Bitcoin: technical analysis

15 July 2019, 10:22

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 9800.00 |

| Take Profit | 9375.00, 8750.00 |

| Stop Loss | 10200.00 |

| Key Levels | 8750.00, 9375.00, 10000.00, 11250.00, 12500.00, 13125.00, 13750.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 10470.00 |

| Take Profit | 12500.00, 13125.00, 13750.00 |

| Stop Loss | 10700.00 |

| Key Levels | 8750.00, 9375.00, 10000.00, 11250.00, 12500.00, 13125.00, 13750.00 |

Current trend

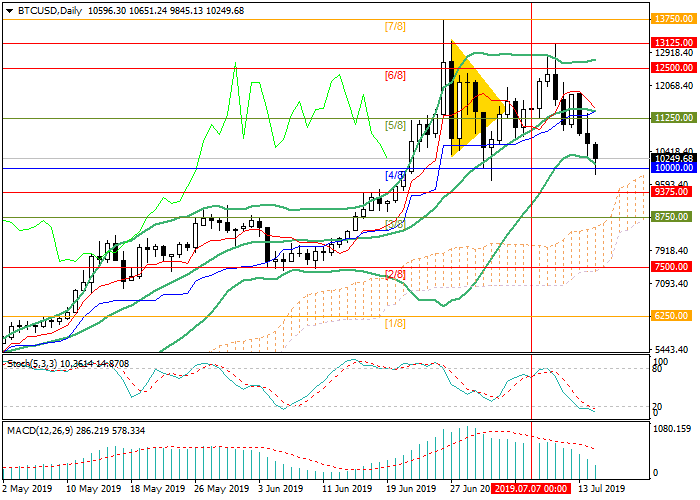

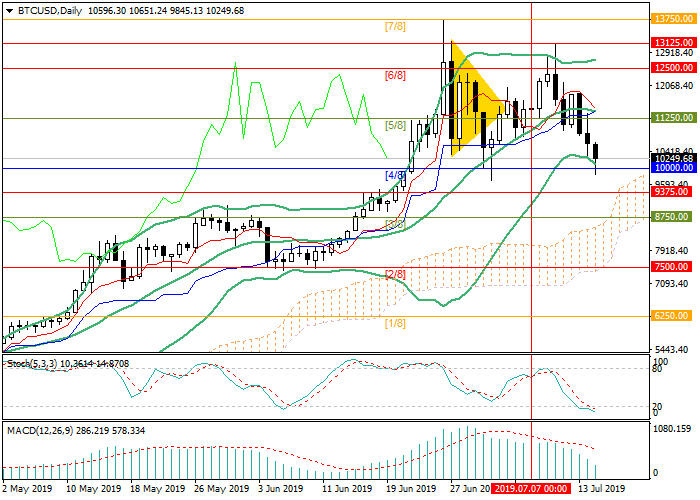

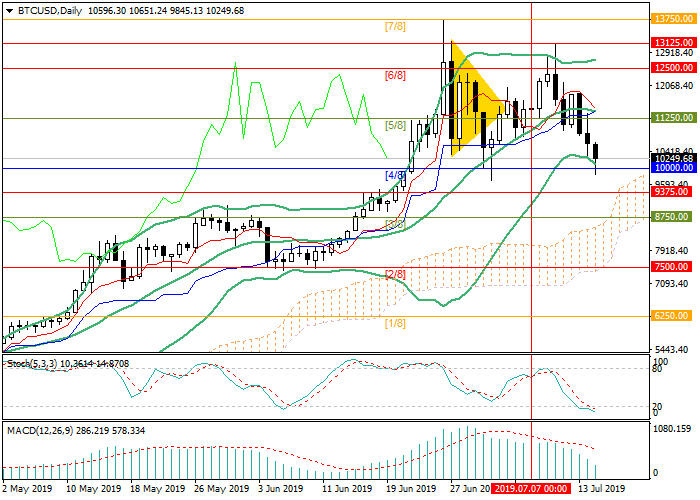

Last week, Bitcoin quotes were trading ambiguously. At first, the price reached the level of 13125.00 (Murrey [5/8] H4) but then was sharply corrected. Currently, the price is testing the level of 10000.00 (Murrey [4/8]) and may continue to decline to the levels of 9375.00 (Murrey [–1/8] H4) and 8750.00 (Murrey [3/8]). The key “bullish” level is 11250.00 (the middle line of Bollinger bands, Murrey [5/8]). After the breakout, growth may continue to the levels of 11250.00 (Murrey [5/8]), 13125.00 (Murrey [5/8] H4), 13750.00 (Murrey [7/8]).

Technical indicators do not give a clear signal. The MACD histogram is decreasing in the positive zone. Stochastic entered the oversold zone, which reflects the probability of the beginning of growth.

Support and resistance

Resistance levels: 11250.00, 12500.00, 13125.00, 13750.00.

Support levels: 10000.00, 9375.00, 8750.00.

Trading tips

Short positions can be opened below the level of 10000.00 with the targets at 9375.00, 8750.00 and stop loss around 10200.00.

Long positions can be opened above the level of 11250.00 with the targets at 12500.00, 13125.00, 13750.00 and stop loss around 10700.00.

Implementation period: 3–4 days.

Last week, Bitcoin quotes were trading ambiguously. At first, the price reached the level of 13125.00 (Murrey [5/8] H4) but then was sharply corrected. Currently, the price is testing the level of 10000.00 (Murrey [4/8]) and may continue to decline to the levels of 9375.00 (Murrey [–1/8] H4) and 8750.00 (Murrey [3/8]). The key “bullish” level is 11250.00 (the middle line of Bollinger bands, Murrey [5/8]). After the breakout, growth may continue to the levels of 11250.00 (Murrey [5/8]), 13125.00 (Murrey [5/8] H4), 13750.00 (Murrey [7/8]).

Technical indicators do not give a clear signal. The MACD histogram is decreasing in the positive zone. Stochastic entered the oversold zone, which reflects the probability of the beginning of growth.

Support and resistance

Resistance levels: 11250.00, 12500.00, 13125.00, 13750.00.

Support levels: 10000.00, 9375.00, 8750.00.

Trading tips

Short positions can be opened below the level of 10000.00 with the targets at 9375.00, 8750.00 and stop loss around 10200.00.

Long positions can be opened above the level of 11250.00 with the targets at 12500.00, 13125.00, 13750.00 and stop loss around 10700.00.

Implementation period: 3–4 days.

No comments:

Write comments