EUR/USD: sideways consolidation

15 July 2019, 12:34

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 1.1273 |

| Take Profit | 1.1115 |

| Stop Loss | 1.1330 |

| Key Levels | 1.0900, 1.0950, 1.1000, 1.1030, 1.1100, 1.1115, 1.1200, 1.1200, 1.1260, 1.1315, 1.1345, 1.1390, 1.1415, 1.1450, 1.1500 |

Current trend

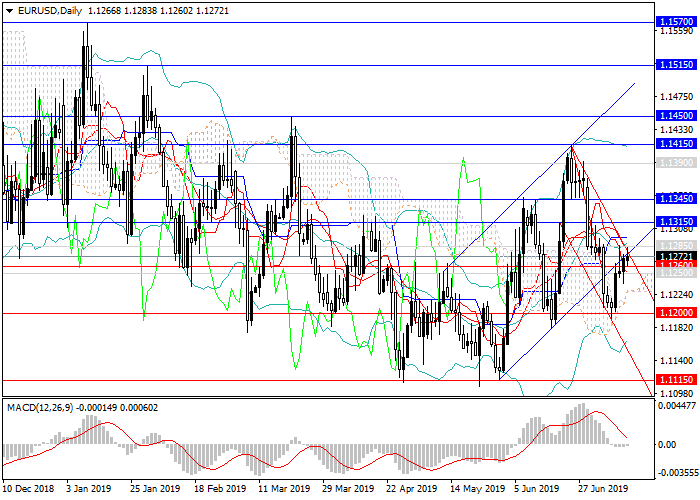

The EUR/USD pair moves within the broad sideways trend. In late June and early July, the price lost more than 200 points in a few days but in the middle of last week, trading sentiment changed. The instrument began to regain losses, returning almost 100 points and reaching the level of 1.1285, the key resistance level. However, it failed to pass the level, which indicates the weakness of EUR, which remains under pressure due to the situation with Brexit. USD, however, has been growing for several weeks due to increased investor interest. Both European and American data of the last week were ambiguous; the pair failed to decide on the future direction and continues to trade within the sideways channel. US labor market data was strong but inflation statistics did not meet the expectations.

This trading week, EU inflation and the main indices data will be released. In the US, there will be statistics on retail sales and industrial production. However, these releases, most likely, will not be able to give the instrument enough impulse to leave the sideways trend.

Support and resistance

A downward impulse may form from the current level to the local minimum of 1.1115. Later, the pair can be corrected upwards. In the longer term, a breakdown of the local minimum and a decrease to 1.1000 –1.0900 is possible.

On the weekly chart and above, technical indicators continue to give a sell signal, MACD keeps high volumes of short positions, and Bollinger bands are directed downwards.

Support levels: 1.1260, 1.1250, 1.1200, 1.1115, 1.1100, 1.1030, 1.1000, 1.0950, 1.0900.

Resistance levels: 1.1315, 1.1345, 1.1390, 1.1415, 1.1450, 1.1500.

Trading tips

Short positions can be opened from the current level with the target at 1.1115 and stop loss 1.1330.

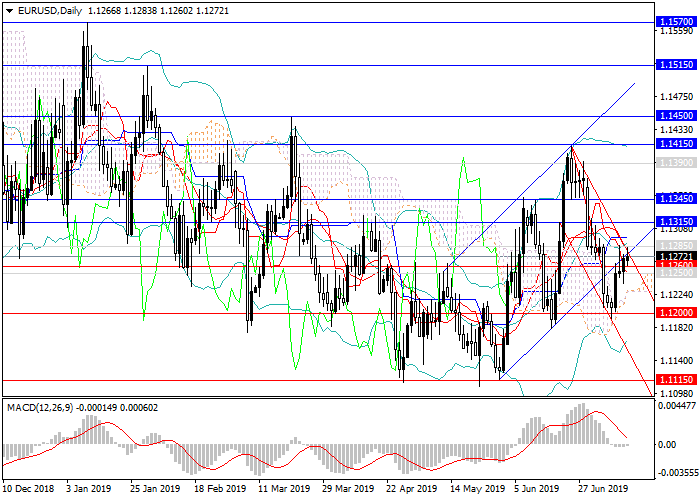

The EUR/USD pair moves within the broad sideways trend. In late June and early July, the price lost more than 200 points in a few days but in the middle of last week, trading sentiment changed. The instrument began to regain losses, returning almost 100 points and reaching the level of 1.1285, the key resistance level. However, it failed to pass the level, which indicates the weakness of EUR, which remains under pressure due to the situation with Brexit. USD, however, has been growing for several weeks due to increased investor interest. Both European and American data of the last week were ambiguous; the pair failed to decide on the future direction and continues to trade within the sideways channel. US labor market data was strong but inflation statistics did not meet the expectations.

This trading week, EU inflation and the main indices data will be released. In the US, there will be statistics on retail sales and industrial production. However, these releases, most likely, will not be able to give the instrument enough impulse to leave the sideways trend.

Support and resistance

A downward impulse may form from the current level to the local minimum of 1.1115. Later, the pair can be corrected upwards. In the longer term, a breakdown of the local minimum and a decrease to 1.1000 –1.0900 is possible.

On the weekly chart and above, technical indicators continue to give a sell signal, MACD keeps high volumes of short positions, and Bollinger bands are directed downwards.

Support levels: 1.1260, 1.1250, 1.1200, 1.1115, 1.1100, 1.1030, 1.1000, 1.0950, 1.0900.

Resistance levels: 1.1315, 1.1345, 1.1390, 1.1415, 1.1450, 1.1500.

Trading tips

Short positions can be opened from the current level with the target at 1.1115 and stop loss 1.1330.

No comments:

Write comments