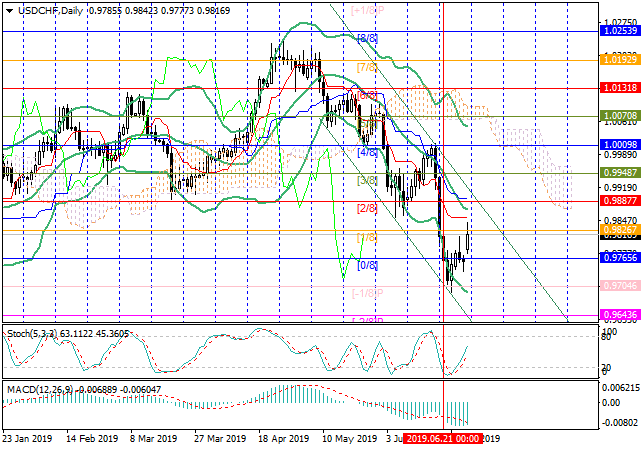

USD/CHF: Murrey analysis

01 July 2019, 15:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 0.9760 |

| Take Profit | 0.9704, 0.9643 |

| Stop Loss | 0.9800 |

| Key Levels | 0.9643, 0.9704, 0.9765, 0.9887, 0.9948, 1.0009 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.9890 |

| Take Profit | 0.9948, 1.0009 |

| Stop Loss | 0.9850 |

| Key Levels | 0.9643, 0.9704, 0.9765, 0.9887, 0.9948, 1.0009 |

On the daily chart, the pair reversed around 0.9704 ([–1/8]) and returned to

the framework of Murrey main trading range. At present, the key “bullish” level

is 0.9887 ([2/8]) around the middle line of Bollinger bands. After its breakout,

growth can continue to the levels of 0.9948 ([5/8]) and 1.0009 ([4/8]). However,

the potential of the downward trend has not yet been exhausted, as indicated by

the downward reversal of Bollinger bands. Therefore, in the near future, in the

event of a new breakdown to the level of 0.9765 ([0/8]), the decline may resume

to the levels of 0.9704 ([–1/8]) and 0.9643 ([–2/8]).

Support and resistance

Resistance levels: 0.9887, 0.9948, 1.0009.

Support levels: 0.9765, 0.9704, 0.9643.

Trading tips

Short positions can be opened below the level of 0.9765 or when the price reverses around the level of 0.9887 with the targets at 0.9704, 0.9643 and stop losses around 0.9800 and 0.9920, respectively.

Long positions can be opened when the price consolidates above the level of 0.9887 with the targets at 0.9948, 1.0009 and stop loss around 0.9850.

Implementation period: 3–4 days.

Support and resistance

Resistance levels: 0.9887, 0.9948, 1.0009.

Support levels: 0.9765, 0.9704, 0.9643.

Trading tips

Short positions can be opened below the level of 0.9765 or when the price reverses around the level of 0.9887 with the targets at 0.9704, 0.9643 and stop losses around 0.9800 and 0.9920, respectively.

Long positions can be opened when the price consolidates above the level of 0.9887 with the targets at 0.9948, 1.0009 and stop loss around 0.9850.

Implementation period: 3–4 days.

No comments:

Write comments