.0070.

Support levels: 0.9870, 0.9765, 0.9704.

Trading tips

Long positions may be opened above 0.9948 with targets at 1.0010, 1.0070 and stop loss at 0.9910.

Short positions may be opened below 0.9870 with targets at 0.9765, 0.9704 and stop loss at 0.9910.

Implementation period: 3-4 days.

No comments:

Write comments