AUD/USD: general review

01 July 2019, 15:17

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.6995 |

| Take Profit | 0.6945, 0.6897 |

| Stop Loss | 0.7025 |

| Key Levels | 0.6835, 0.6897, 0.6945, 0.7019, 0.7080, 0.7141 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.7025 |

| Take Profit | 0.7080, 0.7141 |

| Stop Loss | 0.6995 |

| Key Levels | 0.6835, 0.6897, 0.6945, 0.7019, 0.7080, 0.7141 |

Current trend

Last week, the pair strengthened in anticipation of the meeting between Donald Trump and Xi Jinping in Osaka. The leaders of the United States and China agreed to not introduce new export tariffs and resume trade negotiations, which was positively perceived by the market. Today, the pair is correcting downwards, as tomorrow’s RBA meeting comes to the spotlight; the interest rate can be reduced for the second time in a row, from 1.25% to 1.00% (historical low). However, there is a possibility that the regulator will transfer the rate correction to August, as it will wait for data to assess the impact of the June decline. Most investors believe it is likely that a gradual reduction in the rate will last until the beginning of next year when the RBA will bring it to 0.50%. Thus, in the long run, the Australian currency may remain under pressure.

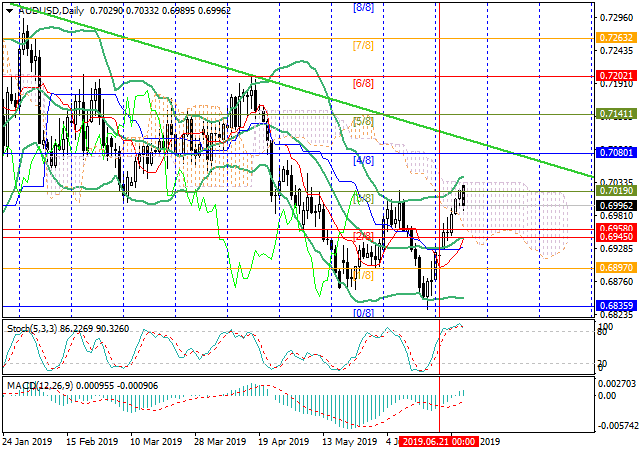

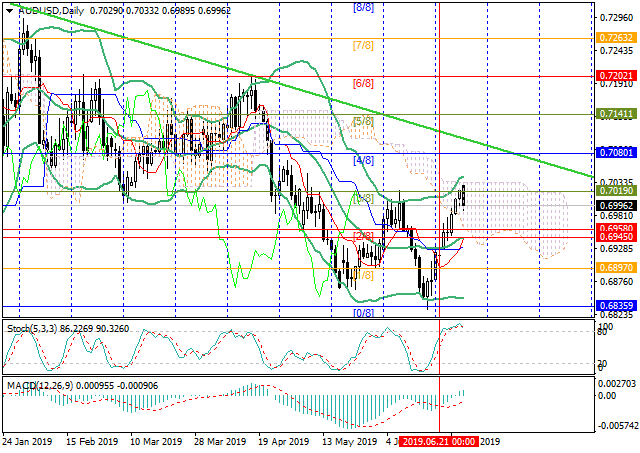

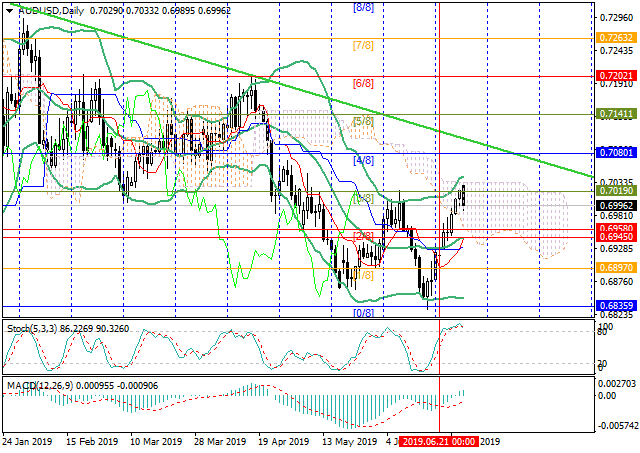

Support and resistance

The price reversed around 0.7019 (Murrey [3/8]) and may continue to decline to 0.6945 (the midline of Bollinger Bands) and 0.6897 (Murrey [1/8]). Reverse consolidation of the price above the level of 0.7019 will give the prospect of growth to 0.7080 (Murrey [4/8]) and 0.7141 (Murrey [5/8]). Technical indicators don't provide a clear signal: Bollinger Bands are reversing upwards, MACD histogram entered the positive zone. But Stochastic is reversing down in the overbought zone, indicating that a sell signal will be formed soon.

Support levels: 0.6945, 0.6897, 0.6835.

Resistance levels: 0.7019, 0.7080, 0.7141.

Trading tips

Short positions may be opened from the current level with targets at 0.6945, 0.6897 and stop loss at 0.7025.

Long positions may be opened if the price consolidates above 0.7019 with targets at 0.7080, 0.7141 and stop loss at 0.6995.

Implementation period: 3-4 days.

Last week, the pair strengthened in anticipation of the meeting between Donald Trump and Xi Jinping in Osaka. The leaders of the United States and China agreed to not introduce new export tariffs and resume trade negotiations, which was positively perceived by the market. Today, the pair is correcting downwards, as tomorrow’s RBA meeting comes to the spotlight; the interest rate can be reduced for the second time in a row, from 1.25% to 1.00% (historical low). However, there is a possibility that the regulator will transfer the rate correction to August, as it will wait for data to assess the impact of the June decline. Most investors believe it is likely that a gradual reduction in the rate will last until the beginning of next year when the RBA will bring it to 0.50%. Thus, in the long run, the Australian currency may remain under pressure.

Support and resistance

The price reversed around 0.7019 (Murrey [3/8]) and may continue to decline to 0.6945 (the midline of Bollinger Bands) and 0.6897 (Murrey [1/8]). Reverse consolidation of the price above the level of 0.7019 will give the prospect of growth to 0.7080 (Murrey [4/8]) and 0.7141 (Murrey [5/8]). Technical indicators don't provide a clear signal: Bollinger Bands are reversing upwards, MACD histogram entered the positive zone. But Stochastic is reversing down in the overbought zone, indicating that a sell signal will be formed soon.

Support levels: 0.6945, 0.6897, 0.6835.

Resistance levels: 0.7019, 0.7080, 0.7141.

Trading tips

Short positions may be opened from the current level with targets at 0.6945, 0.6897 and stop loss at 0.7025.

Long positions may be opened if the price consolidates above 0.7019 with targets at 0.7080, 0.7141 and stop loss at 0.6995.

Implementation period: 3-4 days.

No comments:

Write comments